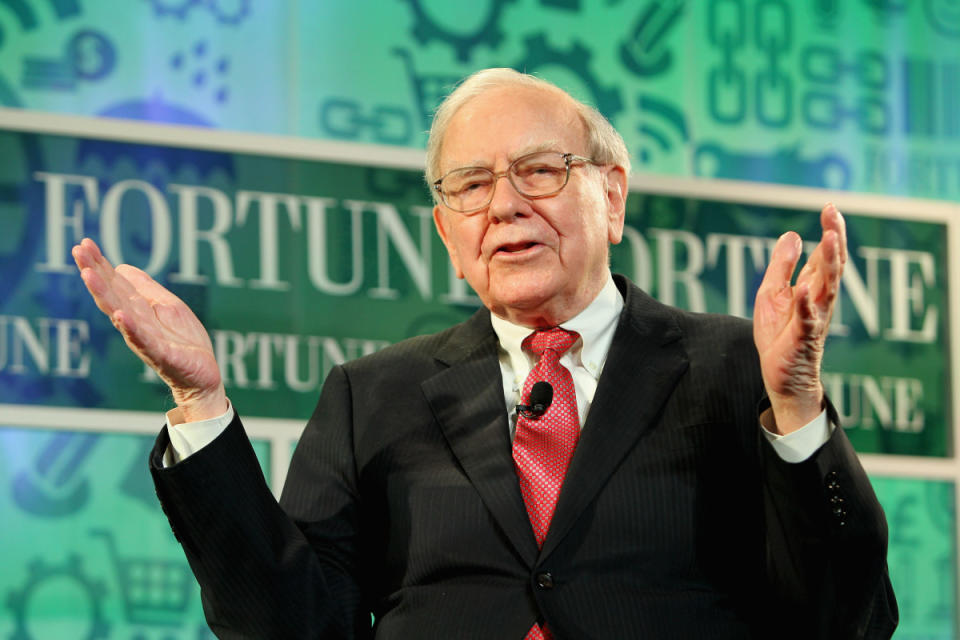

Warren Buffett just sold shares in this popular streaming stock

Warren Buffett has two rules for investing.

Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.

The Oracle of Ohama, as the Nebraska native has been dubbed, has done very well for himself — and investors — by sticking to those two mandates.

Buffett is co-founder, chairman, and CEO of Berkshire Hathaway (BRK.A) (BRK.B) , which owns about 65 companies and hundreds of subsidiaries.

And he is currently the seventh richest person on Earth, with a total net worth estimated at $133 billion, according to the Bloomberg Billionaire Index.

The 93-year-old Buffett takes the long view on investing. After all, this is the guy who said, “someone is sitting in the shade today because someone planted a tree a long time ago.”

Paul Morigi/Getty Images

Buffett’s investment style is legendary

Buffett described his company’s journey “as a bumpy road involving a combination of continuous savings by our owners … the power of compounding, our avoidance of major mistakes and — most important of all — the American Tailwind.”

“America would have done fine without Berkshire,” he said in his 2022 shareholders letter. “The reverse is not true.”

Related: Billionaire George Soros sold this popular semiconductor stock

Of course, nobody is perfect, Buffett included. He has freely admitted that skipping over the opportunity to invest in Alphabet’s (GOOG) Google was one of his major blunders.

And don’t even get started on Dexter Shoes, which he bought in 1993 and which resulted in a $3.5 billion loss to shareholders when what Buffett “assessed as a durable competitive advantage vanished within a few years.”

Buffett has said, “To date, Dexter is the worst deal that I’ve made.”

In a letter to shareholders, he said, “But I’ll make more mistakes in the future. You can bet on that.”

Nevertheless, Buffett has generated annual returns averaging about 22%, roughly doubling the S&P 500.

Buffett: Know when to fold ’em

While the billionaire likes to say that “our favorite holding period is forever,” he has parted company with plenty of companies.

Buffett has said that he will sell if his conglomerate needs money for something else or “when we think we’re reevaluating the economic characteristics of the business.”

Related: Nvidia’s maiden 13F filing sends AI-focused tech stock soaring

Berkshire Hathaway’s filings with the Securities and Exchange Commission can give insights into Buffett’s reasoning.

The reports, known as 13F filings, are backdated to the end of the previous quarter.

While they do not include the full scope of holdings nor possible bets against a particular security, they do provide a glimpse into the strategies of some of the world’s biggest investors.

The latest 13F filing revealed that Buffett’s conglomerate slashed its stake in Paramount Global (PARA) by almost a third (32%) during the fourth quarter.

The media conglomerate, which owns CBS, MTV, Nickelodeon, and the iconic film studio, among other properties, saw its stock drop on the news, and the shares were down about 4.4% at the last check.

Berkshire Hathaway bought $2.6 billion of Paramount stock in 2022, which amounted to 15% of the company.

The news of the stock sale comes just after Paramount began a round of layoffs.

Chief Executive Bob Bakish announced the layoffs in a memo to employees obtained by CNN on Tuesday.

Paramount reportedly an M&A target

While Bakish did not specify the number of layoffs, sources familiar with the matter told CNN around 800, or roughly 3%, of the company’s workers are affected

The announcement follows a Jan. 25 memo in which Bakish warned that Paramount Global would “reduce our workforce globally” as part of “our path to earnings growth.”

More Wall Street Analysts:

In the memo, Bakish cited the company’s “blockbuster” Super Bowl LVIII, which was the most-watched telecast in history.

Paramount cautioned investors in November that a slump in ad sales and intensifying competition would clip its fourth-quarter earnings.

It posted a weaker-than-expected profit of 39 cents a share on revenue of $6.92 billion for the three months ending in October.

The company has been the subject of merger-and-acquisition discussions, including with media mogul Byron Allen, a former Hollywood star, who has made a play for the streaming and entertainment company.

In addition to Paramount, Berkshire sold 10 million Apple (AAPL) shares in the fourth quarter but still owned more than 905 million shares valued at about $174 billion.

The conglomerate also cut its stake in HP (HPQ) by 78% and sold off all its holdings in DR Horton (DHI) , Markel (MKL) , StoneCo (STNE) , and Globe Life (GL) .

Related: Veteran fund manager picks favorite stocks for 2024