Revenue In Line With Expectations, Stock Soars

Cloud content storage and management platform Box (NYSE:BOX) reported results in line with analysts’ expectations in Q4 FY2024, with revenue up 2.5% year on year to $262.9 million. The company expects next quarter’s revenue to be around $262 million, in line with analysts’ estimates. It made a non-GAAP profit of $0.42 per share, down from its profit of $0.45 per share in the same quarter last year.

Is now the time to buy Box? Find out by accessing our full research report, it’s free.

Box (BOX) Q4 FY2024 Highlights:

-

Revenue: $262.9 million vs analyst estimates of $262.8 million (small beat)

-

EPS (non-GAAP): $0.42 vs analyst estimates of $0.38 (9.2% beat)

-

Revenue Guidance for Q1 2025 is $262 million at the midpoint, roughly in line with what analysts were expecting (operating margin guidance for the period also roughly in line)

-

Management’s revenue guidance for the upcoming financial year 2025 is $1.08 billion at the midpoint, in line with analyst expectations and implying 4.3% growth (vs 4.8% in FY2024) (operating margin guidance for the period also roughly in line)

-

Free Cash Flow of $81.83 million, up 40.3% from the previous quarter

-

Gross Margin (GAAP): 76.1%, in line with the same quarter last year

-

Market Capitalization: $4.00 billion

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Document Management

The catch phrase “digital transformation” originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

Sales Growth

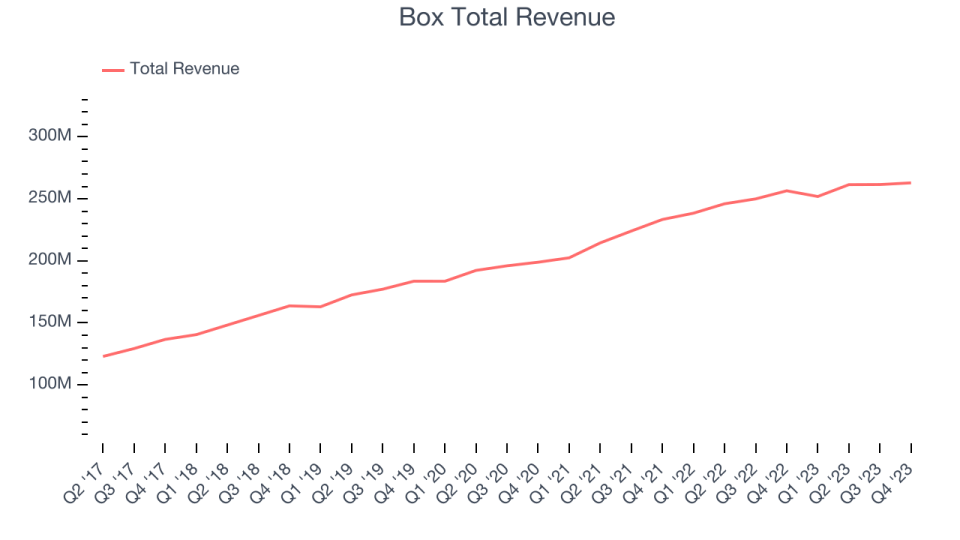

As you can see below, Box’s revenue growth has been unremarkable over the last two years, growing from $233.4 million in Q4 FY2022 to $262.9 million this quarter.

Box’s quarterly revenue was only up 2.5% year on year, which might disappoint some shareholders. However, we can see that the company’s revenue grew by $1.34 million quarter on quarter, accelerating from $109,000 in Q3 2024.

Next quarter’s guidance suggests that Box is expecting revenue to grow 4% year on year to $262 million, slowing down from the 5.6% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $1.08 billion at the midpoint, growing 4.3% year on year compared to the 4.7% increase in FY2024.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

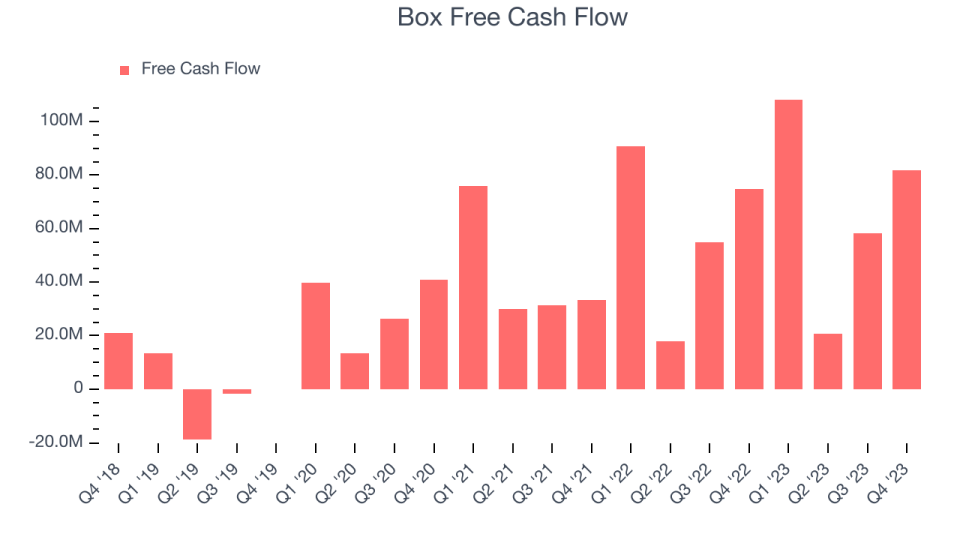

If you’ve followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. Box’s free cash flow came in at $81.83 million in Q4, up 9.6% year on year.

Box has generated $269 million in free cash flow over the last 12 months, an eye-popping 25.9% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Box’s Q4 Results

The results in the quarter were fine, with a small revenue beat and a more convincing EPS beat. Guidance was relatively in line with expectations, showing that the company is staying on track and presenting the market with no major surprises. Box seems excited about the AI potential of its platform, saying “with advancements in AI, companies are accelerating their adoption of the cloud and transforming how they work with their content…Box is at the center of some of the most important trends in technology history as companies look to digitize and automate their businesses.” Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Perhaps expectations were low going into the quarter, which could explain why the stock is up 5.1% after reporting and currently trades at $28.6 per share.

So should you invest in Box right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.