The Next “Magnificent Seven” Stock That No One Is Talking About

“Magnificent Seven” stocks are soaring once again. This basket of well-known tech stocks like Nvidia and Meta Platforms has long been a reliable way to make huge profits fast. In the past 12 months alone, Nvidia shares have risen 240% in value, while Meta Platforms’s stock price has surged 140%.

If you haven’t taken advantage yet, there’s still time. Every Magnificent Seven stock is a quality business with enormous long-term upside potential. But if you want the biggest returns, you should be focused on finding the next stock worthy of joining the Magnificent Seven. With that in mind, few stocks fit the mold as well as Visa (NYSE: V).

Big profits hidden in plain sight

Most people imagine Visa to be a boring payments company. And in many ways, it is. As of last quarter, Visa had 1.3 billion issued credit cards and 3 billion issued debit cards. It is from these cards that Visa makes most of its money, as the company earns a small fee with every transaction. In a nutshell, Visa sits between the businesses and consumers who make purchases with their cards and the financial institutions that lend the money for the purchase.

Why do consumers, businesses, and financial institutions put up with paying Visa for every transaction? It’s because Visa has a network effect that few competitors can match. Purchasers aren’t interested in using a debit or credit card that isn’t accepted by most merchants. Merchants, meanwhile, aren’t interested in accepting forms of payment that only a few purchasers use. Financial institutions, meanwhile, want to work with payment networks that reach the highest number of people. In combination, these market forces create natural industry consolidation.

It’s no wonder, then, that roughly 46% of American adults have a Visa credit card. About 37% have a Mastercard credit card, while a little less than 20% have American Express or Discover cards. These four companies control nearly the entire credit card market in the U.S. The odds are overwhelmingly high that you or a family member have one of these cards in your wallet right now. Meanwhile, the odds are overwhelmingly low that you have a credit card not from these four companies, at least for those residing in the U.S.

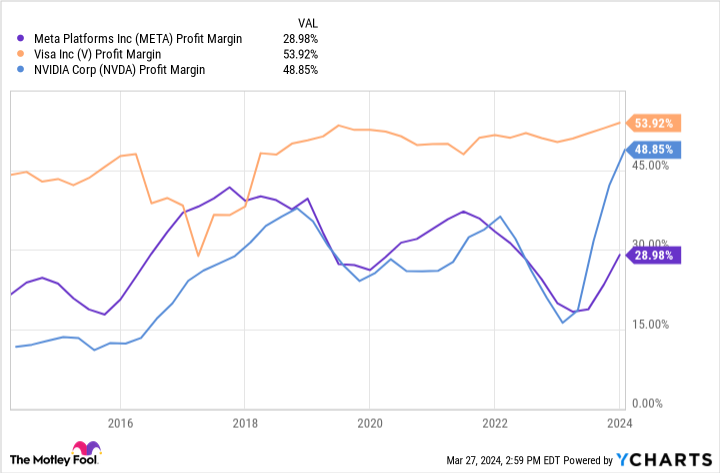

What happens when you control nearly half of a gigantic market? Big profits — even bigger than most Magnificent Seven companies. During the past decade, Visa has generated profit margins averaging nearly 50%. Magnificent Seven companies like Nvidia and Meta Platforms have rarely matched these levels and have had more volatility along the way, too.

High and consistent profit margins have produced eye-popping shareholder returns. Since Visa went public in early 2008, the shares have risen 1,900% in value. A $500 investment would now be worth nearly $10,000. To be sure, some Magnificent Seven stocks have blown this performance out of the water. Nvidia stock, for example, has risen in value by 1,900% during the past five years alone. Still, there’s one trick up Visa’s sleeve that few Magnificent Seven stocks share: Its market cap remains well under $1 trillion.

A $570 billion bet worth taking

In a world where tech companies have seen their valuations soar into the trillions, it can be easy to forget about the law of large numbers. That is, the larger a company gets, the harder it becomes for it to double or triple in size again. The takeaway here is that smaller companies often have more room for growth than larger companies. And while Visa is hardly a small business, it appears that way when comparing it to Magnificent Seven stocks, nearly all of which have market caps well above $1 trillion.

With a market cap of $570 billion, Visa would have to nearly double in value to reach the $1 trillion mark. That’s a reasonable expectation in the years to come. While it has long focused on the U.S. market, Visa has been expanding internationally, adding a significant long-term revenue driver for the company. Whereas Visa’s total transactions grew by 10% year over year in the last quarter, cross-border transactions grew by 20%. International payments volume has consistently been roughly double that of the U.S. segment.

Visa operates a huge, global business with strong network effects and a formidable economic moat. It beats out many Magnificent Seven stocks in terms of profitability and has a promising new growth runway with international expansion. With a significantly smaller market cap than most Magnificent Seven stocks, it’s my pick for investors looking to beat the Magnificent Seven at its own game.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard, Meta Platforms, Nvidia, and Visa. The Motley Fool recommends Discover Financial Services and recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

The Next “Magnificent Seven” Stock That No One Is Talking About was originally published by The Motley Fool