This Growth Stock’s Valuation Has Gotten So Spicy It Was Time to Sell

I love spicy food, especially hot wings. That might be because I grew up in Western New York and needed that extra heat from the wings to keep warm. My love for hot wings was one of the reasons I bought shares of Wingstop (NASDAQ: WING).

However, I recently sold my shares of the fast-growing restaurant operator. The main reason was its very spicy valuation.

Too hot to handle

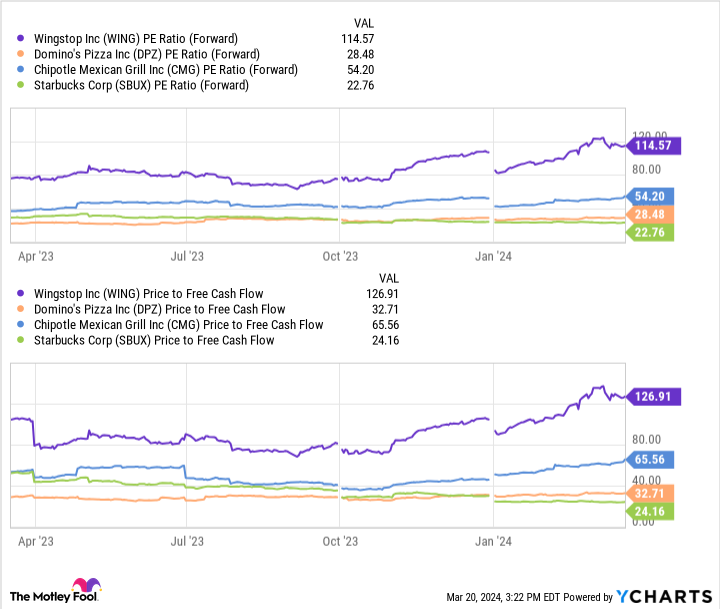

Wingstop trades at an extremely high valuation multiple compared to other restaurant stocks:

As that chart shows, it trades more than 100 times its forward PE ratio and free cash flow. That’s more than double the valuation of Chipotle Mexican Grill (NYSE: CMG), a spicy burrito among restaurant stocks. Wingstop is even more highly valued than some of the priciest tech stocks, which have helped push the Nasdaq 100‘s forward PE ratio close to 29 times.

On the one hand, Wingstop should trade at a premium valuation because it’s growing briskly. Here’s a look at how it compares to some top restaurant stocks over the past year:

|

Restaurant Stock |

Same-Store Sales Growth |

Revenue Growth |

Adjusted Earnings-Per-Share Growth |

|---|---|---|---|

|

Wingstop |

18.3% |

28.7% |

36% |

|

Chipotle |

7.9% |

14.3% |

36.9% |

|

Domino’s Pizza (NYSE: DPZ) |

1.6% |

5.4% |

17% |

|

Starbucks (NASDAQ: SBUX) |

8% |

12% |

27% |

Data source: Company earnings press releases.

As that table shows, Wingstop grew its same-store sales and revenue faster than many of its rivals. However, Chipotle grew its adjusted earnings slightly faster, while Starbucks and Domino’s also delivered fast earnings growth. It’s therefore hard to justify Wingstop’s valuation.

Simmering growth, not scalding

Fast-growing companies can grow into a premium valuation over time. However, it’s hard to see a path where Wingstop grows into its sizzling valuation in a reasonable amount of time. The company aims to deliver mid-single-digit same-store sales growth over the near term and a low-single-digit rate over the longer term while targeting 10%-plus annual unit growth. While those are solid growth rates for the restaurant industry, they’re not unique to Wingstop.

Starbucks launched its triple shot reinvention strategy last year to recharge its growth rate. The leading global coffee chain aims to grow its same-storage sales by 5%-plus over the longer term while growing its revenue by more than 10% annually and delivering 15% annual earnings-per-share growth. Those are strong growth rates for the world’s largest coffee chain.

Meanwhile, leading global pizza purveyor Domino’s expects to grow its annual global sales by more than 7% annually while delivering more than 8% annual profit growth. Finally, while Chipotle doesn’t provide investors with a long-term growth forecast, it expects to deliver same-store sales growth in the mid-single-digit range this year, which matches Wingstop’s 2024 outlook.

Too hot to hold any longer

I am a very long-term investor and rarely sell on valuation concerns alone. However, I think Wingstop’s valuation has run up too high to justify. It’s hard to see much more upside potential since the market has already priced the stock to perfection. It would only get more expensive if shares kept rising. The risk/reward profile therefore skews more to the downside. If the market cools off or Wingstop misses expectations, its stock could crater. That’s why I decided to ring the register and sell my Wingstop stock after a red-hot run. I might consider investing in the stock again if its valuation comes down to a more reasonable level.

Should you invest $1,000 in Wingstop right now?

Before you buy stock in Wingstop, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Wingstop wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 21, 2024

Matt DiLallo has positions in Chipotle Mexican Grill, Domino’s Pizza, and Starbucks. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Domino’s Pizza, Starbucks, and Wingstop. The Motley Fool has a disclosure policy.

This Growth Stock’s Valuation Has Gotten So Spicy It Was Time to Sell was originally published by The Motley Fool