The S&P 500 would have to climb another 25% to reach dot-com-era ‘irrational exuberance,’ SocGen says

-

The S&P 500 would have to climb another 25% to 6,250 to reach dot-com-era “irrational exuberance,” SocGen said.

-

Investors aren’t overvaluing stocks as much as they were at the peak of the dot-com bubble.

-

Though gains are concentrated, market breadth is improving.

The magnificent gains of the Magnificent Seven tech stocks have brought an onslaught of dot-com era comparisons from Wall Street. Nvidia is like Cisco, the AI hype is like the internet craze, and so on.

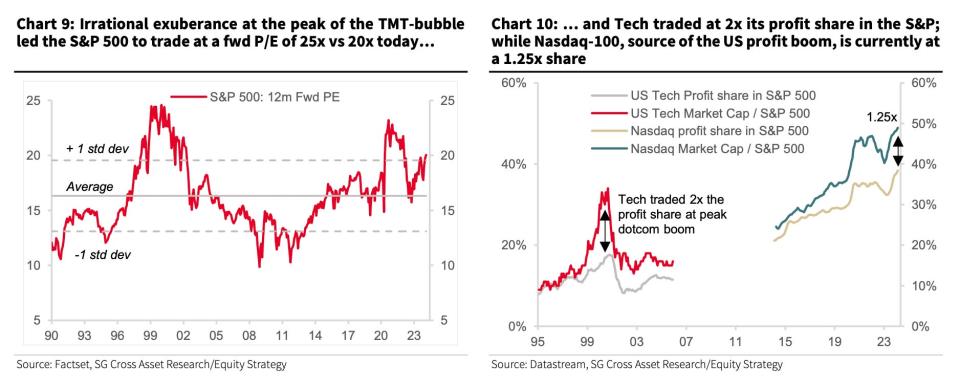

But crunching the numbers, Societe Generale says the S&P 500 would still need to surge by another 25% to reach the levels of “irrational exuberance” that fueled the tech bubble in the 90s.

“Applying the peak of the [technology-media-telecoms] bubble maths to the Nasdaq-100, the S&P 500 would have to reach 6,250 to price in the same level of irrational exuberance,” analysts Manish Kabra and Alain Bokobza wrote in a note on Wednesday.

The benchmark index was trading around 4,966 on Wednesday afternoon.

The math Kabra talks about is the tech sector’s profit share of the S&P 500. At the peak of the dot-com bubble, the tech sector was trading at twice its profit share of the S&P 500, and the benchmark index had a price-to-earnings ratio of 25x.

Today, the Nasdaq-100 is trading at 1.25 times its share of profits (40% of S&P 500’s earnings per share), and the S&P 500 price-to-earnings ratio is 20x.

In other words, investors aren’t overvaluing stocks as much as they were at the peak of the dot-com tech bubble.

It’s not that the S&P 500 isn’t concentrated — stocks like Microsoft, Apple, and Nvidia are a huge part of its stellar performance in the last year, and the Magnificent Seven accounted for 45% of the index’s gain in January.

“There is no doubt concentration is one of the biggest risks,” Kabra wrote. “The index weights of the top 10 US stocks are even higher today than they were in the [dot-com]-bubble.”

But the rally so far has been driven by “rational optimism” instead of irrational exuberance, he said. More stocks are participating in the market rally instead of the coterie of seven tech stars, and equities around the world are being boosted up by strong profits.

Read the original article on Business Insider