Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever

Are you planning to chase fewer growth stocks in the future, and instead collect more investment income? If so, you’re not alone. Plenty of investors dial back their activity levels the longer they’re in the market, recognizing a more passive approach to stock-picking can often yield better returns.

If you’re ready to start making such a shift, here’s a rundown of three great dividend-paying stocks you can buy now and hold forever.

Bank of America

The business is boring and its dividend yield is modest. Bank of America (NYSE: BAC), however, is truly an income holding you can buy and hold forever. You don’t even need to worry about watching it.

That’s not to say BofA stock always performs well. It doesn’t. Like those of all of its banking peers, Bank of America shares underperform during the contraction phase of economic cycles. That’s not likely to change in the future.

But, something else that’s also not likely to change is the use of money to get things done. This includes lending, wealth-building, corporate funding, and the simple storage of capital in the form of deposits. These are all businesses that Bank of America is in. BofA also enjoys the competitive advantage of being one of the banking industry’s very biggest companies, providing it with enough muscle to keep its competitors in check.

Perhaps the top reason income-seeking investors will want a long-term stake in Bank of America stock, though, is its dividend pedigree.

While it was forced to almost completely suspend its dividend in the wake of 2008’s subprime mortgage meltdown, the bank reliably raised its payout before then, and has regularly upped its quarterly payments since. And by more than a little. The dividend’s annual growth during the past five years is nearly 10%.

There’s plenty of room for continued growth, too. Less than one-third of its typical per-share profit is consumed by its dividend payments. That’s a lot of flexibility.

The stock’s current dividend yield of 2.7% isn’t enormous. What Bank of America shares lack in yield, however, they more than make up for in reliability.

W. P. Carey

W. P. Carey (NYSE: WPC) isn’t a household name. In fact, there’s a good chance you’ve never heard of it. Income-minded investors should still put this ticker on their radars though, plugging into the stock while it’s yielding 6.3%.

W. P. Carey is a real estate investment trust, or REIT. That just means it owns properties and passes the bulk of its rental income along to shareholders. Such vehicles are perfectly suited to serve income investors.

Even by REIT standards, however, this one is a bit unique.

SW. P. Carey is a net lease REIT. That just means its tenants are responsible for many of the expenses that would normally be paid by the property owner. This ultimately means W. P. Carey doesn’t charge as much rent as other landlords might for comparable properties, but it also offloads a great deal of expense-based risks onto its tenants. That’s proven to be a major benefit, with inflation pushing many of the variable costs (like taxes, utilities, and insurance) of real estate sharply higher.

And W. P. Carey’s tenants are the kind of businesses that stick around once they’ve set up shop. Its top tenants include U-Haul Self Storage, auto parts manufacturer ABC Technologies, private K-12 school chain Nord Anglia Education, and pharmaceutical research and manufacturing outfit Apotex Pharmaceutical Holdings, just to name a few. No single tenant accounts for more than 3% of its total collected rent, however. It’s also well diversified in terms of geography, with less than 60% of its business in the U.S. No single industry makes up more than a third of its tenant base either.

Do know that REITs are sensitive to changes in interest rates, and to rising rates in particular. W. P. Carey is no exception. That’s the chief reason this REIT’s price has been so erratic (mostly for the worse) since 2019. It could remain volatile for the foreseeable future, too, until interest rates finally start settling down.

As a dividend-paying stock to buy for the long haul though, this is an attractive one.

Philip Morris International

Finally, add tobacco giant Philip Morris International (NYSE: PM) to your list of passive income stocks to buy and hold forever.

That may not sound or seem quite right. It’s widely understood that tobacco usage is a serious health threat. The worldwide smoking-cessation movement has been around for a long time, too, and certainly seems to be getting plenty of traction.

The fact of the matter is, however, smoking is still surprisingly common. The World Health Organization says there are still on the order of 1.25 billion regular tobacco users, down just slightly from the figure of just a little more than 1.3 billion cited for the better part of the past decade. The organization isn’t looking for any significant reduction in this number in the foreseeable future either. Of course, sheer population growth is working in the tobacco industry’s favor.

The point is, although there’s no real growth in store for Philip Morris, there could be several decades’ worth of high-margin revenue just waiting to be scooped up. As the company behind well-known cigarette brands like Marlboro, Parliament, Chesterfield, and of course Philip Morris, this organization is well positioned to continue capturing at least its fair share of this business.

And if you think the introduction of heated tobacco and vaping is a threat, think again. Philip Morris International is also the name behind the Iqos smoke-free heated tobacco technology. Shipments of these products grew nearly 15% in 2023. In the meantime, while total cigarette shipments slumped slightly last year, total unit shipments of all its products combined actually grew.

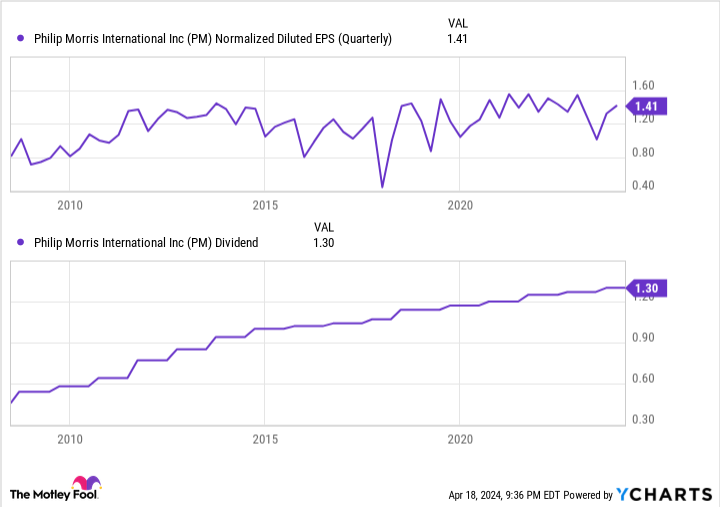

Although smoke-free products now making up roughly a third of the company’s total sales, it’s conceivable that heated tobacco and smokeless tobacco could offset declines in the company’s cigarette business for the future. This will of course provide continued support for a dividend that’s currently yielding 5.7%.

That’s a dividend, by the way, that’s been paid — and raised — like clockwork for years.

Should you invest $1,000 in Bank of America right now?

Before you buy stock in Bank of America, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bank of America wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 18, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America. The Motley Fool recommends Philip Morris International and W. P. Carey. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 3 Stocks to Buy Now and Hold Forever was originally published by The Motley Fool