Stock Splits Ahead? 3 AI Stocks Poised to Split After Nvidia

Artificial intelligence (AI) superstar stock Nvidia (NASDAQ: NVDA) announced a stock split on May 22 this year. Share prices have climbed 36% since then. The wild success could have some other AI companies on Wall Street contemplating following suit (even if the split isn’t necessarily the sole reason behind the stock’s performance).

Remember, a stock split doesn’t change anything about the underlying business or the stock’s fundamentals. It just divides the stock into more shares with proportionally lower prices and per-share financials. Companies split their stock for numerous reasons, including making shares easier to buy and sell for employees (who might get them as stock options in lieu of payment) and investors.

With Nvidia finalizing its stock split on June 10, the question that naturally follows is: Which AI companies might be next for a stock split? Three Fool.com contributors identified Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Super Micro Computer (NASDAQ: SMCI) as those most likely AI stocks to split next.

Here is why.

This venerable tech giant looks primed for a split

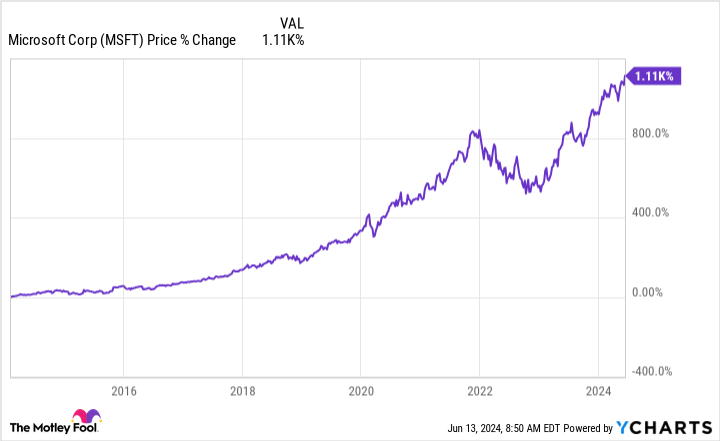

Will Healy (Microsoft): As the company that until very recently had the world’s most valuable market cap, Microsoft is not a surprising candidate for a stock split. Considering how much stock price appreciation it has seen in the past few years, the surprising thing about Microsoft’s stock is that it has been more than 21 years since Microsoft last split its stock.

Between the late 1980s and early 2000s, when Microsoft was the dominated PC operating system company, stock splits were much more common. During that period, the stock split nine times.

However, the Dot-Com market crash and then the rise of Apple chipped away at Microsoft’s leadership over time, particularly after it launched the iPhone in 2007. Between 2000 and 2014, when Steve Ballmer was CEO, Microsoft stock lost 37% of its value.

The state of the company finally improved when Satya Nadella took the CEO position in 2014. He redefined Microsoft as a cloud company and, later, a leader in AI. Over Nadella’s 10-year tenure, Microsoft stock has risen more than 1,110%, taking it to $440 per share as of this writing.

Given that level of stock price growth, the need for a split grew as well. The company’s growth suggests that stock price appreciation is likely to continue. In the first three quarters of fiscal 2024 (ended March 31), net income increased by 26% year over year. The company’s outlook for the rest of the fiscal year points to double-digit percentage revenue growth as well.

Another factor pointing to a stock split involves Microsoft being a component of the Dow Jones Industrial Average. Since the Dow is price-weighted, Microsoft will probably need to split its stock so as not to have an outsized effect on the index’s movement. That should ensure that the 21-year stock split drought finally comes to an end.

Meta Platforms has never issued a stock split, but the time may finally be here

Jake Lerch (Meta Platforms): All in all, 2024 has been a great year for the “Magnificent Seven” stocks. Indeed, six of the seven (Tesla being the only exception) have recorded double-digit percentage gains year to date. Yet of these stocks, only one has never split its shares: Meta Platforms. The time for that first-ever split has arrived. Here’s why.

First off, the stock is expensive. A Meta share trades for around $504 — placing the stock beyond the reach of many retail investors. By implementing a 3-for-1 or even 5-for-1 stock split, Meta could significantly lower its share price and make the stock more accessible to retail investors who might not be able to buy fractional shares, potentially reducing the price to a more reasonable range of $100 to $175.

A recent study from Bank of America revealed another compelling reason for Meta to split its shares: outperformance. The study, which examined stock splits since 1980, found that stocks that were split beat the S&P 500 during the 12 months that followed the split. This was true in each of the last four decades (see chart below).

While many investors would likely cheer a Meta stock split, it’s far from a given. Meta’s management isn’t a fan of stock splits. In its 12 years as a public company, Meta has never performed a stock split. That’s in stark contrast to other tech megacaps like Adobe and Microsoft, who split their shares four and seven times, respectively, in the first 12 years of their existence as public companies.

At any rate, investors should keep a close eye on Meta Platforms. Stock split or not, the company remains one of the top-performing tech stocks thanks to its lucrative digital advertising business. With its Q1 revenue growing at 27% year over year and earnings soaring 127%,…

Read More: Stock Splits Ahead? 3 AI Stocks Poised to Split After Nvidia