Tesla stock surges despite plunging profits as Musk talks robotaxis and cheaper cars

-

Tesla reported first-quarter earnings on Tuesday.

-

Elon Musk talked Tesla’s plans for a robotaxi and cheaper EVs.

-

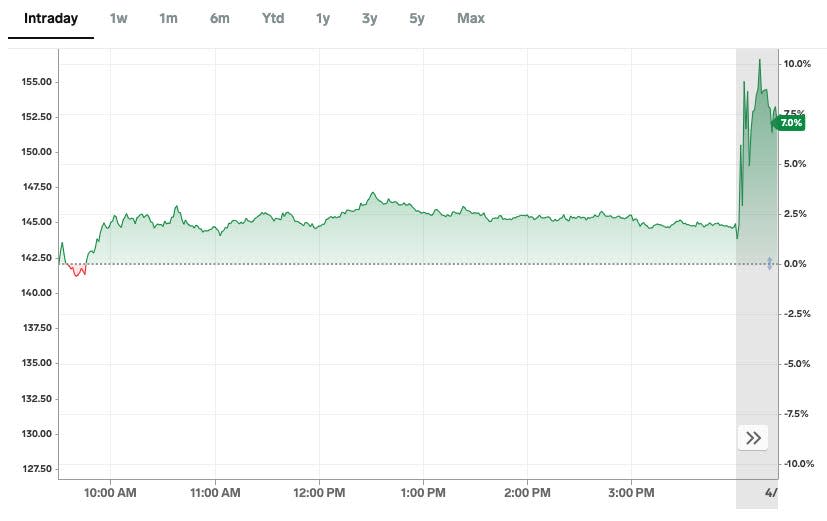

Shares rallied 10% in after-hours trading as investors shrugged off falling profits.

Tesla reported first-quarter earnings on Tuesday after the closing bell.

The electric-vehicle maker posted first-quarter earnings-per-share that fell short of consensus forecasts, but exceeded estimates for gross margin. Tesla also said it will accelerate production of new models of low-cost vehicles.

Tesla stock climbed more than 10% in volatile late trading shortly after the results. The stock rose 1.8% on Tuesday trading, and but has struggled so far in 2024, falling 42% year-to-date through the close.

During the earnings call, Tesla CEO Elon Musk talked about Tesla’s plans to unveil its Robotaxi later this year and the company’s efforts to accelerate production of a more affordable line up of EVs.

Tesla’s shares are still up as the call ends

The stock is up more than 10% in after-hours trading as the call draws to a close.

Tesla’s head of investor relations, Martin Viecha, announces his departure

Viecha says he’s leaving the company after seven years in the role at Tesla.

He’s the third executive to depart Tesla in the past week. Drew Baglino, Tesla’s senior vice president of powertrain and electrical engineering, announced last week that he’d left the company. Rohan Patel, Tesla’s vice president of public policy and business development, also left the company last week.

Musk says battery costs are falling

The number of orders for EV batteries from competing automakers has dropped, Musk says, adding that it seems Tesla’s battery suppliers have excess capacity.

Musk says analysts should drive the latest FSD update

Musk says he strongly recommends that anyone who is thinking about the company’s stock should test out the latest updates to the Full Self-Driving software.

“It is impossible to understand Tesla if you haven’t done this,” Musk says.

Musk takes a question about Tesla’s price cuts

Musk says he thinks Tesla can stay cash-flow positive even with the potential of future price cuts.

“If you have a great product at a great price, the sales will be excellent,” Musk says, adding that the company plans to keep making its cars and prices more competitive.

Analyst asks what ‘sacrifices’ Tesla is making with recent layoffs

Tesla CFO Vaibhav Taneja says the cuts will make Tesla more resilient.

“Any tree that grows needs pruning,” Taneja says.

Musk says the company needs to reorganize for a new phase of growth.

“We’re not giving up anything that significant that I’m aware of,” Musk says.

Analyst asks if Musk is spread too thin and if he’ll still be around in 3 years

Musk says he rarely takes a day off, and Tesla represents the majority of his work.

“I make sure Tesla is very prosperous,” Musk says.

Musk says Tesla is in conversations with one major automaker regarding FSD licensing

Tesla has worked with automakers like Ford and GM to license its Supercharger technology in the past.

VP of vehicle engineering Lars Moravy dodges question on timeline of $25,000 EV

Moravy sticks to earlier remarks when asked directly about the cheaper model and its timeline, giving no specifics on a date or price.

Elon takes a question about FSD regulatory approval

“It’s helpful that other autonomous car companies have been cutting a path through the regulatory jungle,” Musk says.

Musk says he doesn’t think there will be “significant regulatory barriers” to Tesla’s Full Self-Driving software being approved for use more widely. The driver-assist software currently requires a licensed driver to monitor it.

Eventually, there will be 10 million Tesla robotaxis around the world, he says.

We’re already onto questions

Individual investors will kick off things like usual, with the company taking questions from an online form where shareholders can upvote questions to the top of the queue.

CFO addresses layoffs

CFO Vaibhav Taneja says that the company’s 10% reduction in overall headcount will save it “in excess of $1 billion on an annual run rate basis.”

The earnings call kicks off

Musk, CFO Vaibhav Taneja, and Tesla’s head of investor relations Martin Viecha are here to discuss the results.

Tesla takes a dig at hybrid cars

“Global EV sales continue to be under pressure as many carmakers prioritize hybrids over EVs,” the company says in its earnings release. “While positive for our regulatory credits business, we prefer the industry to continue pushing EV adoption, which is in-line with our mission.”

Musk has dismissed the wildly popular, and often more affordable segment, in the past. In 2022, he called it a “phase,” saying on X that it’s “Time to move on from hybrid cars.”

Tesla says it’s moving up production plans for cheaper EVs

“We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” Tesla’s earning release says.

Earlier this month, Reuters reported that Tesla had canned plans for its $25,000 electric car. “Reuters is lying (again),” Musk wrote on X in response.

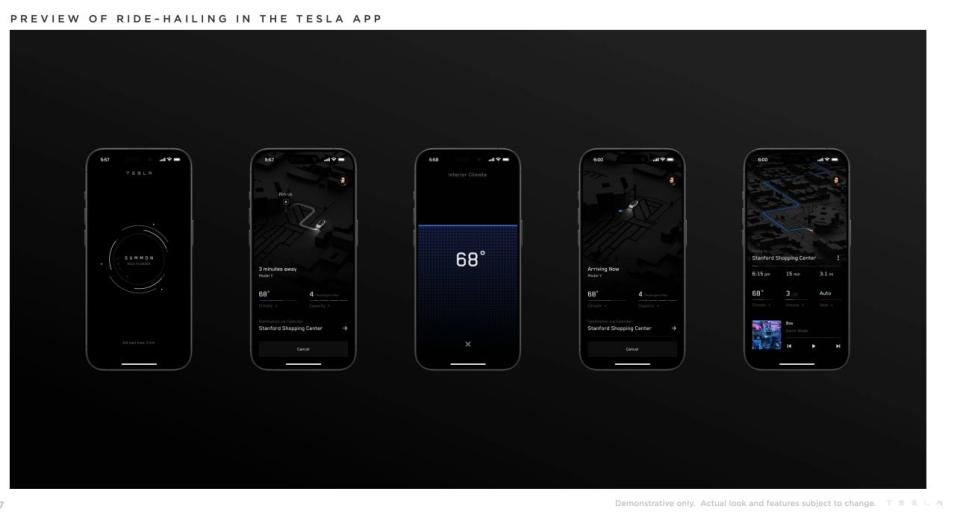

Tesla gives a preview of its ride-hailing service

The company is showing off the interface for an eventual ride-hailing service that would be accessible through the Tesla app. The interface shows that customers would be able to summon a car and control the temperature in the vehicle using the app, much like Uber.

Musk said earlier this month that Tesla plans to unveil its new robotaxi in August.

Tesla stock climbs 6% in volatile after-hours trading after company says it will accelerate the launch of ‘more affordable’ models

“We have updated our future vehicle line-up to accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025. These new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms, and will be able to be produced on the same manufacturing lines as our current vehicle line-up.” — Tesla shareholder deck

Tesla misses 1st-quarter EPS and revenue estimates, beats on gross margin.

1st quarter

-

Gross margin: 17.4% vs. 19.3% y/y, estimate 16.5%

-

Adjusted EPS: $0.45 vs. $0.85 y/y, estimate $0.52

-

Revenue: $21.30 billion, -8.7% y/y, estimate $22.3 billion

-

Negative free cash flow: $2.53 billion vs. positive $441 million y/y, estimate positive $653.6 million

-

Capital expenditure $2.77 billion, +34% y/y, estimate $2.39 billion

-

Operating income $1.17 billion, -56% y/y, estimate $1.53 billion

Source: Bloomberg data

Barclays says Tesla is ‘facing an investment thesis pivot.’

Barclays said in a note last week it expected Tesla’s earnings call to be a negative catalyst for the stock as investors came to terms with the company’s potential strategic redirection away from a low-cost Model 2.

“Facing an investment thesis pivot and a sea of uncertainty, this Tesla call is extra highly anticipated,” a Barclays analyst, Dan Levy, said. “Expect negative catalyst.”

Levy said he thought Tesla’s closely watched first-quarter gross margins would be below consensus estimates on Wall Street.

Barclays rates Tesla at “neutral,” with a $180 price target.

Bank of America says ‘results matter, but growth factors may matter more.’

Bank of America said Tesla’s headwinds are well known and are likely fully reflected in the stock price. That will make the company’s commentary around the current state of EV demand and its future growth plans all the more important.

They think that could be setting up the stock for a positive reaction.

“Despite near term pressures, the unveiling of future growth drives has the potential to support the stock,” Bank of America said. “Results matter, but growth factors may matter more.”

While the bank doesn’t expect Tesla to make any big product announcements during its earnings call, it could provide some hints on the highly anticipated Robotaxi event which is scheduled for August 8. Tesla could also reiterate its intention to launch a low-cost Model 2 in 2025 or 2026, which would likely be met with a positive price reaction in the stock.

Bank of America rates Tesla at “Neutral” with a $220 price target.

Wedbush says Tesla’s upcoming earnings report is ‘a moment of truth’ for the company.

Analyst Dan Ives said the current environment for Tesla is reminiscent of the challenges and uncertainty the company faced in 2015, 2018, and 2020, but it could result in a loss of long-term shareholders.

“This time is clearly a bit different as for the first time many long time Tesla believers are giving up on the story and throwing in the white towel,” Ives said.

Ives said it is crucial that Tesla CEO Elon Musk confirms that a low-cost Model 2 is still on the company’s product road map, and said that first-quarter results will likely take a backseat to any updates to the company’s long-term vision.

Wedbush rates Tesla at “Outperform” with a $300 price target.

JPMorgan says Tesla’s recent layoffs suggest the company’s long-term growth prospects are dwindling.

Tesla’s recent layoffs suggest the company’s long-term growth prospects are dwindling, according to a recent note from JPMorgan.

“>10% global layoff undermines hypergrowth narrative and should further dispel notion big 1Q delivery miss was somehow supply-driven,” JPMorgan said.

Instead, Tesla’s big first-quarter delivery miss was likely driven by a concerning decline in demand for electric vehicles, according to the note.

And the company’s premium valuation is at substantial risk if growth is stuttering.

JPMorgan rates Tesla at “Underweight” with a $115 price target.

Tesla’s consensus first-quarter adjusted EPS estimate is $0.52.

1st quarter

-

Adjusted EPS estimate: $0.52

-

EPS estimate: $0.41

-

Automotive gross margin estimate: 17.6%

-

Revenue estimate: $22.3 billion

-

Free cash flow estimate: $651.7 million

-

Gross margin estimate: 16.5%

-

Capital expenditure estimate: $2.4 billion

-

Cash and cash equivalents estimate: $23.24 billion

2nd quarter

Full-year 2024

-

Deliveries estimate: 1.94 million

-

Automotive gross margin estimate: 17.9%

-

Capital expenditure estimate: $9.91 billion

Source: Bloomberg data

Read the original article on Business Insider