Revenue In Line With Expectations, Growth To Accelerate Next Year

Domain registrar and web services company, GoDaddy (NYSE:GDDY) reported results in line with analysts’ expectations in Q4 FY2023, with revenue up 5.8% year on year to $1.1 billion. On the other hand, the company expects next quarter’s revenue to be around $1.10 billion, slightly below analysts’ estimates. It made a GAAP profit of $7.85 per share, improving from its profit of $0.60 per share in the same quarter last year.

Is now the time to buy GoDaddy? Find out by accessing our full research report, it’s free.

GoDaddy (GDDY) Q4 FY2023 Highlights:

-

Revenue: $1.1 billion vs analyst estimates of $1.10 billion (small miss)

-

EPS: $7.85 vs analyst estimates of $1.05 (651% beat due to release of valuation allowance on U.S. and state deferred tax assets, resulting in a non-routine non-cash benefit of approximately $1 billion recorded to income taxes)

-

Revenue Guidance for Q1 2024 is $1.10 billion at the midpoint, in line with analyst estimates of $1.10 billion

-

Management’s revenue guidance for the upcoming financial year 2024 is $4.52 billion at the midpoint, missing analyst estimates by 0.7% and implying 6.3% growth (vs 4% in FY2023)

-

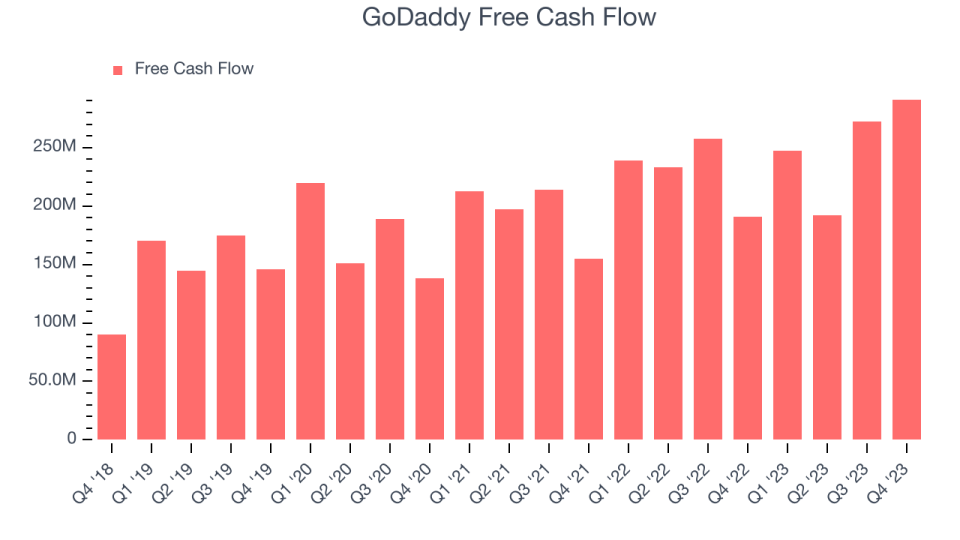

Free Cash Flow of $291.1 million, similar to the previous quarter

-

Gross Margin (GAAP): 63.4%, in line with the same quarter last year

-

Market Capitalization: $15.82 billion

“GoDaddy demonstrated strong operational execution and financial performance while also making significant progress in our mission of empowering entrepreneurs around the world,” said GoDaddy CEO Aman Bhutani.

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE:GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Sales Growth

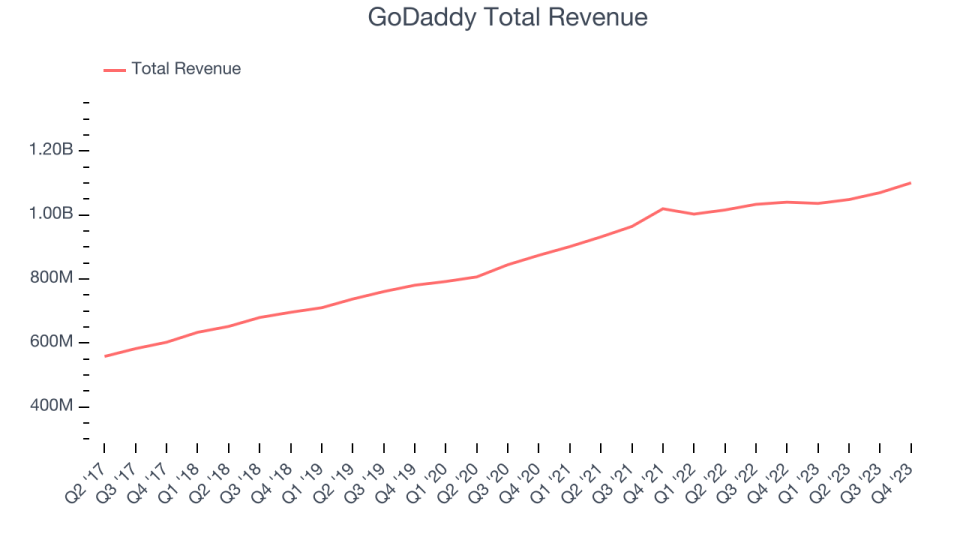

As you can see below, GoDaddy’s revenue growth has been unimpressive over the last two years, growing from $1.02 billion in Q4 FY2021 to $1.1 billion this quarter.

GoDaddy’s quarterly revenue was only up 5.8% year on year, which might disappoint some shareholders. However, we can see that the company’s revenue grew by $30.6 million quarter on quarter, re-accelerating from $21.6 million in Q3 2023.

Next quarter’s guidance suggests that GoDaddy is expecting revenue to grow 5.7% year on year to $1.10 billion, improving on the 3.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $4.52 billion at the midpoint, growing 6.3% year on year compared to the 4% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you’ve followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills. GoDaddy’s free cash flow came in at $291.1 million in Q4, up 52.5% year on year.

GoDaddy has generated $1.00 billion in free cash flow over the last 12 months, an impressive 23.5% of revenue. This high FCF margin stems from its asset-lite business model and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a cash cushion.

Key Takeaways from GoDaddy’s Q4 Results

It was great to see GoDaddy expecting revenue growth to accelerate next year. That stood out as a positive in these results. On the other hand, despite the acceleration the full-year revenue guidance missed Wall Street’s estimates. Overall, this was a mixed quarter for GoDaddy. The stock is flat after reporting and currently trades at $113.1 per share.

So should you invest in GoDaddy right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.