Vail Resorts (NYSE:MTN) Reports Sales Below Analyst Estimates In Q2 Earnings, Stock Drops

Luxury ski resort company Vail Resorts (NYSE:MTN) fell short of analysts’ expectations in Q2 FY2024, with revenue down 2.2% year on year to $1.08 billion. It made a GAAP profit of $5.76 per share, improving from its profit of $5.16 per share in the same quarter last year.

Is now the time to buy Vail Resorts? Find out by accessing our full research report, it’s free.

Vail Resorts (MTN) Q2 FY2024 Highlights:

-

Revenue: $1.08 billion vs analyst estimates of $1.15 billion (6.5% miss)

-

EPS: $5.76 vs analyst expectations of $5.99 (3.8% miss)

-

Gross Margin (GAAP): 50%, up from 46.5% in the same quarter last year

-

Visitors: 7.26 million

-

Market Capitalization: $8.50 billion

Commenting on the Company’s fiscal 2024 second quarter results, Kirsten Lynch, Chief Executive Officer, said, “Given the unfavorable conditions across our North American resorts, we are pleased that our results for the quarter demonstrate the resiliency of our strategic business model and our network of resorts and loyal guests. The results for the second quarter were negatively impacted by challenging conditions at all of our North American resorts, with approximately 42% lower snowfall across our western North American resorts through January compared to the same period in the prior year and limited natural snow and variable temperatures at our Eastern U.S. resorts (comprising the Midwest, Mid-Atlantic, and Northeast).”

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from “things” to “experiences”. Leisure facilities seek to benefit but must innovate to do so because of the industry’s high competition and capital intensity.

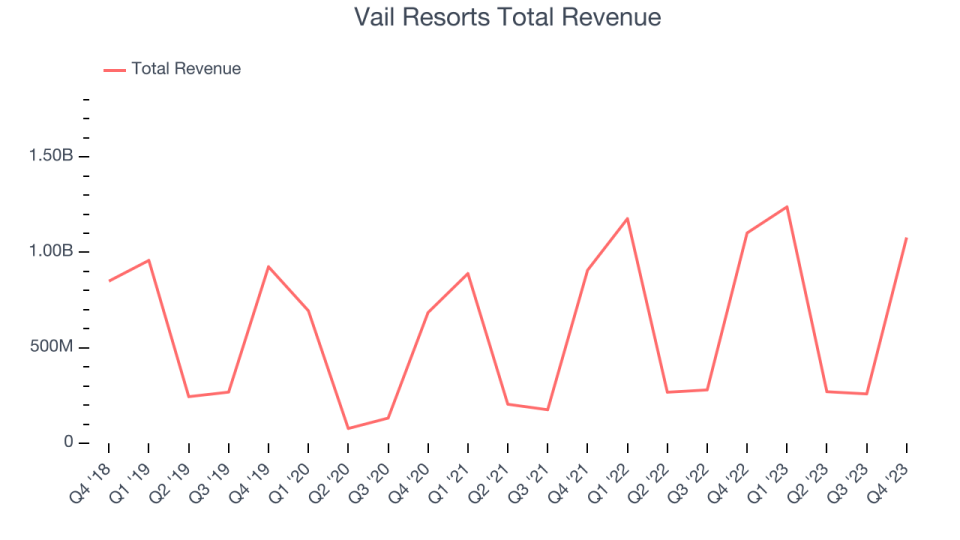

Sales Growth

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Vail Resorts’s annualized revenue growth rate of 6% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That’s why we also follow short-term performance. Vail Resorts’s annualized revenue growth of 14.4% over the last two years is above its five-year trend, suggesting some bright spots.

We can dig even further into the company’s revenue dynamics by analyzing its number of visitors, which reached 7.26 million in the latest quarter. Over the last two years, Vail Resorts’s visitors only grew slightly, showing the company has been generating revenue growth through higher prices for both lift tickets and on-mountain dining.

This quarter, Vail Resorts missed Wall Street’s estimates and reported a rather uninspiring 2.2% year-on-year revenue decline, generating $1.08 billion of revenue. Looking ahead, Wall Street expects sales to grow 10.8% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

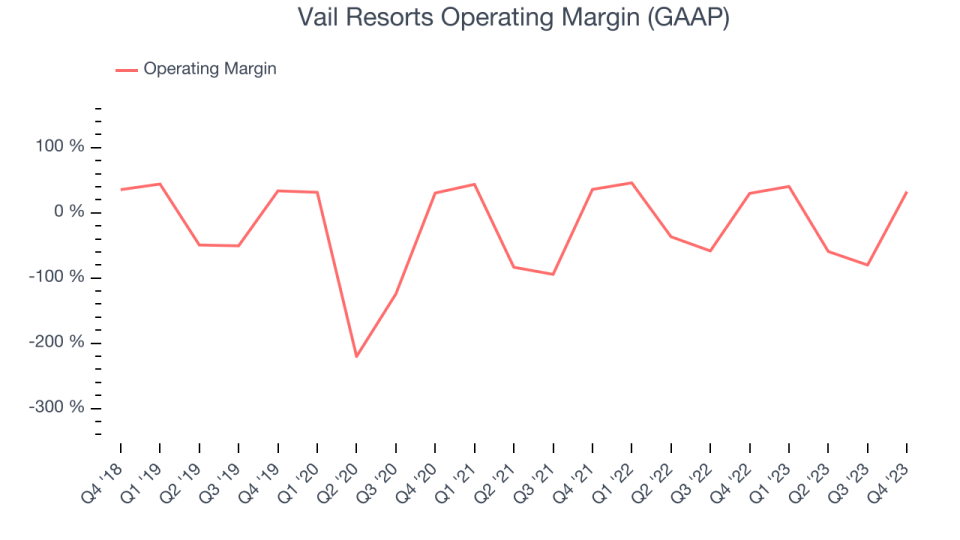

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Vail Resorts has been a well-managed company over the last eight quarters. It’s demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 19.2%.

In Q2, Vail Resorts generated an operating profit margin of 32.5%, up 2.7 percentage points year on year.

Over the next 12 months, Wall Street expects Vail Resorts to become more profitable. Analysts are expecting the company’s LTM operating margin of 17% to rise to 22.3%.

Key Takeaways from Vail Resorts’s Q2 Results

We struggled to find many strong positives in these results. Its revenue and EPS unfortunately missed Wall Street’s estimates as its number of visitors fell 9.7% year-on-year. That decrease was driven by unfavorable weather conditions as the company’s western North American ski resorts saw ~42% lower snowfall. Whistler Blackcomb and the company’s Lake Tahoe properties were particularly impacted. Total lift revenue, however, saw a 2.6% increase as it charged higher prices to its customers.

Looking ahead, Vail Resorts lowered its full-year revenue and EPS guidance based on the soft start to the ski season. Overall, the results could have been better, but we note much of the company’s underperformance was due to seasonal factors. The stock is down 7.4% on the results and currently trades at $208 per share.

Vail Resorts may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.