Where Will Micron Technology Stock Be in 1 Year?

Micron Technology (NASDAQ: MU) stock turned out to be a solid investment over the past year with impressive gains of 75%, and this semiconductor specialist appears to have what it needs to sustain its momentum thanks to its growing prominence as an artificial intelligence (AI) play.

Brokerage and investment banking firm Stifel Financial has upgraded Micron stock to buy from hold. Analyst Brian Chin now has a price target of $120 on Micron, up significantly from the earlier target of $80. The upgraded price target points toward a 25% upside from current levels.

AI is a big reason behind Chin’s analyst upgrade. Chin’s research note pointed out that Micron has now joined the AI party, which is not surprising as Micron’s high-bandwidth memory (HBM) has already been selected by Nvidia for deployment in its next-generation AI chips. But that’s not where the good news ends.

Let’s look at the reasons why AI is set to drive solid growth for Micron in the coming year.

AI will drive significant memory market growth for Micron

Micron has already won the HBM slot at Nvidia, and Stifel’s Chin predicts that it is on track to supply this type of memory to Advanced Micro Devices as well. If that’s indeed the case, then Micron will be well on its way to capitalizing on a solid growth opportunity.

Market research firm Yole Group estimates that HBM shipments could jump a massive 150% in 2024, generating just over $14 billion in revenue for memory chipmakers. For comparison, the HBM market was worth an estimated $5.5 billion in 2023. The good part is that this market is set for solid expansion in the long run, with shipments predicted to increase at an annual pace of 25% through 2029.

Stifel points out that the growing demand for HBM will have a positive impact on the dynamic random-access memory (DRAM) market as a whole, creating tight supplies and lifting average selling prices (ASPs). It is worth noting that there is a supply shortage of HBM chips already, which is why memory industry participants are focusing their energies on increasing the output of these chips.

As a result, there may be a shortage in other niches of the memory market as well. For instance, the demand for consumer electronics such as personal computers (PCs) and smartphones is anticipated to jump in 2024 following sharp declines in the past couple of years. IDC forecasts a 2.8% increase in smartphone shipments this year following a 3.2% drop last year.

PC shipments are expected to jump 3.4% this year, compared to a 14% drop in 2023. AI, however, is likely to give the likes of Micron an incremental growth opportunity in both PCs and smartphones. That’s because AI-powered smartphones and PCs are likely to command bigger memory chips, thereby expanding Micron’s addressable market.

All this indicates why Stifel is forecasting a tight supply of DRAM this year, which should ideally lead to stronger pricing. The good part is that the memory market is already seeing stronger pricing. DRAM prices were up between 13% and 18% in the fourth quarter of 2023, reversing two years of declines. They are expected to jump identically in the current quarter as well.

More importantly, memory pricing is likely to get better as the year progresses. This explains why the DRAM market’s revenue is expected to increase a terrific 88% in 2024 to just over $87 billion, according to Gartner. The improving end-market conditions tell us just why Micron’s top and bottom lines are set to improve substantially this year, which could lead to a huge jump in the company’s stock price.

How much upside can investors expect over the next year?

Micron released its fiscal 2024 first-quarter results (for the three months ended Nov. 30, 2023) in December last year. The company’s revenue was up nearly 16% year over year to $4.7 billion. However, as the DRAM prices were yet to gain momentum at that time, its non-GAAP (adjusted) loss increased to $0.95 per share from $0.04 per share in the year-ago period.

Its operating income margin stood at a negative 20% in the quarter. However, that was an improvement over the negative operating margin of 30% in the fourth quarter of fiscal 2023, indicating that the memory market’s improving dynamics are already having a positive impact on Micron.

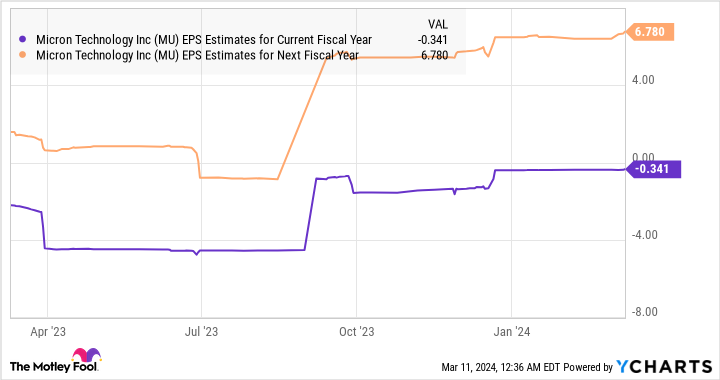

Analysts predict Micron’s loss will shrink to $0.34 per share in fiscal 2024 from $4.45 per share in the previous year. More importantly, its earnings in the next fiscal year, which will begin in September 2024, are predicted to jump big-time.

Assuming Micron’s bottom line indeed jumps to $6.78 per share in the next fiscal year and it trades at 30 times earnings at that time (using the Nasdaq-100 index’s forward earnings multiple as a benchmark as Micron is a component of this index), its stock price could jump to $203 next year. That points toward a potential upside of just over 111% from current levels, indicating that investors can consider buying this semiconductor stock right now as it is trading at a really attractive 10 times earnings.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Where Will Micron Technology Stock Be in 1 Year? was originally published by The Motley Fool