YETI (NYSE:YETI) Reports Sales Below Analyst Estimates In Q4 Earnings, Stock Drops 12.9%

Outdoor lifestyle products brand (NYSE:YETI) missed analysts’ expectations in Q4 FY2023, with revenue up 16% year on year to $519.8 million. It made a non-GAAP profit of $0.90 per share, improving from its profit of $0.78 per share in the same quarter last year.

Is now the time to buy YETI? Find out by accessing our full research report, it’s free.

YETI (YETI) Q4 FY2023 Highlights:

-

Revenue: $519.8 million vs analyst estimates of $535.9 million (3% miss)

-

EPS (non-GAAP): $0.90 vs analyst expectations of $0.96 (6.4% miss)

-

Guidance for 2024 EPS (non-GAAP): $2.48 at the midpoint vs analyst expectations of $2.68 (7.6% miss)

-

Free Cash Flow of $159.5 million, up 121% from the previous quarter

-

Gross Margin (GAAP): 60.6%, up from 37.3% in the same quarter last year

-

Market Capitalization: $4.19 billion

Matt Reintjes, President and Chief Executive Officer, commented, “In the fourth quarter, we saw strength in a number of key areas of our business. Our Drinkware business grew 12%, pushing the category to over $1 billion in annual sales. Also, our international expansion continued in the fourth quarter, with our business outside the US growing 39%. Despite strong topline performance in these areas, our fourth quarter results were below our guidance, primarily as a result of more cautious and inconsistent spending on high-priced ticket items in our Coolers & Equipment category. Gross margins continued to expand in the fourth quarter, reaching an all-time high of over 60 percent, which supported a return of adjusted operating margin expansion. And we exited the year with our strongest balance sheet to-date, including a record cash position of nearly $440 million.”

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and gear tailored for adventure enthusiasts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

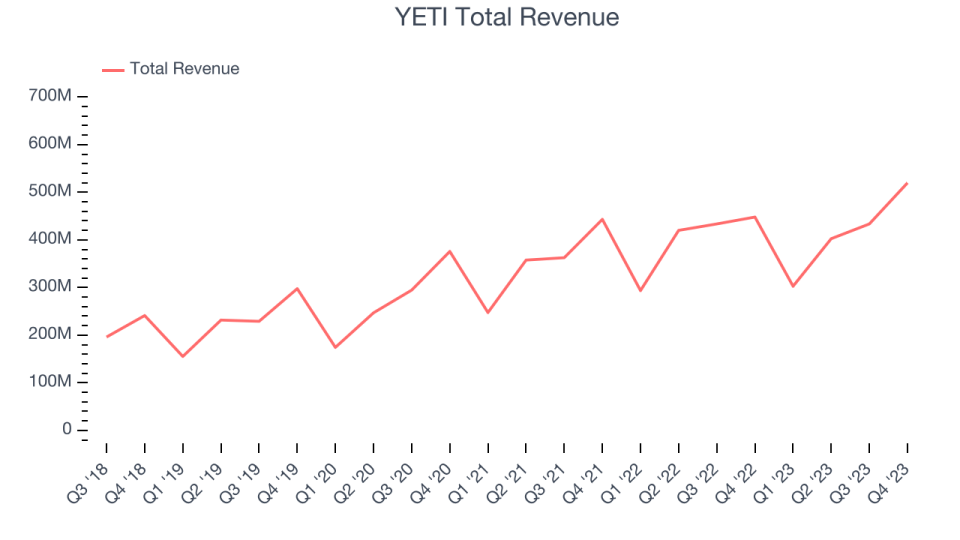

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. YETI’s annualized revenue growth rate of 16.3% over the last five years was solid for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That’s why we also follow short-term performance. YETI’s recent history shows its momentum has slowed, as its annualized revenue growth of 8.4% over the last two years is below its five-year trend.

This quarter, YETI’s revenue grew 16% year on year to $519.8 million, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 11.8% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

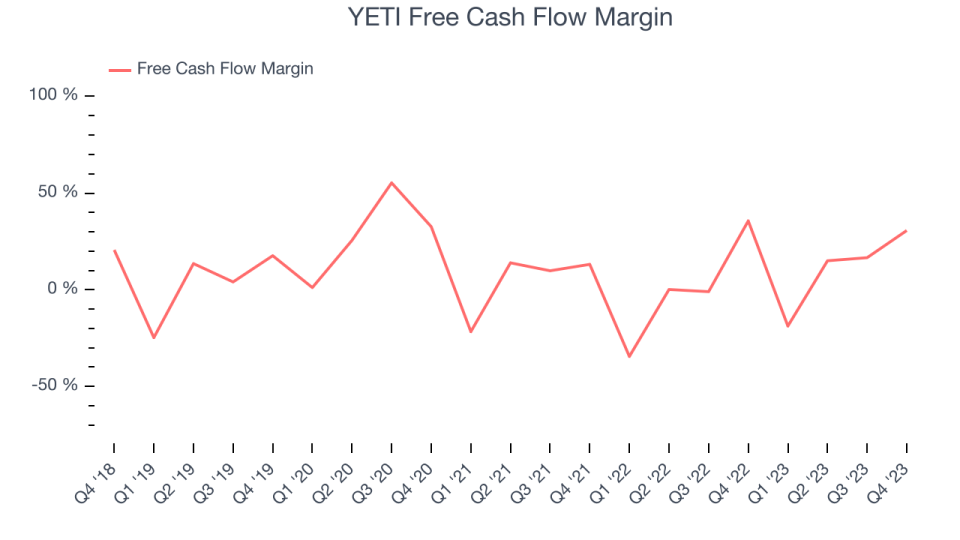

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, YETI has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.9%, subpar for a consumer discretionary business.

YETI’s free cash flow came in at $159.5 million in Q4, equivalent to a 30.7% margin and in line with the same quarter last year. Over the next year, analysts predict YETI’s cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 14.2% will decrease to 10%.

Key Takeaways from YETI’s Q4 Results

We struggled to find many strong positives in these results. Its full-year EPS forecast missed and its revenue fell short of Wall Street’s estimates by a meaningful amount. In the quarter, revenue and EPS also fell short. Management said that “results were below our guidance, primarily as a result of more cautious and inconsistent spending on high-priced ticket items in our Coolers & Equipment category.” Overall, this was a poor quarter for YETI. The company is down 12.9% on the results and currently trades at $42 per share.

YETI may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.