Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: ‘Inflation Is

Real estate stocks slid at Wednesday’s market open, weighed down by the latest disappointing data on housing starts and a spike in mortgage rates, darkening the outlook for the sector.

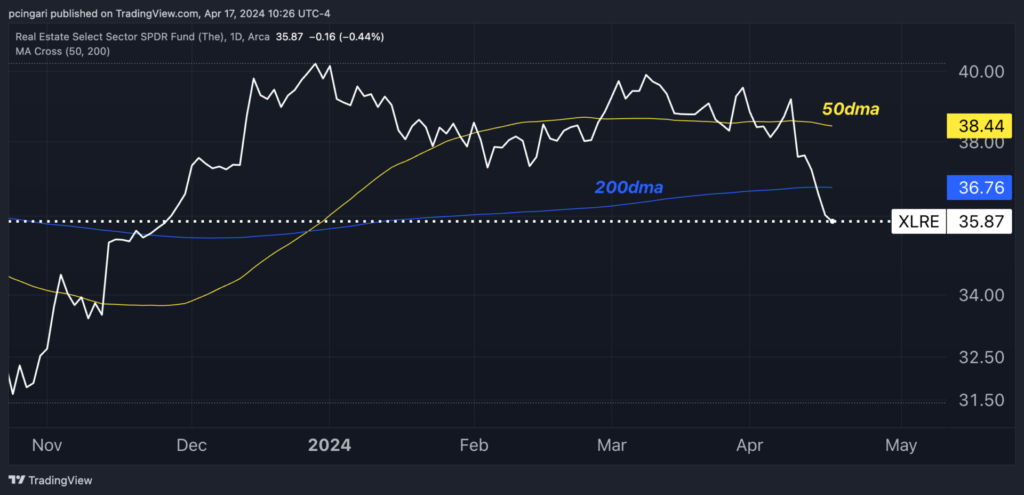

By 9:00 a.m. EST, the Real Estate Select Sector SPDR Fund (NYSE:XLRE) had dropped by 0.3%. This marked its fourth consecutive day of losses and set a course for its lowest close since the end of November 2023.

The fund has also slipped below its 200-day moving average, a critical long-term benchmark, signaling that investor sentiment has turned negative.

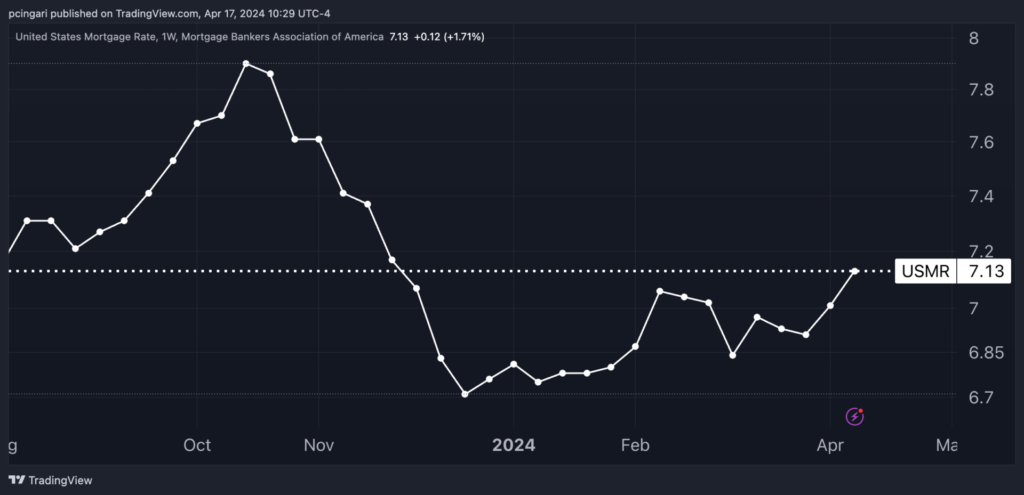

The average interest rate for 30-year fixed-rate mortgages with loan balances up to $766,550 climbed by 12 basis points to 7.13% for the week ending Apr. 12, 2024, according to the latest figures from the Mortgage Bankers Association. This rate is the highest recorded since early December.

On Wednesday, the yield on a 30-year Treasury bond, a key benchmark for long-term mortgage rates, traded at 4.75%, at the highest since mid-November 2023, as Fed Chair Powell admitted that there has been a lack of progress in the disinflation trend.

Read also: Powell Delays Fed Rate Cuts, Says ‘We Need Greater Confidence In Inflation’: 2-Year Yields Spike To 5%

Chart: Real Estate Stocks Fall Below Key Long-Term Moving Average As Inflation Bites Again

Weaknesses In Multifamily Segment Continue

Joel Kan, MBA’s Vice President and Deputy Chief Economist, explained the rise in rates, stating, “Rates increased for the second consecutive week, driven by incoming data indicating that the economy remains strong and inflation is proving tougher to bring down.”

Despite the uptick in mortgage rates, there was a 3.3% week-over-week increase in the Market Composite Index, which measures mortgage loan application volume.

Kan further noted, “Application activity picked up, possibly as some borrowers decided to act in case rates continue to rise. Purchase applications were the primary driver of this increase, although they are still about 10% lower than last year’s levels. There was a slight uptick in refinance applications, mainly due to a 3% rise in conventional applications.”

Chart: US 30-Year Mortgage Rates Rose To The Highest Level Since Late November

The real estate market’s challenges are linked to affordability and a shrinking availability as the supply of new homes falls.

Andrew Foran, an economist at Toronto Dominion Securities, commented on the trend in home building, “Homebuilding activity moderated in March as weakness in the multifamily segment persisted and the single-family segment gave back most of its considerable gain from the prior month.”

Data revealed a 14.7% month-over-month decline in housing starts in March, with the figures dropping to 1.32 million annualized units, significantly below the anticipated 1.49 million.

Both the single-family and multifamily sectors experienced declines, with single-family starts down by 12.4% (or 145,000 units) and multifamily starts plummeting by 21.7% (or 83,000 units). This retreat in multifamily starts marked the lowest level since April 2020.

Additionally, residential permits decreased more than expected in March, falling by 4.3% month-over-month to 1.46 million annualized units. This included a 5.7% drop in single-family permits—the first decline in fifteen months—and a 1.2% reduction in multifamily permits.

Rising & Falling

The weakest performers among real estate stocks with a market cap of at least $1 billion on Wednesday were:

| Name | 1-day %chg |

|---|---|

| Prologis, Inc. (NYSE:PLD) | -6.55% |

| First Industrial Realty Trust, Inc. (NYSE:FR) | -3.33% |

| STAG Industrial, Inc. (NYSE:STAG) | -2.89% |

| EastGroup Properties, Inc. (NYSE:EGP) | -2.89% |

| Rexford Industrial Realty, Inc. (NYSE:REXR) | -2.35% |

Those showing the highest gains were:

| Name | 1-day %chg |

|---|---|

| SL Green Realty Corp. (NYSE:SLG) | 3.18% |

| Opendoor Technologies Inc. (NYSE:OPEN) | 2.55% |

| Medical Properties Trust, Inc. (NYSE:MPW) | 2.49% |

| eXp World Holdings, Inc. (NYSE:EXPI) | 2.32% |

| Vornado Realty Trust (NYSE:VNO) | 2.25% |

Now Read: Best REITs to Buy in April

Image: Midjourney

Read More: Real Estate Stocks Fall As Mortgage Rates Rise To 4-Month Highs: ‘Inflation Is