Revenue In Line With Expectations But Stock Drops

Local business platform Yelp (NYSE:YELP) reported results in line with analysts’ expectations in Q1 CY2024, with revenue up 6.5% year on year to $332.8 million. It made a GAAP profit of $0.20 per share, improving from its loss of $0.02 per share in the same quarter last year.

Is now the time to buy Yelp? Find out in our full research report.

Yelp (YELP) Q1 CY2024 Highlights:

-

Revenue: $332.8 million vs analyst estimates of $333.4 million (small miss)

-

Adjusted EBITDA: $64.5 million vs analyst estimates of $50.5 million (big beat)

-

EPS: $0.20 vs analyst estimates of $0.06 ($0.14 beat)

-

Gross Margin (GAAP): 91.8%, in line with the same quarter last year

-

Free Cash Flow of $65.87 million, similar to the previous quarter

-

Market Capitalization: $2.66 billion

“In the first quarter, the strength and momentum in our services categories, particularly home services, offset a challenging environment for our restaurant, retail and other categories,” said Jeremy Stoppelman, Yelp’s co-founder and chief executive officer.

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE:YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

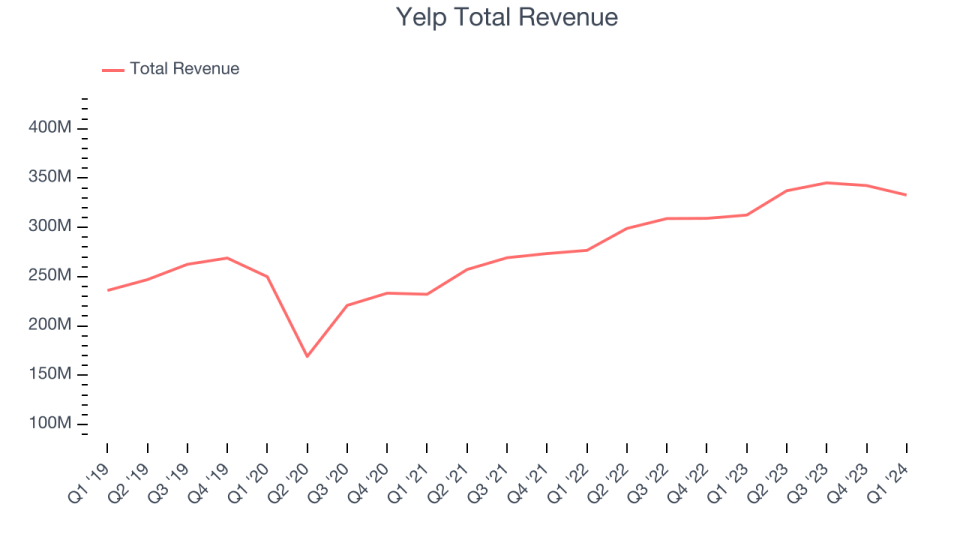

Sales Growth

Yelp’s revenue growth over the last three years has been mediocre, averaging 17.4% annually. This quarter, Yelp reported mediocre 6.5% year-on-year revenue growth, missing Wall Street’s expectations.

Ahead of the earnings results, analysts were projecting sales to grow 7.3% over the next 12 months.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Key Takeaways from Yelp’s Q1 Results

Yelp’s revenue growth regrettably slowed and its revenue missed Wall Street’s estimates. On the other hand, adjusted EBITDA came in ahead. Overall, this was a mixed quarter for Yelp. The company is down 5.3% on the results and currently trades at $37.55 per share.

Yelp may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.