Revenue In Line With Expectations, Customer Growth Accelerates

Cloud storage and e-signature company Dropbox (Nasdaq: DBX) reported results in line with analysts’ expectations in Q1 CY2024, with revenue up 3.3% year on year to $631.3 million. It made a non-GAAP profit of $0.58 per share, improving from its profit of $0.42 per share in the same quarter last year.

Is now the time to buy Dropbox? Find out in our full research report.

Dropbox (DBX) Q1 CY2024 Highlights:

-

Revenue: $631.3 million vs analyst estimates of $628.6 million (small beat)

-

Operating profit (non-GAAP): $230.7 million vs analyst estimates of $207.0 million (11.4% beat)

-

EPS (non-GAAP): $0.58 vs analyst estimates of $0.50 (16.4% beat)

-

Gross Margin (GAAP): 83.2%, up from 80.9% in the same quarter last year

-

Free Cash Flow of $166.3 million, down 12.6% from the previous quarter

-

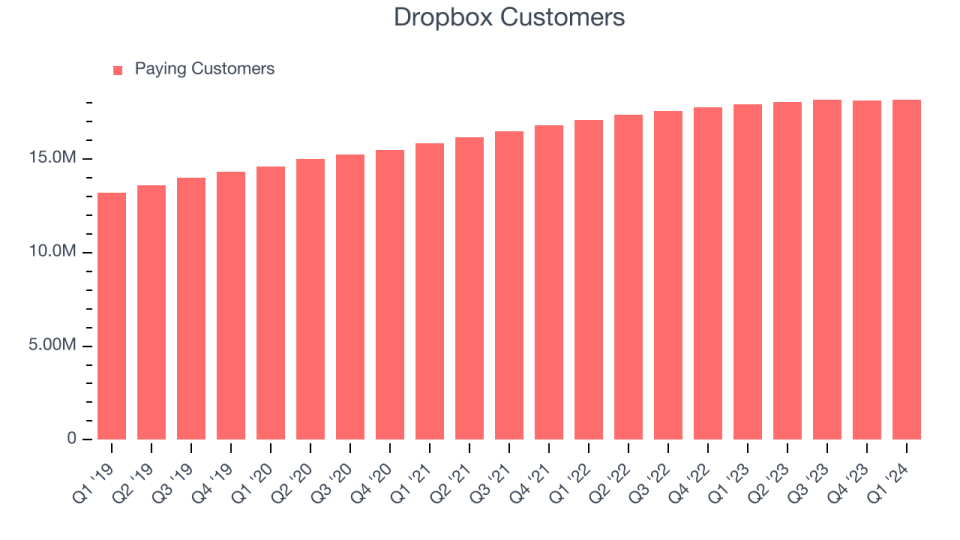

Customers: 18.16 million, up from 18.12 million in the previous quarter

-

Market Capitalization: $7.89 billion

“In Q1, our core business delivered in-line revenue and better than anticipated profitability ,” said Dropbox Co-Founder and Chief Executive Officer Drew Houston.

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox (NASDAQ:DBX) provides a file hosting cloud platform that helps organizations collaborate and share documents.

Document Management

The catch phrase “digital transformation” originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

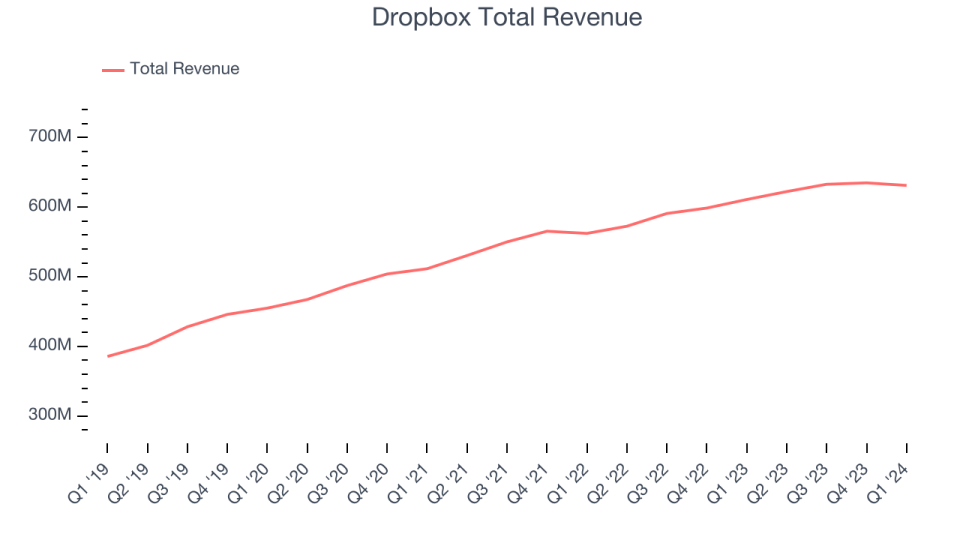

Sales Growth

As you can see below, Dropbox’s revenue growth has been unremarkable over the last three years, growing from $511.6 million in Q1 2021 to $631.3 million this quarter.

Dropbox’s quarterly revenue was only up 3.3% year on year, which might disappoint some shareholders. On top of that, the company’s revenue actually decreased by $3.7 million in Q1 compared to the $2 million increase in Q4 CY2023.

Looking ahead, analysts covering the company were expecting sales to grow 1.6% over the next 12 months before the earnings results announcement.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Customer Growth

Dropbox reported 18.16 million customers at the end of the quarter, an increase of 40,000 from the previous quarter. That’s a little better customer growth than last quarter but a bit below what we’ve typically seen over the last year, suggesting that the company may be reinvigorating growth.

Key Takeaways from Dropbox’s Q1 Results

We were impressed by Dropbox’s strong growth in customers this quarter and strong beat on operating profit. We were also glad its gross margin improved. On the other hand, its billings unfortunately missed analysts’ expectations. Overall, this quarter’s results seemed fairly positive and shareholders should feel optimistic. The stock is up 2.7% after reporting and currently trades at $23.75 per share.

Dropbox may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.