Which “Strong Buy” Retail Stock Is the Better Bet?

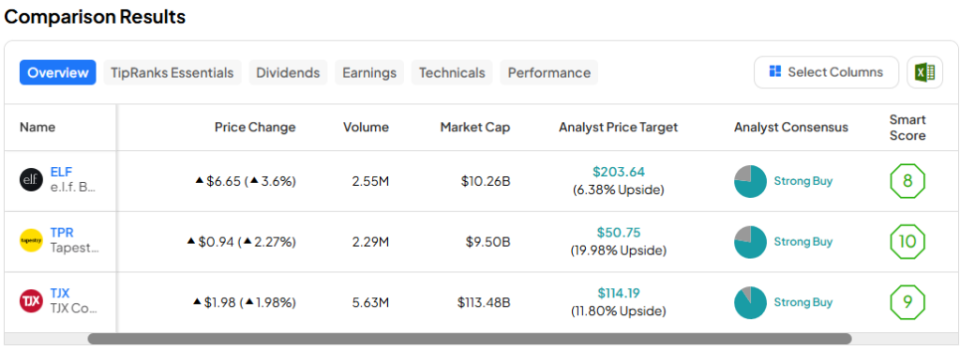

The consumer seems to be behaving in mysterious ways lately. With inflation coming back down and purse tightening still in effect, in some places more than others, it’s becoming increasingly difficult to get an accurate read of the consumer. They choose to splurge on certain luxuries, conveniences, and experiences but not at the grocery aisle. Given these dynamics, in this piece, we’ll check in with TipRanks’ Comparison Tool below to see how three Strong-Buy-rated discretionary retailers — ELF, TRP, and TJX — stack up over the year ahead.

As inflation touches down, with the odd price cuts potentially in the cards for certain items, I find that the consumer stands to get a lot healthier from here. As they spend more on specific discretionary goods, we may be getting a hint of where consumers are headed next.

e.l.f. Beauty (NASDAQ:ELF)

Shares of cosmetics retailer e.l.f. Beauty shot up nearly 19% on Thursday, leaving the rest of the market in the dust as it reported fiscal fourth-quarter results that were much better than expected. Indeed, the opportunity to grab ELF stock on the dip may have come and gone. The good news is that the disruptive cosmetics company is still down 14% from its all-time high of $221.83 per share.

With so much brand momentum and appeal with younger consumers, I expect more outperformance ahead as e.l.f. Beauty looks to grab more market share to fuel its growth. All things considered, I’m staying bullish on the stock, even after its remarkable post-quarter pop.

For Fiscal Q4 2024, e.l.f. saw revenue soar 77% year-over-year. Such scorching growth also accompanied a 140 bps improvement in EBITDA margins. Undoubtedly, the magnitude of sales growth and margin gains is simply not sustainable. That said, the boom could easily last for a while longer and help power shares to greater heights. In a way, e.l.f. seems to be like the Nvidia (NASDAQ:NVDA) of the beauty industry.

As the $10.7 billion disruptive cosmetics industry newcomer looks to replicate success in international markets (think Canada and the UK), there may still be room to extend the run. Nonetheless, expectations are bound to adjust to the downside after the firm called for slower growth for the rest of its fiscal year.

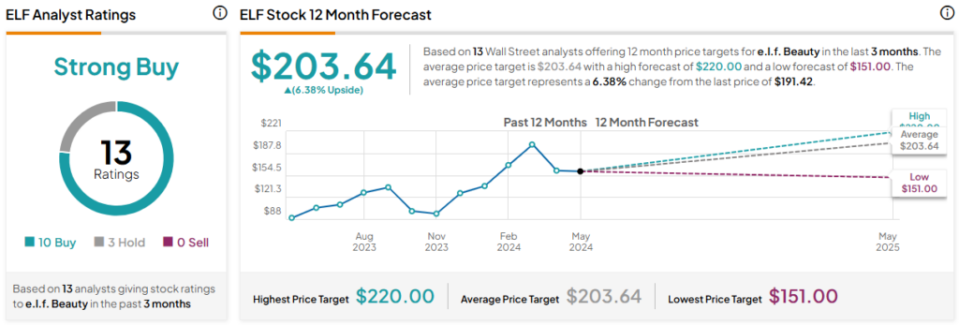

What Is the Price Target of ELF Stock?

ELF stock is a Strong Buy, according to analysts, with eight Buys and two Holds assigned in the past three months. The average ELF stock price target of $203.64 implies 6.4% upside potential.

Tapestry (NYSE:TPR)

Tapestry is the house behind such “accessible” luxury brands as Coach and Kate Spade. These are goods, like leather bags and wallets that are classy and upscale but not wildly expensive as the likes of a Dior or a Chanel. The stock has been on a wild ride over the past year, crashing and blasting off in a matter of months. Such volatility could persist for some time as Tapestry looks to acquire its way to greater growth.

Though the medium-term could see more steep swings, I must say I like the longer-term trajectory, even after news broke that the Capri Holdings (NYSE:CPRI) acquisition (Tapestry is trying to acquire Capri, another luxury retail company) is being blocked by the U.S. Federal Trade Commission (FTC).

Sure, a Capri deal would have further solidified Tapestry’s moat, with new brands such as Versace and Jimmy Choo joining the mix. Regardless, Tapestry still has plenty of places where it can put the extra cash if no deal happens. Perhaps trimming away at debt and buying back shares while they’re relatively cheap could prove wise if a deal can’t be completed by year’s end at the hands of the FTC.

In the meantime, I’m staying bullish while shares trade at 10.9 times trailing price-to-earnings (P/E), just below the luxury goods industry average of 11.2 times P/E. Indeed, dip-buyers who pursued the name have been rewarded greatly.

As it stands today, TPR stock is in a better spot than it was in the back half of last year, with a lower bar to pass (revenue expectations have fallen to “more than $6.6 billion,” $100 million less than what analysts had hoped for).

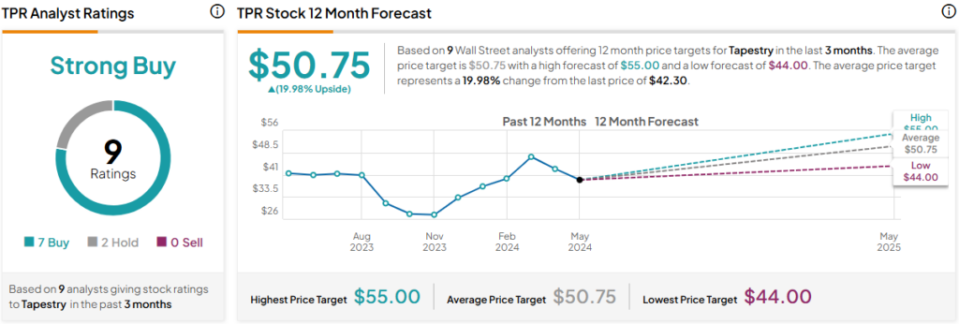

What Is the Price Target of TPR Stock?

TPR stock is a Strong Buy, according to analysts, with seven Buys and two Holds assigned in the past three months. The average TPR stock price target of $50.75 implies 20% upside potential.

The TJX Companies (NYSE:TJX)

TJX Companies stock is in the midst of a nice multi-year bull run and recently made a new all-time high. The off-price retailer has continued to feed the hunger for discretionary bargains amid inflation’s painful pinch. With another strong earnings beat in the books for its recent fiscal second quarter (earnings per share of $0.93, ahead of the $0.88 expectation), it seems like the appetite for discounts is not fading.

Either way, I’m staying bullish on TJX stock at 24.8 times trailing P/E as it continues to deliver on that sought-after “offline treasure hunt experience.”

Same-store sales were up a modest 3% for the quarter — not incredible, but still decent for a retailer of nice-to-have goods. UBS (NYSE:UBS) analyst Jay Sole is a big fan of the stock, recently upgrading to Buy from Hold while hiking his price target by $28.00 to $132.00 per share.

What’s behind Sole’s big upgrade? He sees “big potential” in some of TJX’s “newer businesses” in addition to the European business. Additionally, Sole no longer sees the firm’s lacking digital presence as an “existential threat.” He’s absolutely right.

Perhaps staying mostly offline has been an edge for TJX. After all, you can’t really have that same “treasure hunt” experience online as you would at a brick-and-mortar location. And given the costs associated with a digital storefront, the deals (or earnings) probably wouldn’t have been as good as they are now.

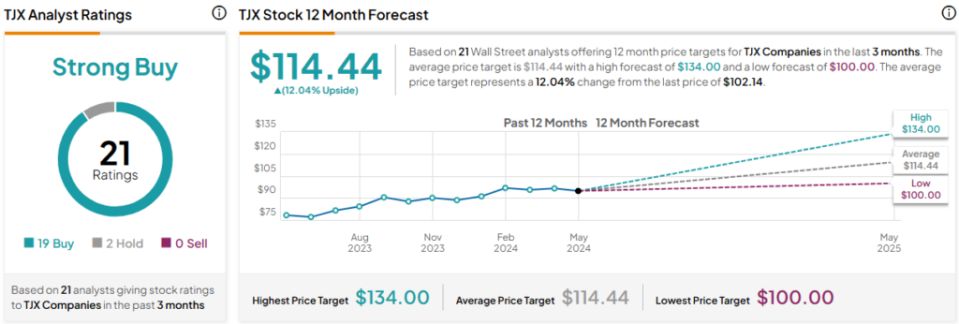

What Is the Price Target of TJX Stock?

TJX stock is a Strong Buy, according to analysts, with 19 Buys and two Holds assigned in the past three months. The average TJX stock price target of $114.44 implies 12% upside potential.

Conclusion

Consumers are becoming more selective about how and where they spend. The following three retail plays have sound value propositions relative to their industry rivals. This is bound to help them as inflation-hit folks seek out good deals on high-quality discretionary goods. Overall, out of the three stocks, analysts see the most upside from TPR stock.