Why MicroStrategy Stock Fell More Than 20% Last Month

Shares of MicroStrategy (NASDAQ: MSTR) dropped 20.7% lower in January 2024, according to data from S&P Global Market Intelligence. In keeping with the business intelligence specialist’s recent history, the price move was dictated by rumblings in the Bitcoin (CRYPTO: BTC) market — but this time, it wasn’t about the cryptocurrency’s actual price change.

Here, let me explain.

ETFs shake up the Bitcoin landscape

MicroStrategy’s January chart relied on the emerging access to exchange-traded funds (ETFs) based on Bitcoin’s spot price. Many investors have treated MicroStrategy as the closest thing to a Bitcoin-focused stock since it started converting its cash reserves into direct Bitcoin holdings.

So when the U.S. Securities and Exchange Commission (SEC) finally looked likely to give a final thumbs-up or thumbs-down on spot-price Bitcoin ETFs after years of pleading and lawsuits, MicroStrategy lost some of that crypto-focused investor attention.

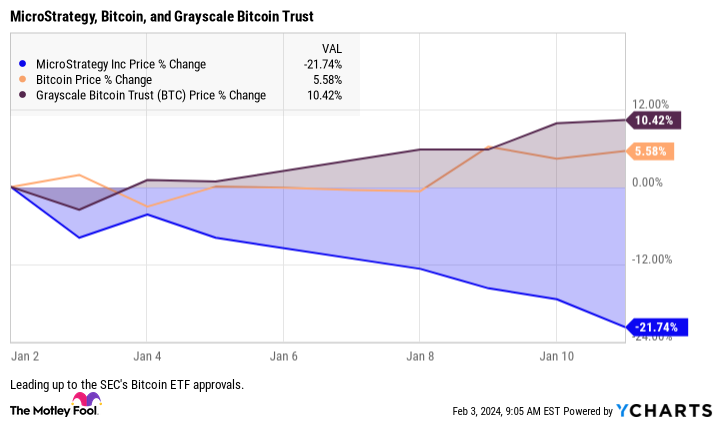

MicroStrategy’s stock was down 21.7% month to date on Jan. 11, when the 11 freshly approved Bitcoin ETFs started trading. Bitcoin had gained 5.6% over the same span. Most of the new ETFs didn’t have a price history before that date, but the Grayscale Bitcoin Trust (NYSEMKT: GBTC) converted from a traditional mutual fund to a more flexible ETF, and the fund price rose by 10.4% in early January:

MicroStrategy’s stock price stayed at this lower level after the ETF approvals. The Grayscale fund immediately started losing value, along with similar declines in the other ETFs and in the underlying cryptocurrency, ending the month just 1.3% higher. Spot-price ETFs are supposed to boost the long-term dollar value invested in Bitcoin, but the early returns have not been impressive.

MicroStrategy’s dual identity

MicroStrategy still runs a successful business intelligence operation, but the software story doesn’t get much attention from investors and headline writers these days. That includes MicroStrategy’s own headline-penning staff, by the way. The third-quarter report listed MicroStrategy’s Bitcoin balance right in the title, leaving popular business metrics such as revenue and earnings to be found in the full report. I expect the same approach in the upcoming fourth-quarter report, scheduled for Tuesday, Feb. 6.

That’s just the way it is. Founder and chairman Michael Saylor chose to anchor his company to the Bitcoin chart in the coronavirus-riddled fall of 2020, and he really went all-in on this investment. In the third quarter, the company had $45 million in cash reserves but $2.45 billion of Bitcoin holdings. Most of the cryptocurrency stash was financed by open-market stock sales and additional debt. It’s like taking out a second mortgage on your family home to finance more Bitcoin buys.

This way, MicroStrategy still plays a unique role in the crypto market, potentially amplifying the long-term gains in Bitcoin prices by adding more digital coins to its coffers along the way. That’s different from the Grayscale Bitcoin Trust and other ETFs, which always strive to reflect the current Bitcoin price.

It’s a risky strategy, but Saylor looks like a genius when Bitcoin prices are going up. January’s price plunge showed how quickly the tide can turn when Bitcoin’s price drops or investors get ahold of alternative stock-like crypto assets. The upcoming earnings report should repeat the same themes, with the software business playing a distant second fiddle to Michael Saylor’s Bitcoin devotion.

Should you invest $1,000 in MicroStrategy right now?

Before you buy stock in MicroStrategy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MicroStrategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Anders Bylund has positions in Bitcoin and Grayscale Bitcoin Trust. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Why MicroStrategy Stock Fell More Than 20% Last Month was originally published by The Motley Fool