Will Artificial Intelligence (AI) Allow Nvidia to Crush Apple and Microsoft, and Become the Most Valuable “Magnificent Seven” Stock?

Nvidia (NASDAQ: NVDA) has emerged as the hottest player in the artificial intelligence (AI) space. Its cutting-edge graphics processing units (GPUs) are the most important hardware element of the servers that run advanced AI applications.

In the particularly high-margin category of GPUs tailored to run AI and other accelerated computing applications, Nvidia currently commands roughly 90% of the market. While competitors, including Advanced Micro Devices and Intel, are making moves to ramp up their capabilities in the ultra-high-performance GPU space, many analysts expect Nvidia to retain its incredible strength in the category.

With incredible performances behind it and management guiding for further explosive growth, Nvidia stock has risen by 240% over the last year and is up 82% so far in 2024.

These gains have pushed Nvidia’s market cap to roughly $2.27 trillion. It now ranks as the world’s third-most valuable company and the third-most valuable member of the “Magnificent Seven.” Apple, currently sitting in second place, has a market cap of $2.65 trillion, while top dog Microsoft is valued at approximately $3.12 trillion.

Could Nvidia soon be the world’s most valuable company?

AI’s most influential player is reaping the rewards

Starting late in 2022, incredible leaps forward in artificial intelligence technologies began to emerge at a rapid pace. That progress ramped up dramatically in 2023, and it has shown no sign of slowing down this year.

As businesses and institutions have made moves to gain exposure to the AI space, demand has soared for Nvidia’s most advanced processors. Its sales and earnings have shot through the roof.

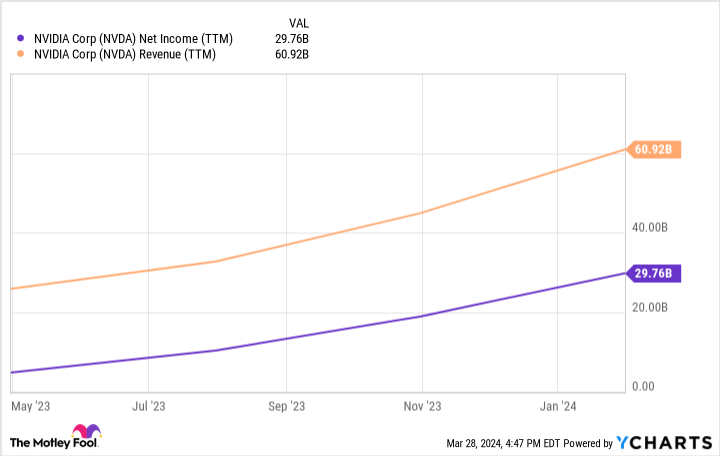

In last year’s fourth quarter, the company’s sales grew 265% year over year to $22.16 billion. Thanks to dramatic performance acceleration in 2023’s second half, Nvidia’s annual sales increased by 126% to $60.9 billion.

Nvidia posted $29.76 billion in net income last year — equal to 49% of its total sales. That’s an incredible net income margin for a hardware-oriented business; those often have lower margins compared to software-oriented businesses due to the higher incremental costs associated with producing physical goods.

But the company’s incredible margins reflect just how highly in demand its GPUs are right now. It’s reasonable to expect that Nvidia’s incredible growth will moderate, but the business looks poised to grow at a much faster rate than Apple and Microsoft for the next few years at least.

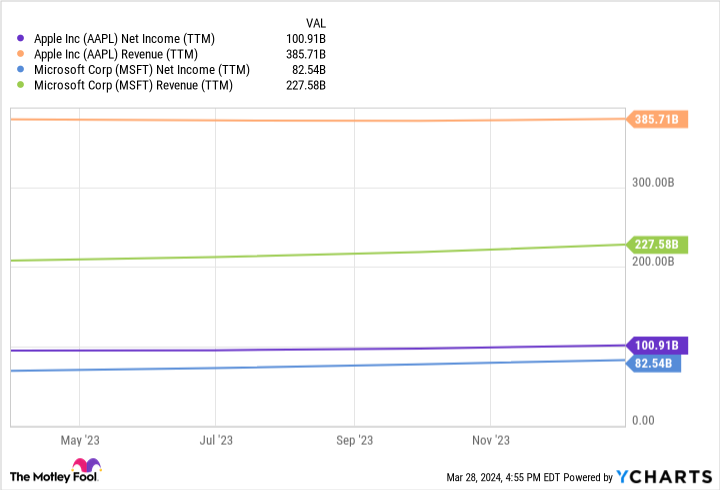

Apple and Microsoft still generate far more revenue and net income than Nvidia. On the other hand, the chip powerhouse looks well positioned to continue being the biggest winner in the AI revolution, and has been growing at a far faster rate than those larger tech giants.

For comparison, Microsoft grew its sales roughly by 10% over the trailing-12-month period and increased its net income by 20%. Meanwhile, Apple’s revenue was flat across that stretch, though its net income rose by 7%.

If demand for AI services continues to rise dramatically, there’s a good chance that Nvidia will surpass Apple’s market cap and take the title of world’s most valuable company from Microsoft within the next five years. While the GPU leader’s business has historically been shaped by cyclical trends, it still appears to be in the early stages of benefiting from the unfolding AI revolution.

Right now, Nvidia is benefiting from the emergence of an unprecedented new technology — and that means forecasting its performance over the next five years involves a heavy dose of speculation. But given its incredible sales and earnings momentum and the overall market excitement for artificial intelligence applications, it wouldn’t be shocking to see Nvidia claim the title of world’s most valuable business.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Will Artificial Intelligence (AI) Allow Nvidia to Crush Apple and Microsoft, and Become the Most Valuable “Magnificent Seven” Stock? was originally published by The Motley Fool