More Than a Quarter of Billionaire Carl Icahn’s Portfolio Is In These 3 Energy Stocks

Carl Icahn is known for his big bets. Right now, just three energy stocks comprise more than one quarter of his portfolio. Each stock has very different characteristics, so if you want to follow Icahn, be sure to understand all three.

This 1 stock is Icahn’s biggest bet

Icahn may have more than one quarter of his portfolio in just three energy stocks, but most of that quarter is comprised of a single stock: CVR Energy (NYSE: CVI).

CVR Energy is primarily a petroleum refiner, making products like gasoline and nitrogen fertilizer. This is a very different business than an upstream petroleum company, which produces the raw input that CVR Energy then refines. Whereas an oil and gas producer wants commodity prices to rise, thus raising its profit margins, refiners like CVR Energy are more interested in crack spreads — the value difference between raw petroleum and its refined byproducts.

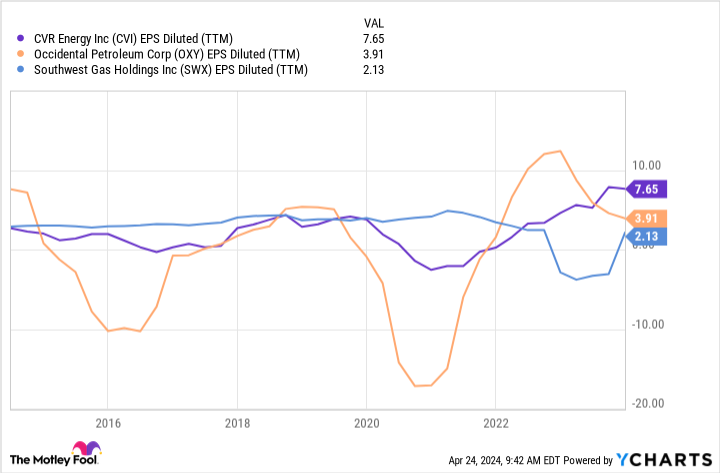

Because CVR Energy is simply capturing this “middleman” value, it can make money in all types of pricing environments. To be sure, it’s still heavily exposed to crude oil pricing fluctuations, but compared to energy producers like Occidental Petroleum (NYSE: OXY) — the next stock on this list — CVR Energy’s profit margins are relatively stable.

Why is Icahn so bullish on CVR Energy? He’s owned the stock for a long time, acquiring a majority stake in 2012. According to filings, he particularly likes the company’s strategically located assets. Refiners want to be located near production and transportation facilities, and CVR Energy has enviable assets close to major crude oil and refined product transportation hubs. Icahn also loves the dividend, which currently delivers a 6% yield.

These 2 stocks give Icahn a complete energy portfolio

The other two major energy holdings in Icahn’s portfolio are the aforementioned Occidental Petroleum — of which Icahn owns warrants, not the stock directly — and Southwest Gas Holdings (NYSE: SWX). In combination with CVR Energy, these stocks effectively create an integrated energy business. Occidental is a major oil and gas producer, while Southwest Gas is a natural gas utility serving more than 2 million residential, commercial, and industrial customers in Arizona, Nevada, and California. As a basket of stocks, Icahn has complete energy exposure, from production to refining all the way to distribution to the end customer.

Taken separately, each stock provides its own balance of risk and reward. Occidental Petroleum does well when energy prices are rising. CVR Energy does well when refining margins are on the rise. Southwest Gas, meanwhile, actually prefers a more stable pricing environment, allowing it to profit from its distribution network, not commodity price fluctuations.

If you’re going to replicate Icahn’s energy stock picks in your own portfolio, it’s best to replicate them in totality. That is, don’t just pick one. Icahn is likely well aware of how each stock offsets risk in another. If oil prices crash, his Southwest Gas and CVR Energy holdings can potentially shoulder the blow. And if refining margins narrow, that value usually flows elsewhere along the supply chain, meaning Occidental Petroleum and Southwest Gas become beneficiaries.

Still, there’s no doubt that Icahn is most bullish on CVR Energy. But it’s not clear why. Valero Energy, another refiner, has seen its share price rise by 196% over the last five years. CVR Energy shares, meanwhile, have fallen in value by 31% over that time frame. And yet Valero trades at 2.1 times book value, while CVR Energy trades at nearly 4 times book value!

CVR Energy stock hardly seems like a bargain, despite Icahn’s apparent bullishness. If you add shares to your portfolio, it’s probably best to diversify your energy supply chain exposure with stocks like Occidental Petroleum and Southwest Gas.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

More Than a Quarter of Billionaire Carl Icahn’s Portfolio Is In These 3 Energy Stocks was originally published by The Motley Fool