SWBI) Best of the Bunch

Wrapping up Q4 earnings, we look at the numbers and key takeaways for the leisure products stocks, including Smith & Wesson (NASDAQ:SWBI) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 18 leisure products stocks we track reported a weaker Q4; on average, revenues missed analyst consensus estimates by 0.7% while next quarter’s revenue guidance was 7.6% below consensus. Stocks have faced challenges as investors prioritize near-term cash flows, but leisure products stocks held their ground better than others, with the share prices up 4.8% on average since the previous earnings results.

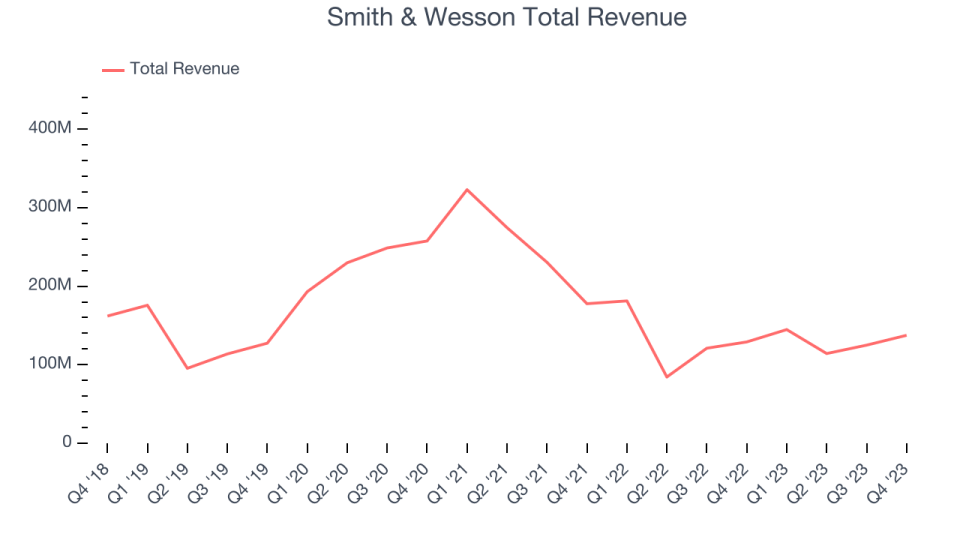

Best Q4: Smith & Wesson (NASDAQ:SWBI)

With a history dating back to 1852, Smith & Wesson (NASDAQ:SWBI) is a firearms manufacturer known for its handguns and rifles.

Smith & Wesson reported revenues of $137.5 million, up 6.5% year on year, topping analyst expectations by 2.9%. It was an exceptional quarter for the company, with an impressive beat of analysts’ earnings estimates.

The stock is up 30.7% since the results and currently trades at $17.56.

Is now the time to buy Smith & Wesson? Access our full analysis of the earnings results here, it’s free.

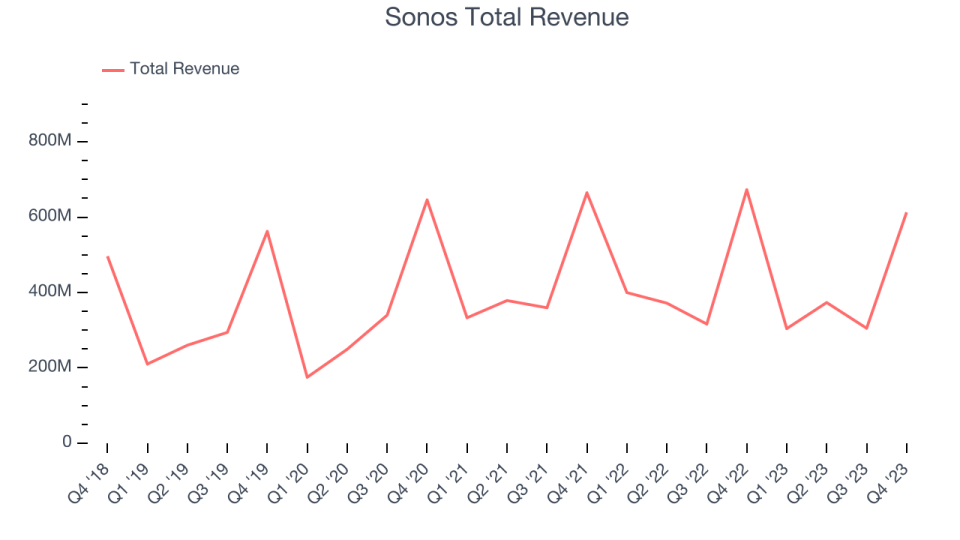

Sonos (NASDAQ:SONO)

A pioneer in connected home audio systems, Sonos (NASDAQ:SONO) offers a range of premium wireless speakers and sound systems.

Sonos reported revenues of $612.9 million, down 8.9% year on year, outperforming analyst expectations by 4.4%. It was a decent quarter for the company, with an impressive beat of analysts’ earnings estimates and a solid beat of analysts’ revenue estimates.

The stock is up 13.9% since the results and currently trades at $18.75.

Is now the time to buy Sonos? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Brunswick (NYSE:BC)

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

Brunswick reported revenues of $1.36 billion, down 14% year on year, falling short of analyst expectations by 5.4%. It was a weak quarter for the company, with full-year revenue guidance missing analysts’ expectations.

The stock is up 15.7% since the results and currently trades at $93.26.

Read our full analysis of Brunswick’s results here.

Hasbro (NASDAQ:HAS)

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ:HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

Hasbro reported revenues of $1.29 billion, down 23.2% year on year, falling short of analyst expectations by 4.9%. It was a weak quarter for the company, with a miss of analysts’ revenue and EPS estimates.

The stock is up 6.7% since the results and currently trades at $54.75.

Read our full, actionable report on Hasbro here, it’s free.

Funko (NASDAQ:FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $291.2 million, down 12.6% year on year, surpassing analyst expectations by 3.3%. It was a solid quarter for the company, with revenue and EPS exceeding expectations. Lastly, while revenue guidance for next quarter fell short of Wall Street’s estimates, full year adjusted EBITDA guidance was nicely ahead.

The stock is down 5.9% since the results and currently trades at $6.08.

Read our full, actionable report on Funko here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.