Revenue In Line With Expectations

Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ:ULTA) reported results in line with analysts’ expectations in Q4 FY2023, with revenue up 10.2% year on year to $3.55 billion. The company’s outlook for the full year was also close to analysts’ estimates with revenue guided to $11.75 billion at the midpoint. It made a GAAP profit of $8.08 per share, improving from its profit of $6.68 per share in the same quarter last year.

Is now the time to buy Ulta? Find out by accessing our full research report, it’s free.

Ulta (ULTA) Q4 FY2023 Highlights:

-

Revenue: $3.55 billion vs analyst estimates of $3.53 billion (small beat)

-

EPS: $8.08 vs analyst estimates of $7.54 (7.2% beat)

-

Management’s revenue guidance for the upcoming financial year 2024 is $11.75 billion at the midpoint, in line with analyst expectations and implying 4.8% growth (vs 9.7% in FY2023)

-

Management’s EPS guidance for the upcoming financial year 2024 is $26.60 at the midpoint, below analyst expectations of $27.03

-

Gross Margin (GAAP): 37.7%, in line with the same quarter last year

-

Free Cash Flow of $994 million, up 24.2% from the same quarter last year

-

Same-Store Sales were up 2.5% year on year (beat vs. expectations of up 2.0% year on year)

-

Store Locations: 1,385 at quarter end, increasing by 30 over the last 12 months

-

Market Capitalization: $27.54 billion

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ:ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

Ulta is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

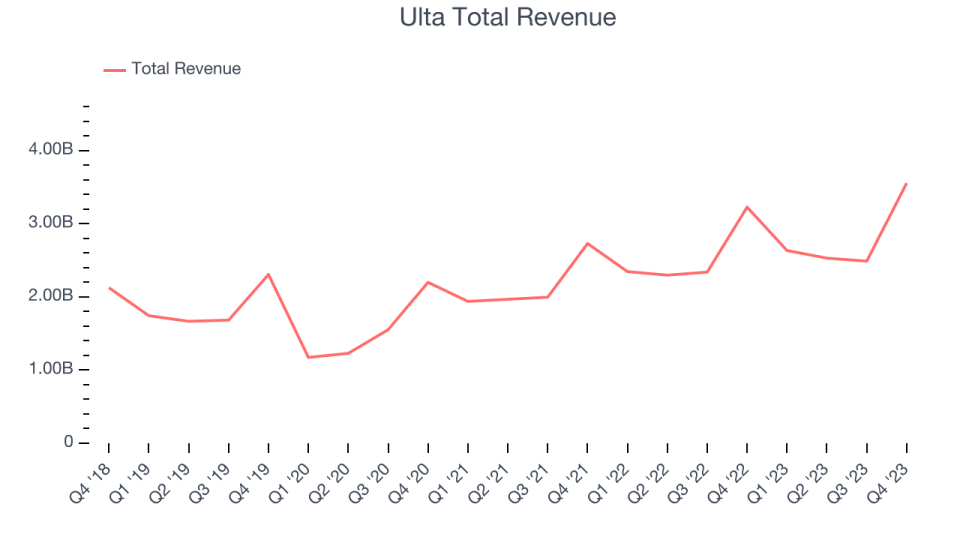

As you can see below, the company’s annualized revenue growth rate of 10.9% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was decent as it opened new stores and grew sales at existing, established stores.

This quarter, Ulta’s year-on-year revenue growth clocked in at 10.2%, and its $3.55 billion in revenue was in line with Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 3.9% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

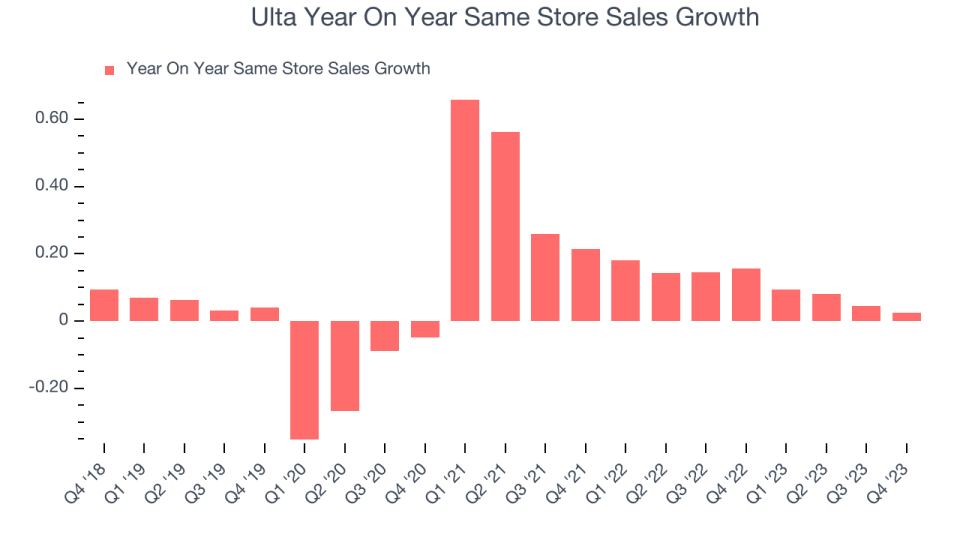

Ulta has generated solid demand for its products over the last two years. On average, the company’s same-store sales have grown by a healthy 10.9% year on year. This performance suggests that its steady rollout of new stores could be beneficial for shareholders. When a company has strong demand, more locations should help it reach more customers seeking its products.

In the latest quarter, Ulta’s same-store sales rose 2.5% year on year. By the company’s standards, this growth was a meaningful deceleration from the 15.6% year-on-year increase it posted 12 months ago. We’ll be watching Ulta closely to see if it can reaccelerate growth.

Key Takeaways from Ulta’s Q4 Results

It was good to see Ulta beat analysts’ same store sales, revenue, and gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, while full year revenue guidance was roughly in line, its full-year earnings forecast was underwhelming and missed. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. Investors were likely expecting more, and the stock is down 3.5% after reporting, trading at $546 per share.

So should you invest in Ulta right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.