Revenue In Line With Expectations

Commercial real estate firm CBRE (NYSE:CBRE) reported results in line with analysts’ expectations in Q1 CY2024, with revenue up 7.1% year on year to $7.94 billion. It made a non-GAAP profit of $0.78 per share, improving from its profit of $0.37 per share in the same quarter last year.

Is now the time to buy CBRE? Find out in our full research report.

CBRE (CBRE) Q1 CY2024 Highlights:

-

Revenue: $7.94 billion vs analyst estimates of $7.95 billion (small miss)

-

EBITDA: $424 million vs analyst estimates of $438 million (3.2% miss)

-

EPS (non-GAAP): $0.78 vs analyst estimates of $0.69 (12.7% beat)

-

Gross Margin (GAAP): 18.4%, down from 19.2% in the same quarter last year

-

Free Cash Flow was -$560 million, down from $759.6 million in the previous quarter

-

Market Capitalization: $26.19 billion

Established in 1906, CBRE (NYSE:CBRE) is one of the largest commercial real estate services firms in the world.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

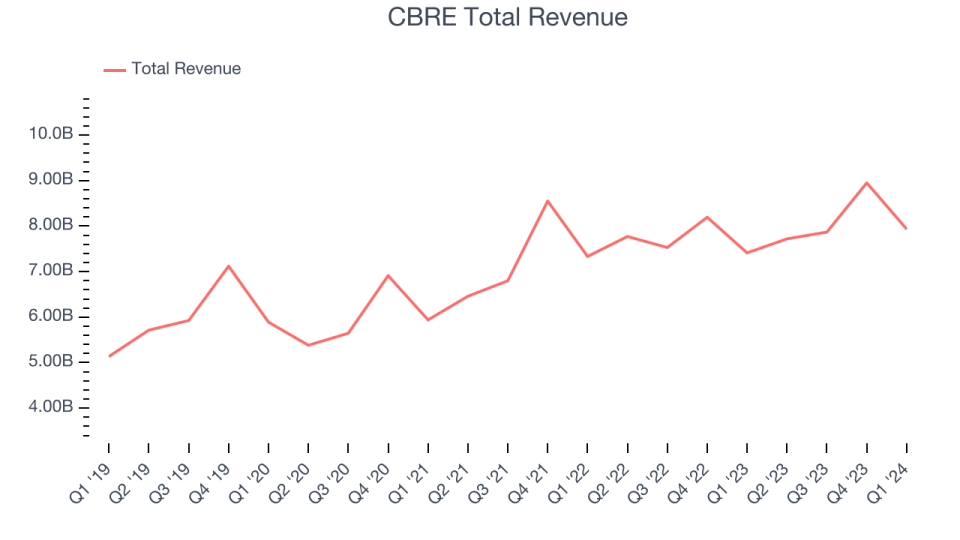

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. CBRE’s annualized revenue growth rate of 8.3% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That’s why we also follow short-term performance. CBRE’s recent history shows the business has slowed as its annualized revenue growth of 5.6% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Advisory Services, Workplace Solutions, and Investment Management, which are 24%, 73.2%, and 2.9% of revenue. Over the last two years, CBRE’s Workplace Solutions revenue (facilities and project management) averaged 36.6% year-on-year growth while its Advisory Services (leasing, capital markets) and Investment Management (real estate investments) revenues averaged 6.8% and 7% declines.

This quarter, CBRE grew its revenue by 7.1% year on year, and its $7.94 billion of revenue was in line with Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 10.7% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

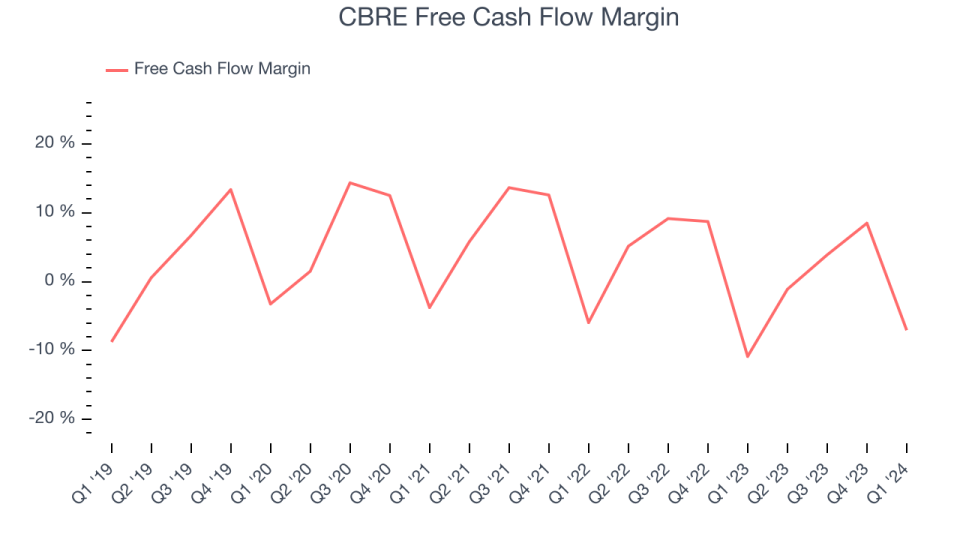

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, CBRE has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 2.2%, subpar for a consumer discretionary business.

CBRE burned through $560 million of cash in Q1, equivalent to a negative 7.1% margin, increasing its cash burn by 30.4% year on year.

Key Takeaways from CBRE’s Q1 Results

CBRE’s key Workplace Solutions revenue outperformed Wall Street’s estimates. However, that’s where the good news ends. Total revenue missed slightly and EBITDA missed by more. On the other hand, its operating margin missed. Overall, this was a mediocre quarter for CBRE. The company is down 2.9% on the results and currently trades at $84.32 per share.

So should you invest in CBRE right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.