Why Solar Energy Stocks Finally Had a Good Week

The week finally went well for solar energy investors, with stock values up double digits in many cases. And some of the most beaten-up residential solar stocks are outperforming the market.

According to data provided by S&P Global Market Intelligence, SolarEdge (NASDAQ: SEDG) is up 6.4% this week as of 10:30 a.m. ET, Sunrun (NASDAQ: RUN) has gained 19.2%, and Sunnova Energy (NYSE: NOVA) is up 34.9%. It was a broad move, but some key companies drove the industry higher.

Is Sunnova’s pop sign of a bottom?

In separate notes to clients, Goldman Sachs analyst Brian Lee gave a bullish outlook for Sunnova Energy and maintained a $14 price target while Guggenheim analyst Joseph Osha gave the stock a buy rating after meeting with CEO John Berger. In both cases, the analysts thought Sunnova’s cash generation potential from selling assets would allow the company to refinance debt that comes due in 2026.

Cash has been the most important topic for investors over the past few months as higher interest rates have made it more difficult to finance solar projects while demand started to drop because of California’s net metering rule change. Companies have had to resort to raising money at unattractive terms, so even a small sign that financing is available could be a catalyst for stocks like Sunnova and Sunrun.

Interest rates are finally falling

Over the past month, the 10-year government bond yield is down 11 basis points in the U.S. and between 8 basis points and 26 basis points in Europe. As I mentioned above, those lower rates will make it easier to finance solar projects and this comes at a time when installers are expecting activity to start to pick up in the summer of 2024.

Installers are expecting lower component costs, rising utility rates, and a more mature sales cycle to start helping results in the back half of 2024. That’s not far away as we near the end of the first quarter and it seems stocks are finally perking up.

The bottom is in… for now

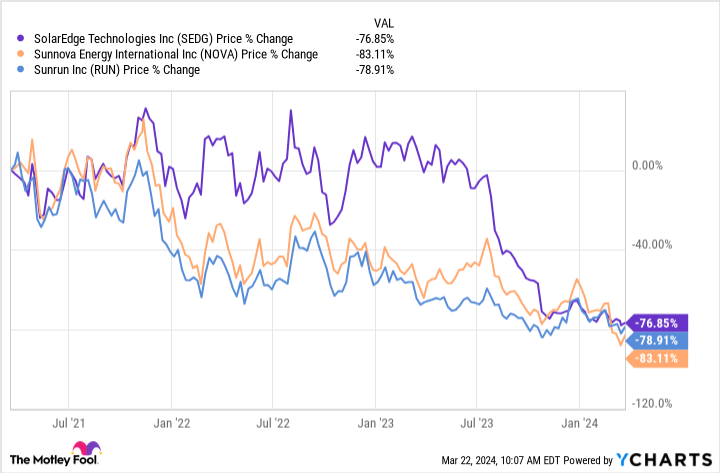

It’s hard to overstate how bad 2023 was for the residential solar industry. Policy changes in California and Europe combined with rising interest rates made it much more difficult to finance projects and everyone felt the pain. Installers were hit first because they were at the front lines, but component suppliers like SolarEdge were hurt because sales not only fell as installations dropped, but customers cut inventory as well.

Across the industry, there’s hope a turnaround is on the horizon and some signs are pointing in that direction. Interest rates have stabilized and may be moving lower, short-term liquidity issues have been resolved, and lending for projects is opening up again. Now, it’s on the industry to show fundamental improvement, and if it does this could be near the bottom for solar energy stocks.

I’m cautiously optimistic the industry will recover in 2024 and this week was a sign that it just might. But don’t be surprised if there’s more volatility ahead because this has been a roller-coaster ride for investors.

Should you invest $1,000 in Sunnova Energy International right now?

Before you buy stock in Sunnova Energy International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sunnova Energy International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool recommends SolarEdge Technologies. The Motley Fool has a disclosure policy.

Why Solar Energy Stocks Finally Had a Good Week was originally published by The Motley Fool