These Dividend Stocks Can Double Your Money in Under 6 Years

Compound interest is a powerful wealth creator. For example, an investment that can deliver a 13% annual rate of return can double in value in less than six years. While 13% is an above-average return, many high-quality dividend stocks have delivered an average annual total return above that level over the past decade (and can continue doing so in the future).

Prologis (NYSE: PLD) and Brookfield Renewable (NYSE: BEPC)(NYSE: BEP) are high-performing dividend stocks. They should have the fuel to double investors’ money in less than six years.

A wealth-creating REIT

Prologis has delivered a prodigious 16.8% average annual total return over the last decade (and 16.7% over the previous six years). Its rapidly rising dividend is a big driver of the leading industrial REIT’s strong performance. Prologis has increased its dividend at a 12% compound annual rate over the last five years, supported by a similar growth rate in its core funds from operations (FFO). That’s double the average dividend growth rate of the other REITs and companies in the S&P 500.

The warehouse giant is in an excellent position to continue growing its core FFO and dividend at high rates in the future. The REIT expects to grow its core FFO per share by 9% to 11% annually through at least 2026, driven by rent growth and development projects. There’s upside to that forecast. Over the past several years, it has added an average of 1.5% to its FFO per share annually by making accretive acquisitions. Given its elite balance sheet, Prologis has ample financial flexibility to make new investments.

Prologis’ forecast (and recent history) suggests the REIT could grow its dividend in line with core FFO, implying the potential of increasing its 2.7%-yielding payout at around a double-digit annual rate. That should give it the power to produce total returns of around 12% annually at the low end to 15%+ at the high end if it makes accretive acquisitions in line with its recent average.

Accelerating wealth-creating potential

Brookfield Renewable has generated an impressive 13.4% average annual total return over the last decade (and 13.1% over the previous six years). The global renewable energy juggernaut has expanded its FFO per share at a more than 10% compound annual rate over the last 10 years. That gave it the power to grow its dividend at a 6% compound annual rate.

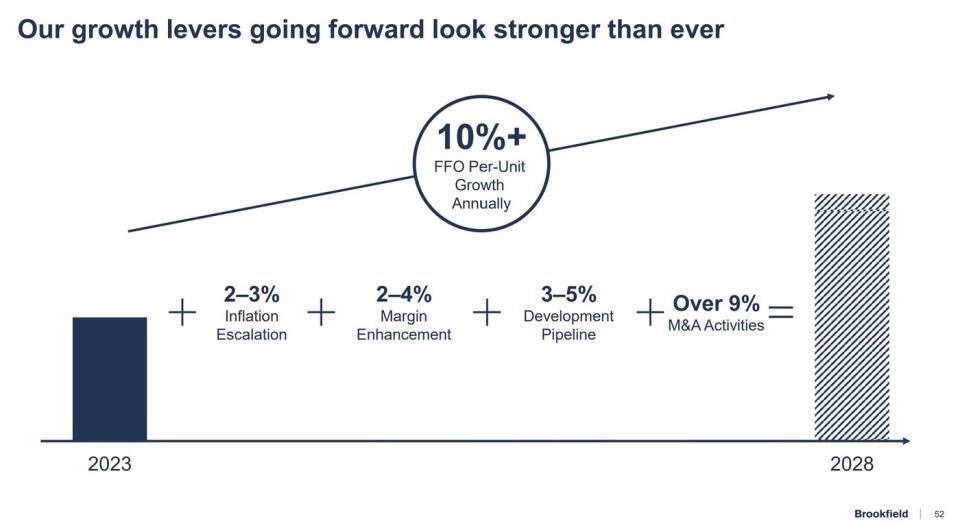

The company could grow even faster in the coming years:

As that slide shows, a trio of organic catalysts could power 7% to 12% annual FFO per share growth through at least 2028. On top of that, Brookfield sees mergers and acquisitions (M&A) potentially adding more than 9% to its FFO per share each year. That easily supports its plan of growing its dividend by 5% to 9% annually.

Several factors drive Brookfield’s robust M&A potential. On the one hand, it has ample access to capital. Brookfield Renewable routinely recycles capital by selling mature assets and using the proceeds to fund higher-return new investments. On top of that, the company and its parent, Brookfield Asset Management, have a growing Brookfield Global Transition Fund (BGTF) platform. The companies are working to close their second BGTF, which aims to raise around $20 billion. That’s about $5 billion more than the record $15 billion raised in the first fund.

Meanwhile, new investment opportunities abound. While the company’s acquisition of Australian utility Origin Energy failed to win shareholder support, it’s seeing “plentiful opportunities to deploy capital at or above our target returns,” according to CEO Connor Teskey. That drives the company’s confidence in achieving its goal of deploying $7 billion to $8 billion of equity capital on new investments over the next five years, a portion of which it will deploy through its BGTFs.

With a dividend yield of around 4.6% and the potential to deliver more than 10% annual FFO per share growth, Brookfield should have no trouble achieving its long-term target of producing 12% to 15% average annual total returns.

A visible pathway to total returns in the low teens

Prologis and Brookfield Renewable have delivered a total return above 13% annually over the past decade. They’re well positioned to match (or exceed) that rate over the next several years. These dividend stocks will double investors’ money in less than six years if they do. That makes them great stocks to buy right now for those seeking to compound their wealth in the coming years.

Should you invest $1,000 in Prologis right now?

Before you buy stock in Prologis, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Prologis wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Matthew DiLallo has positions in Brookfield Asset Management, Brookfield Renewable, Brookfield Renewable Partners, and Prologis. The Motley Fool has positions in and recommends Brookfield Asset Management, Brookfield Renewable, and Prologis. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

These Dividend Stocks Can Double Your Money in Under 6 Years was originally published by The Motley Fool