The Best Stocks to Invest $1,000 in Right Now

Everyone likes a good deal. But being cheap doesn’t mean you’re getting good value in investing. The goal should be to pay fair value (or less) for high-quality businesses that will grow and create value for shareholders over time.

One of my favorite pieces of investing wisdom is that the stock market isn’t a single entity but a market of many different stocks. In other words, just because the broader market is near its all-time high doesn’t mean there aren’t quality stocks in plain sight at bargain prices.

To prove my point, consider these three. Each has a promising long-term future that isn’t reflected in the valuations they trade at today.

1. Unleash the software robots

UiPath (NYSE: PATH) is a company that specializes in robotic process automation, or RPA. It is software that observes, learns, and then can perform repetitive computer tasks in place of a human. UiPath is a leader in this field. The company grows, often by having a customer start using its software and then implement it throughout the company. UiPath’s strong 123% net revenue retention rate reflects this. Anything above 100% indicates that existing customers tend to stick around and sign more lucrative deals over time. UiPath sits comfortably above that benchmark.

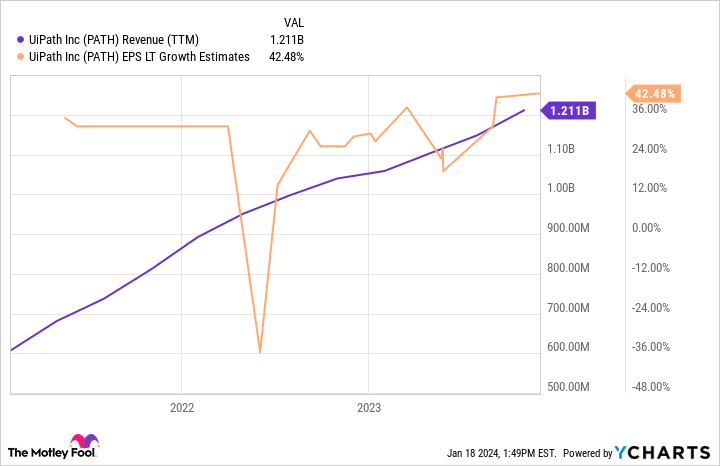

The long-term path to growth is established. UiPath has gained traction in large industries that still heavily rely on human (computer) labor, including healthcare, banking, manufacturing, and the public sector. The company has doubled its revenue over the past several years, and analysts believe earnings will compound at 42% as revenue continues outgrowing its expenses.

Today, the stock trades at a forward P/E of 45. That’s potentially a very appealing price tag if UiPath can perform up to analysts’ estimates over the coming years. The company’s PEG ratio is roughly 1, meaning that much of UiPath’s long-term growth could translate to investment returns. RPA technology could streamline how many companies operate, so getting UiPath at this price could work well for long-term investors.

2. Next-generation cybersecurity with stellar growth

SentinelOne (NYSE: S) is a next-generation cybersecurity company that sells its autonomous Singularity Platform to enterprises. It uses artificial intelligence and machine learning to analyze computer files before and while they execute to catch potential threats in real time. Its technology has been recognized in cybersecurity evaluations, including Gartner‘s Magic Quadrant and MITRE’s Engenuity Att&ck Evaluations, receiving leadership designations in both.

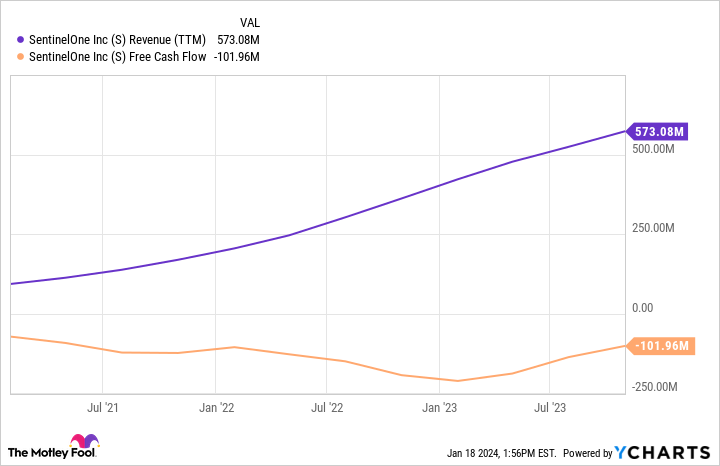

Having a cutting-edge solution in an innovation-dependent industry has been good for business. SentinelOne’s revenue has grown from under $100 million to nearly $600 million in just a few years. The company’s biggest knock right now is its lack of profits. The business has burned almost $102 million in cash over the past 12 months.

However, investors should consider SentinelOne’s massive $800 million cash hoard. Additionally, analysts believe the company could turn generally accepted accounting principles (GAAP) profitable next fiscal year, which ends in January 2025. The stock could get a boost from Wall Street when SentinelOne turns profitable. The stock’s valuation has fallen to a price-to-sales ratio of 11, a steep discount to its profitable archrival CrowdStrike.

3. Don’t overlook the gig economy

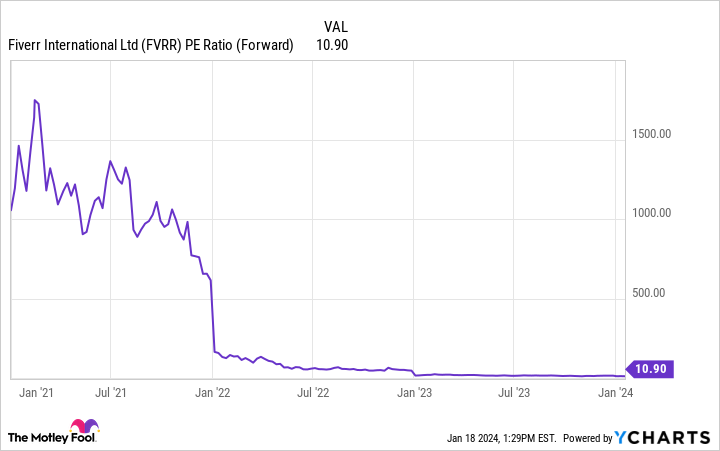

Fiverr International (NYSE: FVRR) has been quite a ride over the past several years. The stock was a sensation during COVID-19 when lockdowns caused a growth spurt at Fiverr as people turned to gigs to get by. Growth slowed as lockdowns passed, setting the stock on a decline that it hasn’t yet recovered from. Fiverr operates a marketplace where people and companies can buy and sell freelance services. Approximately 4.2 million buyers use Fiverr.

The company’s goal has been to go upstream or transition from low-dollar individual buyers to enterprise customers who would spend much more. There has been progress here. Fiverr’s average spending per buyer has increased 39% over the past three years. What Fiverr’s long-term ceiling may be remains to be seen, but remote work has become increasingly popular, which could bode well for the company’s growth prospects.

Importantly, Fiverr is profitable, and the market treats the stock like it’s done growing earnings. Shares trade at a price-to-earnings ratio of just under 11. Fiverr’s management believes there is a $247 billion addressable market in the United States alone, and the company’s annual revenue today is just $353 million. With solid business execution, it doesn’t stretch the imagination to see Fiverr’s earnings easily outgrowing the stock’s current price tag over time.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 16, 2024

Justin Pope has positions in Fiverr International and SentinelOne. The Motley Fool has positions in and recommends CrowdStrike, Fiverr International, and UiPath. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

The Best Stocks to Invest $1,000 in Right Now was originally published by The Motley Fool