Soft Q2 Suggests Weak Future

Disney stock (NYSE:DIS) appears to have weak prospects following a rather soft Q2 earnings report. While the entertainment giant did demonstrate some positive progress in its strategic evolution during the quarter, with retained momentum in its parks and profitability improvements across the board, challenges persist. Notably, its legacy TV channels are struggling, and its Direct-to-Consumer division faces stiff competition, hindering its potential. Thus, my stance on the stock remains neutral.

Entertainment Segment: Legacy TV on Decline, DTC Faces Stiff Competition

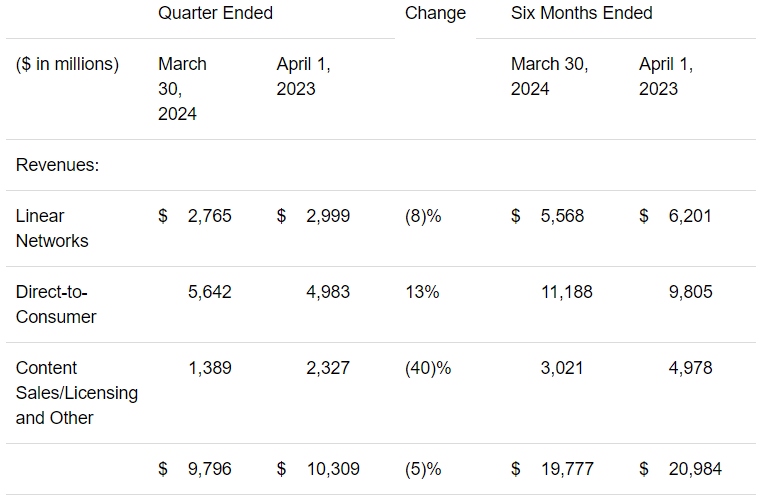

Disney’s Entertainment segment, which makes up about 44% of the company’s revenue mix, had an underwhelming period in Q2. Segment revenues declined by 5% to $9.8 billion for the quarter, as declines in its Linear Networks division and content sales/licensing couldn’t be offset by some growth driven in the DTC business. See below.

More specifically, Linear Networks posted revenues of $2.77 billion, down 8% from last year, due to both domestic and international challenges. On the domestic front, Linear Networks faced hardships due to declining subscribers, which, in turn, was due to the non-renewal of carriage of certain networks.

A drop in ad revenue following lower impressions due to softer average viewership also negatively impacted this segment. Clearly, Disney Channel, National Geographic, and ESPN, among other channels, keep losing appeal.

The bullish perspective might argue that Disney effectively addresses the inevitable decline of traditional television by strengthening its DTC arm within the Entertainment segment through the expansion of Disney+. Nevertheless, it’s essential to highlight two key considerations in this context.

The first consideration here is that even though DTC revenues grew by 14% in Q2, this was mainly due to higher pricing, as Disney+ actually lost subscribers compared to last year. Worldwide subscribers fell to 153.6 million, down from 157.8 million last year.

Disney is clearly struggling against stiff competition in this field. Evidently, Netflix (NASDAQ:NFLX) revved its subscriber growth to 16% year-over-year during the same period, to 269.6 million members. This is despite having already captured a much larger chunk of the market.

The second consideration is that DTC revenue falls significantly short of the profitability seen in Linear Networks. Consequently, while Disney may manage to substitute Linear Networks’ revenue with DTC earnings, replicating the same profit margins would prove challenging. Although the DTC sector has shown improvement, transitioning from a $587 million operating loss to a $47 million operating profit in Q2 of this year, it’s evident that the business is still hovering around the breakeven point.

Parks Take on the Heavy Lifting, Driving Up Profitability

Shifting gears to the brighter side of Disney’s Q2, we see its remarkable performance in the Parks & Experiences division. Revenues from Parks & Experiences grew by 10% year-over-year to $8.4 billion, as you can see below. This was due to better Walt Disney World Resort and Disney Cruise Line results. In turn, these businesses benefited from higher guest spending due to higher average ticket prices. The fact that Disney keeps increasing its ticket prices while still attracting massive crowds is absolutely phenomenal.

Therefore, Disney was able to achieve a higher operating income from parks, which increased by 12% to $2.29 billion. Combined with DTC cutting down its operating losses, as I mentioned previously, and overall efforts to improve profitability, you can see how Disney’s total operating income grew by 17% to $3.85 billion.

Unconvincing Bull Case Not Inspiring Confidence at Current Valuation

Despite seeing some improvements in Disney’s bottom line in its Q2 report, the overall investment case fails to inspire confidence given its current valuation. The outlook for the Entertainment segment appears grim as traditional channels lose traction and Disney’s DTC fails to rise above the competition. Further, the stagnant state of the Sports segment merits little attention. Lastly, the Experiences segment appears solid. Yet, a question remains: how long can Disney keep raising prices before facing demand constraints?

Given this picture, I don’t see the stock having further upside from its current levels. At about 22.3 times this year’s expected adjusted EPS, I would argue Disney is fairly valued at best, if not modestly overvalued. Given that interest rates remain high and Disney fails to produce a decent earnings yield and/or dividend yield, this risk is worth considering.

Is DIS Stock a Buy, According to Wall Street?

Peeking at Wall Street’s outlook on the stock, Walt Disney features a Strong Buy consensus rating based on 22 Buys and two Holds assigned in the past three months. Despite my more cautious view, at $133.55, the average Disney stock price projection implies 26.2% upside potential.

The Takeaway

In my view, Disney’s Q2 results were a mixed bag. While the Experiences segment shined through strong performance in Parks, the Entertainment segment faces worrisome challenges, particularly when it comes to the decline of legacy TV and stiff competition in the DTC space. Considering these factors alongside Disney’s current valuation, my outlook on the stock remains neutral, as uncertainties linger over its future.