Sen. Warren challenger goes to bat for Coinbase, crypto industry in SEC lawsuit

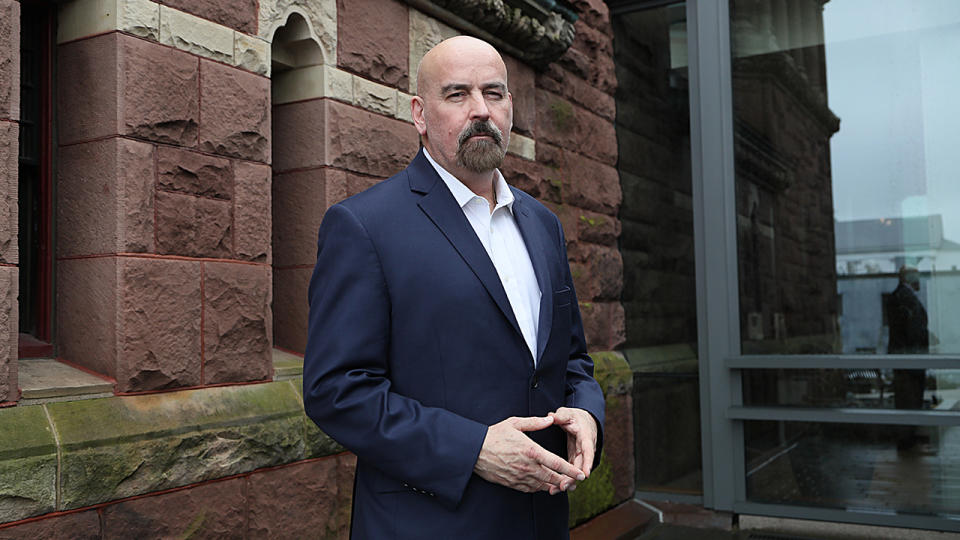

Massachusetts Senate candidate John Deaton isn’t letting the busy campaign trail prevent him from fighting the Securities and Exchange Commission on behalf of the crypto industry.

FOX Business was first to report that the crypto-enthusiast and lawyer, now turned political candidate, filed an amicus brief in the Southern District of New York on Friday in support of the U.S.’s largest crypto exchange, Coinbase, in its ongoing legal battle with the SEC.

Deaton says he’s intervening in the case on behalf of 4,701 Coinbase users, developers and crypto investors who want their voices heard in court.

CRYPTO INDUSTRY FIGHTS BACK AGAINST GOVERNMENT CRACKDOWN

“SEC Chairman Gary Gensler and his agency have demonstrated that they are not interested in protecting small investors and operate only to serve their political masters,” Deaton tells FOX Business. “The SEC has unlimited resources, paid for by the taxpayer, and Coinbase is a multibillion-dollar company with the best lawyers money can buy. The consumers deserve an advocate and a voice as well.”

Coinbase’s Chief Legal Officer Paul Grewal thanked Deaton and trade group Blockchain Association for filing amicus briefs in a post to his X account Friday afternoon. The SEC did not immediately respond to a request for comment.

The SEC sued Coinbase in June for allegedly violating securities laws by operating as an unregistered broker dealer offering unregistered securities in the form of crypto tokens on its platform. A Manhattan judge ruled in March that the SEC has enough grounds to move forward with the case.

Coinbase has since filed a motion for a so-called interlocutory appeal, asking the judge to halt legal proceedings so that a higher court can resolve once and for all the biggest legal impasse dividing the SEC and the crypto industry: Does the Howey Test apply to crypto transactions?

The Howey Test is the result of a 1946 Supreme Court ruling and the litmus test the country’s highest court uses for determining whether a transaction qualifies as an investment contract and thus a security.

CRYPTO NO LONGER OUTSIDER AT FAMED MIAMI BEACH ETF CONFERENCE

The SEC argues that all cryptocurrencies except for Bitcoin are likely securities because of their resemblance to traditional investments like stocks and bonds where investors buy into a product with the expectation of profits.

The crypto industry says the SEC is engaging in a jurisdictional power grab, attempting to force digital assets into the existing framework of the nation’s securities laws, which did not factor in blockchain technology when they were established in the 1930’s. Many in the industry also believe most digital assets more closely resemble commodities and, therefore, belong under the purview of the SEC’s sister agency, the Commodity Futures Trading Commission.

In his amicus brief, Deaton takes aim at what he says is the SEC’s inconsistent views on how tokens should be regulated.

SEC lawyers in the Coinbase lawsuit argued that Bitcoin, the only asset the SEC believes is not a security, has earned that status because it doesn’t have an ecosystem, or “network” behind it.

Deaton argues that Bitcoin arguably has the largest and most established ecosystem, which is the reason that investors choose to put their money into it.

“Bitcoin is certainly distinguishable from other cryptocurrencies but claiming it is not a security, unlike other tokens, because it doesn’t have an ecosystem, is just plain dumb,” Deaton says.

Deaton’s brief, which heavily criticizes the SEC’s “malevolent” approach to regulating crypto, supports Coinbase’s motion for appeal, arguing that the inconsistent way in which the SEC has been applying the Howey Test to digital assets should make it a matter ultimately decided by a higher court.

“If the Howey test is going to be interpreted and used to include all transactions in perpetuity, an appellate court, possibly the U.S. Supreme Court, needs

to be the one who validates it,” he wrote.

Deaton also cites statements from Republican SEC Commissioners Hester Peirce and Mark Uyeda as well as government officials like Congressman Ritchie Torres (D-New York) expressing concerns about the hostile regulatory environment under Gensler.

CRUZ, GOP SENATORS DOUBLE DOWN ON ANTI-CENTRAL BANK DIGITAL CURRENCY LEGISLATION

“The underlying lack of clarity seems to be a strategic effort by the SEC to hinder the digital asset industry. If not rooted in maliciousness, they certainly, at least, do not seem to be advancing their mission of protecting investors,” Deaton says in the brief.

This is not the first time Deaton, who’s running as a Republican to unseat the incumbent Democratic Senator from Massachusetts Elizabeth Warren, has taken on securities regulators to advocate on behalf of the $2 trillion crypto industry.

But he’s now doing it as a political candidate and has been able to use his bully pulpit to rally the crypto industry and its heavyweights to his campaign and raise significant sums of money. It helps that Warren is among the most anti-crypto lawmakers in Congress and an ally of SEC Chairman Gary Gensler, also an industry critic.

Deaton’s involvement in crypto firm Ripple’s three-year legal battle with the SEC earned him folk hero status among retail holders of the XRP token. He represented XRP investors as a so-called amicus curiae, or “friend of the court,” and did the same on behalf of users of the LBC token in the SEC’s lawsuit against decentralized content sharing platform LBRY.

Deaton’s efforts in the Ripple case were widely regarded as part of the reason Manhattan District Judge Torres ruled, in what was seen as a watershed moment for the industry, that sales of the token XRP between retail investors on exchanges, did not meet the SEC’s classification of a securities transaction.

If the ruling stands appeal, it would set a legal precedent that the SEC does not have oversight of the transactions between retail investors who engage in secondary market transactions using exchanges such as Coinbase to buy and sell crypto.

The ruling has also sparked a fierce legal debate over what makes a digital asset a security, the central argument in most of the lawsuits the SEC has brought against the crypto industry.

Three judges in the same Southern District of New York courthouse have writte opposing legal opinions on whether transactions involving digital assets satisfy the Howey Test, a point that Deaton cites in the brief and uses as an argument for why Coinbase should be granted permission to file an interlocutory appeal and possibly solve the regulatory riddle of digital assets once and for all.

Interlocutory appeals are difficult to get granted, and it’s unclear whether Judge Failla, who is presiding over the Coinbase case, will side with the exchange on this issue.

Original article source: Sen. Warren challenger goes to bat for Coinbase, crypto industry in SEC lawsuit