Warner Bros. Discovery (NASDAQ:WBD) Reports Sales Below Analyst Estimates In Q1 Earnings

Global entertainment and media company Warner Bros. Discovery (NASDAQ:WBD) missed analysts’ expectations in Q1 CY2024, with revenue down 6.9% year on year to $9.96 billion. It made a GAAP loss of $0.40 per share, improving from its loss of $0.44 per share in the same quarter last year.

Is now the time to buy Warner Bros. Discovery? Find out in our full research report.

Warner Bros. Discovery (WBD) Q1 CY2024 Highlights:

-

Revenue: $9.96 billion vs analyst estimates of $10.22 billion (2.6% miss)

-

EPS: -$0.40 vs analyst estimates of -$0.21 (-$0.19 miss)

-

Gross Margin (GAAP): 39.2%, up from 37.5% in the same quarter last year

-

Free Cash Flow of $390 million, down 88.2% from the previous quarter

-

Market Capitalization: $19.11 billion

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

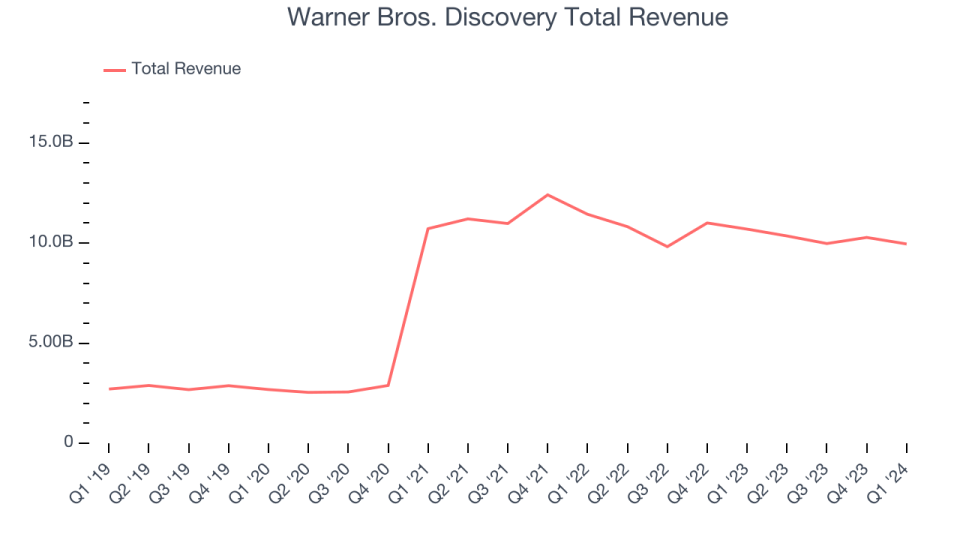

A company’s long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Warner Bros. Discovery’s annualized revenue growth rate of 29.9% over the last five years was exceptional for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That’s why we also follow short-term performance. Warner Bros. Discovery’s recent history shows a reversal from its five-year trend, as its revenue has shown annualized declines of 6.1% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Distribution, Advertising, and Content, which are 50.1%, 21.6%, and 25.7% of revenue. Over the last two years, Warner Bros. Discovery’s revenues in all three segments declined.Distribution revenue (licensing fees) averaged year-on-year decreases of 2.4% while Advertising (marketing services) and Content (films, streaming, games) averaged drops of 10.4% and 9.7%.

This quarter, Warner Bros. Discovery missed Wall Street’s estimates and reported a rather uninspiring 6.9% year-on-year revenue decline, generating $9.96 billion of revenue. Looking ahead, Wall Street expects sales to grow 2% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

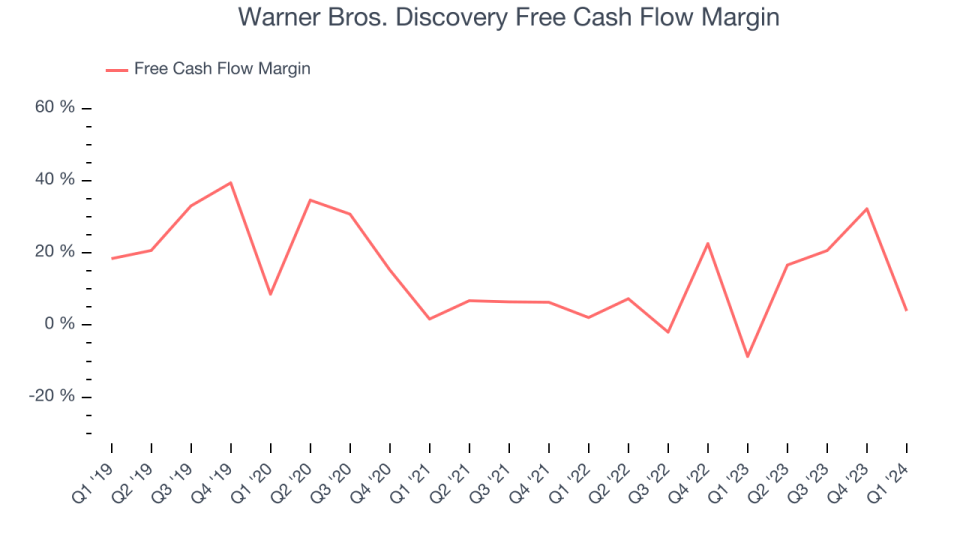

Over the last two years, Warner Bros. Discovery has shown decent cash profitability, giving it some reinvestment opportunities. The company’s free cash flow margin has averaged 11.6%, slightly better than the broader consumer discretionary sector.

Warner Bros. Discovery’s free cash flow came in at $390 million in Q1, equivalent to a 3.9% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter. Over the next year, analysts predict Warner Bros. Discovery’s cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 18.4% will decrease to 12.9%.

Key Takeaways from Warner Bros. Discovery’s Q1 Results

We struggled to find many strong positives in these results. Its operating margin missed and its EPS fell short of Wall Street’s estimates. Overall, this was a bad quarter for Warner Bros. Discovery. The company is down 3% on the results and currently trades at $7.55 per share.

Warner Bros. Discovery may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.