These 2 Stocks Carry a Lot of Risk, but Their Upside Is Huge

You’ll probably have to pay an expensive premium for a slam-dunk growth stock that’s almost certain to flourish over the next few years. Valuations reflect expectations, so you usually have to assume uncertainty and risk if you want to buy a stock at a steep discount.

The two stocks below have enormous upside potential, but they also come with downside risks you can’t ignore. Let’s weigh the potential risk and reward.

CRISPR Therapeutics

CRISPR Therapeutics (NASDAQ: CRSP) is developing innovative gene therapy technologies to treat a variety of serious and rare diseases. Its product pipeline includes treatments for sickle cell disease, beta thalassemia, several cancers, cardiovascular disease, diabetes, and muscular dystrophy.

By targeting the affected genetic factors that contribute to these diseases, CRISPR technology can drastically reduce the need for other treatments — or eliminate them entirely. Those represent transformative and extremely valuable developments if they can be implemented in a way that’s both medically effective and safe for patients.

The innovation and value of CRISPR’s candidates create major upside potential for investors, but the risks are undeniable. The company is still in a relatively early stage, and it does not have any revenue from product sales yet. That creates a ton of uncertainty for shareholders.

CRISPR Therapeutics shares charged higher in November, following the announcement that its first drug, Casgevy, gained approval in the U.K. This was quickly followed by the news that it also received marketing approval by the U.S. Food & Drug Administration, opening the door to another large market. This is an enormous step, and it drastically increases the likelihood that the company will generate sales and cash flows in the near future.

However, the company still needs to navigate pricing and reimbursement hurdles with insurers and government agencies. That’s a thorny process that’s caused some would-be competitors to throw in the towel before, so it’s not just a formality. Luckily, CRISPR’s partnership with Vertex Pharmaceuticals can be a major resource, given Vertex’s scale and history of dealing with that exact issue.

While those regulatory approvals are hugely encouraging, there’s still plenty of uncertainty. Each Casgevy patient could come at a high price point, but the addressable market for sickle cell disease and beta thalassemia isn’t enormous. The partnership with Vertex will also reduce the amount of cash ultimately flowing to CRISPR.

Even if we assume that the launch of this first product goes smoothly, the stock valuation can only be justified if the company can bring other products in its pipeline to market. In the meantime, CRISPR will continue to burn cash on development, clinical trials, and regulatory functions.

Now that the market has fully digested the news of these approvals, CRISPR’s valuation reflects the likely upside of Casgevy sales. Its next big move upward will probably come from subsequent drug approvals or promising news related to those. The downside would come from any issues bringing Casgevy to market or bad news on additional pipeline developments.

CRSP Total Return Level data by YCharts

The biotech stock‘s $5 billion market capitalization leaves plenty of room for huge gains if the company has a portfolio of lucrative treatments a few years down the line. It’s nearly 50% below its all-time high, which illustrates just how it could pop if there’s good news. Yet without any sales or profits to speak of, the stock has a long way to fall if bad news comes along.

C3.ai

C3.ai (NYSE: AI) has been a volatile and somewhat divisive stock for the past few years. The company provides AI software-as-a-service to enterprise customers, and it’s established real traction in the energy sector and other traditional low-tech industries. C3.ai’s products enhance its customers’ existing software to improve vital functions, including sales forecasting, customer service, production scheduling, supply chain optimization, and asset maintenance.

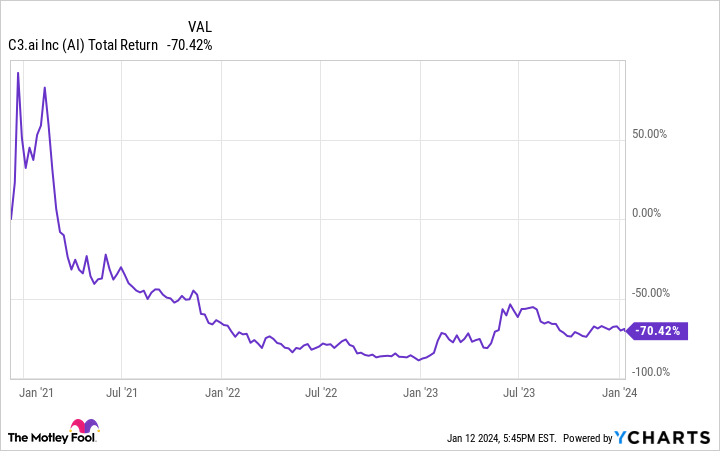

C3.ai is down nearly 80% from its all-time high, but it’s also climbed 130% over the past year. That volatility is echoed by investor commentary on the company. Some analysts draw very bearish conclusions from their research, citing heavy customer concentration, fierce competition, relatively modest revenue growth, and ongoing cash burn.

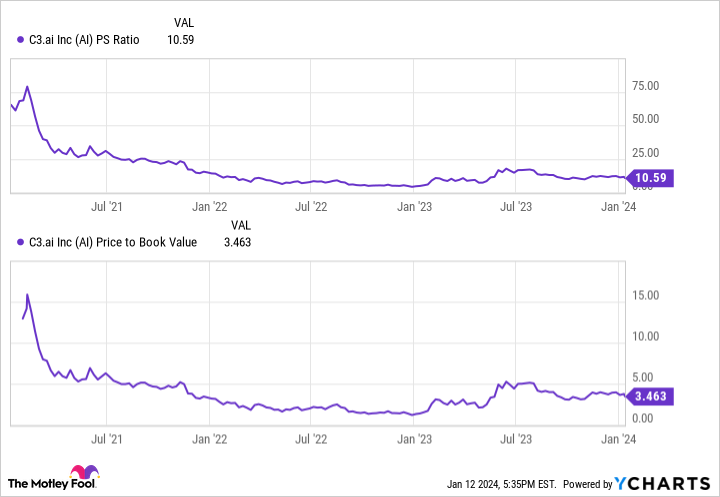

More bullish investors are comfortable with its 17% annual sales growth, and they expect the momentum in the AI industry to keep C3.ai moving higher. Its price-to-sales ratio is 10.6 right now — that’s high enough to result in a crash if the company’s results sour in coming quarters, but it’s low enough to result in big gains if the company successfully cashes in on robust demand for AI software.

This is a tricky case, because the bulls and the bears are all making compelling arguments. It’s ultimately a situation with high uncertainty, and the AI industry is still in its early stages. This makes C3.ai unsuitable for risk-averse investors, but there’s undeniable opportunity for more risk-tolerant investors who are seeking upside potential — especially if you’re looking for an AI stock outside of the popular ones like Microsoft, Alphabet, or Nvidia.

Should you invest $1,000 in CRISPR Therapeutics right now?

Before you buy stock in CRISPR Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CRISPR Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Ryan Downie has positions in Alphabet, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, CRISPR Therapeutics, Microsoft, Nvidia, and Vertex Pharmaceuticals. The Motley Fool recommends C3.ai. The Motley Fool has a disclosure policy.

These 2 Stocks Carry a Lot of Risk, but Their Upside Is Huge was originally published by The Motley Fool