Revenue In Line With Expectations But Full-Year Sales Guidance Misses Expectations

Satellite radio and media company Sirius XM (NASDAQ:SIRI) reported results in line with analysts’ expectations in Q4 FY2023, with revenue flat year on year at $2.29 billion. On the other hand, the company’s full-year revenue guidance of $8.75 billion at the midpoint came in 4.2% below analysts’ estimates. It made a GAAP profit of $0.09 per share, down from its profit of $0.09 per share in the same quarter last year.

Is now the time to buy Sirius XM? Find out by accessing our full research report, it’s free.

Sirius XM (SIRI) Q4 FY2023 Highlights:

-

Market Capitalization: $19.55 billion

-

Revenue: $2.29 billion vs analyst estimates of $2.29 billion (small miss)

-

EPS: $0.09 vs analyst estimates of $0.08 (15.7% beat)

-

Management’s revenue guidance for the upcoming financial year 2024 is $8.75 billion at the midpoint, missing analyst estimates by 4.2% and implying -2.3% growth (vs -0.6% in FY2023)

-

Free Cash Flow of $445 million, up 52.9% from the previous quarter

-

Gross Margin (GAAP): 54%, up from 50.2% in the same quarter last year

-

Sirius XM Subscribers: 33.88 million

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Cable and Satellite

Cable and satellite companies often enjoy local oligopolies as there are limited options if a household or business wants TV or internet service. The flip side of this coin is that these businesses have oligopolies because they are capital-intensive, with multi-year investments in laying fiber, for example, needed to serve customers. These massive physical footprints make it challenging to adjust to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power.

Sales Growth

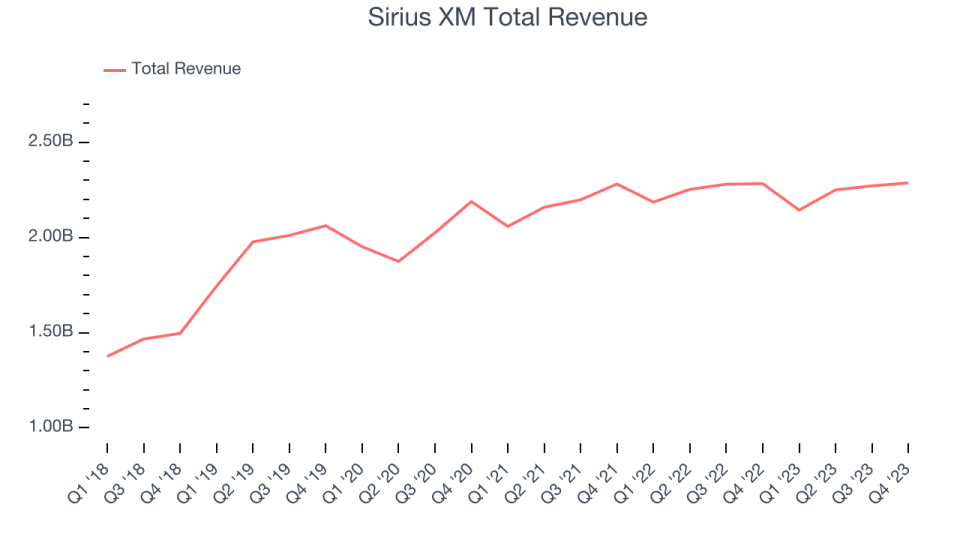

A company’s long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Sirius XM’s annualized revenue growth rate of 9.2% over the last 5 years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That’s why we also follow short-term performance. Sirius XM’s recent history shows its growth has slowed, as its annualized revenue growth of 1.5% over the last 2 years is below its 5-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of sirius xm subscribers and pandora subscribers, which clocked in at 33.88 million and 6.01 million in the latest quarter. Over the last 2 years, Sirius XM’s sirius xm subscribers were flat while its pandora subscribers averaged 2.7% year-on-year declines.

This quarter, Sirius XM’s $2.29 billion of revenue was flat year on year and in line with Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 2% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

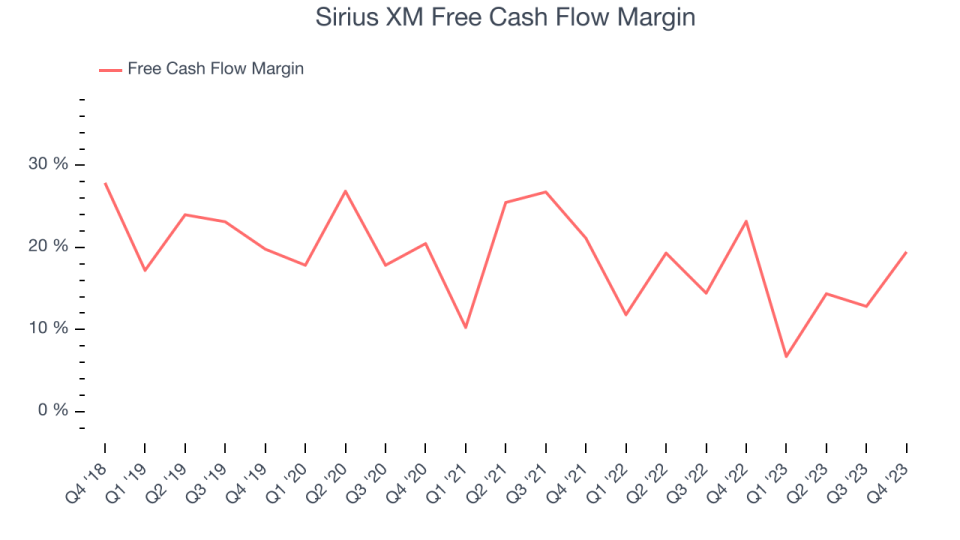

Over the last two years, Sirius XM has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company’s free cash flow margin has averaged 15.3%, above the broader consumer discretionary sector.

Sirius XM’s free cash flow came in at $445 million (19.5% margin) in Q4, down 15.9% year on year.

Over the next year, analysts predict Sirius XM’s cash profitability will improve. Their consensus estimates imply a 5.8 percentage point increase in the company’s free cash flow margin to 25.2%.

Key Takeaways from Sirius XM’s Q4 Results

It was good to see Sirius XM beat analysts’ adjusted EBITDA and EPS estimates this quarter, driven by better-than-expected results in its Pandora segment. That stood out as a positive in these results. On the other hand, its full-year revenue, adjusted EBITDA, and EPS guidance fell short. Overall, this was a mediocre quarter for Sirius XM. The stock is flat after reporting and currently trades at $5.1 per share.

Sirius XM may not have had the best quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.