Two Beaten-Down Stocks That Could Soar 170% and 630%, Respectively, According to Wall Street

A bull market is here, but not every stock is benefiting. Some players remain in the doldrums. It’s up to investors to decide whether those left behind are likely to remain there or make top buying opportunities today that could deliver great rewards down the road.

Wall Street is particularly enthusiastic about two beaten-down biotech stocks that soared in the earlier days of the pandemic. These two developed coronavirus vaccine candidates, and investors were betting they could eventually commercialize the products and win big. One reached commercialization but sales disappointed, while the other hasn’t yet reached the vaccine finish line.

Read below to discover whether Wall Street’s exuberance about these two struggling stocks was justified.

Novavax

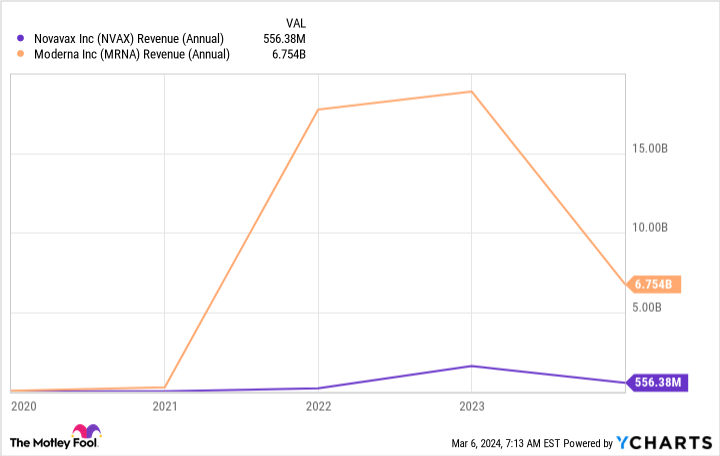

Novavax (NASDAQ: NVAX) stock soared more than 2,700% back in 2020 as investors bet on the company’s vaccine candidate. The product did enter the market, but late, so Novavax missed out on the biggest revenue opportunity. While rival Moderna‘s vaccine revenue peaked at around $18 billion, Novavax’s peak revenue came in considerably lower.

As vaccine demand declined in later pandemic stages, Novavax even questioned its ability to continue business — and the biotech launched a cost-cutting plan. Though Novavax isn’t out of the woods yet, positive elements have emerged. The company settled a dispute with one of its customers, removing one major uncertainty, and has made significant progress along the route to cost savings.

For example, the company has reduced its workforce by 30% over the past year and aims to cut research and development and administrative expenses to as low as $700 million this year, compared to the level of $1.7 billion in 2022.

What can we expect from Novavax in the months and years ahead if it meets its cost-cutting goals? The company aims to progressively carve out market share by the fall by launching its vaccine early in the season and focusing on retail pharmacies, where most vaccination is done. And the company hopes to launch a combined COVID/flu vaccine in 2026.

Meanwhile, Wall Street expects Novavax shares to jump more than 170% within the coming 12 months. I think that’s overly optimistic, but if the company continues to make cost-savings progress and reports positive news from its vaccine program, the stock could advance significantly from today’s level. Still, this stock is for aggressive investors, as it carries a decent amount of risk and has fluctuated greatly in the past.

Ocugen

Earlier in the pandemic, Ocugen (NASDAQ: OCGN) surged more than 700% in a matter of days as the company acquired the rights to sell Bharat Biotech’s Covaxin, a coronavirus vaccine, in the United States. But the product never gained authorization in the U.S., and Ocugen’s shares progressively declined. Today, they trade for less than $1.

This biotech company hasn’t given up on coronavirus vaccines, though. Today it’s developing inhaled vaccine candidates for flu and coronavirus, and those projects are in preclinical studies.

Ocugen’s closer-to-market candidates include a candidate acquired through its reverse merger with Histogenics back in 2019 and one of the company’s own candidates in its specialty area of eye disease treatments. This former Histogenics candidate is Neocart, a cell therapy to rebuild damaged knee cartilage. Ocugen plans on beginning a phase 3 trial in the second half of this year.

The other advanced candidate is OCU-400, which treats Retinitis Pigmentosa, a genetic disease that results in vision loss as cells in the retina break down. The company aims to launch a phase 3 trial early this year. Ocugen has other earlier-stage eye disease candidates in its pipeline, too.

The company doesn’t yet have products on the market and isn’t generating revenue. But if all goes smoothly with Neocart and OCU-400, this could change over the next few years.

Wall Street is very bullish on Ocugen, with the average 12-month share-price forecast calling for a gain of more than 630%. I think this is overly optimistic. If Ocugen is successful with one or both of its closest-to-market candidates, the shares could climb this much or more over time, but I wouldn’t expect the potential launches of late-stage trials to spur that much of an increase.

It’s still too early to place a long-term bet on this company. Ocugen started out specializing in eye disease but has branched out into other areas. That’s fine, but before investing, I’d like to gain more visibility on what the company may look like a few years down the road.

Should you invest $1,000 in Novavax right now?

Before you buy stock in Novavax, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novavax wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.

Two Beaten-Down Stocks That Could Soar 170% and 630%, Respectively, According to Wall Street was originally published by The Motley Fool