Pilgrim’s Pride (NASDAQ:PPC) Reports Sales Below Analyst Estimates In Q1 Earnings

Chicken producer Pilgrim’s Pride (NASDAQ:PPC) fell short of analysts’ expectations in Q1 CY2024, with revenue up 4.7% year on year to $4.36 billion. It made a non-GAAP profit of $0.77 per share, improving from its profit of $0.08 per share in the same quarter last year.

Is now the time to buy Pilgrim’s Pride? Find out in our full research report.

Pilgrim’s Pride (PPC) Q1 CY2024 Highlights:

-

Revenue: $4.36 billion vs analyst estimates of $4.43 billion (1.5% miss)

-

Adjusted EBITDA: $371.9 million vs analyst estimates of $342.9 million (8.5% beat)

-

EPS (non-GAAP): $0.77 vs analyst estimates of $0.63 (22.1% beat)

-

Gross Margin (GAAP): 8.8%, up from 4.2% in the same quarter last year

-

Free Cash Flow of $162.6 million, similar to the previous quarter

-

Market Capitalization: $8.53 billion

“Although we experienced depressed market conditions and persistent consumer inflation throughout 2023, we saw this as opportunity to enhance our competitive advantage. To that end, we focused on consistent execution of our strategies, controlling what we can control, and maintaining investment in our operations. These efforts further strengthened our business, accelerating our profitable growth as market conditions evolved,” said Fabio Sandri, Pilgrim’s Chief Executive Officer.

Offering everything from pre-marinated to frozen chicken, Pilgrim’s Pride (NASDAQ:PPC) produces, processes, and distributes chicken products to retailers and food service customers.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

Pilgrim’s Pride is one of the largest consumer staples companies and benefits from a strong brand, giving it customer trust and leverage in many purchasing and distribution negotiations.

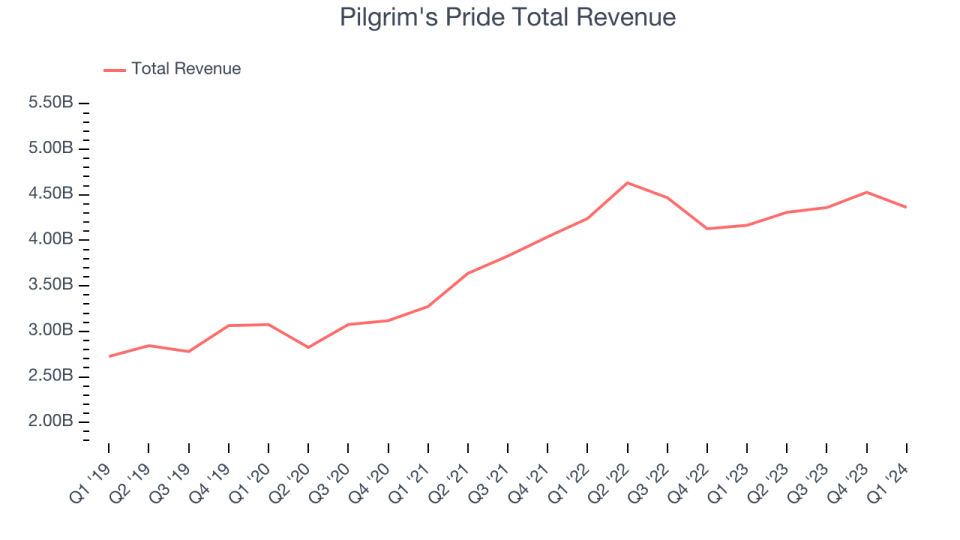

As you can see below, the company’s annualized revenue growth rate of 12.6% over the last three years was solid for a consumer staples business.

This quarter, Pilgrim’s Pride’s revenue grew 4.7% year on year to $4.36 billion, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

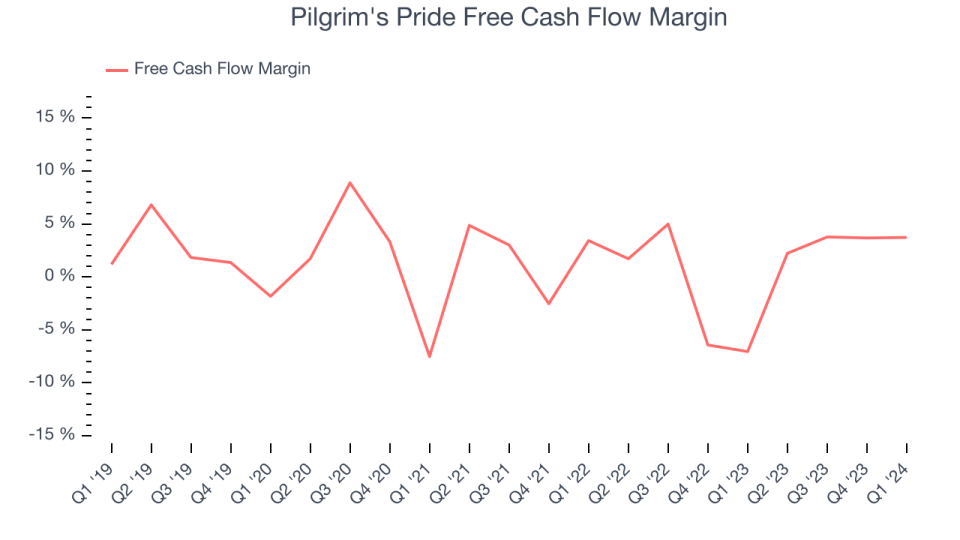

Pilgrim’s Pride’s free cash flow came in at $162.6 million in Q1, representing a 3.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to positive this quarter.

Over the last eight quarters, Pilgrim’s Pride has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 1%, subpar for a consumer staples business. However, its margin has averaged year-on-year increases of 4.8 percentage points over the last 12 months. Continued momentum should improve its cash flow prospects.

Key Takeaways from Pilgrim’s Pride’s Q1 Results

We enjoyed seeing Pilgrim’s Pride beat Wall Street’s expectations on adjusted EBITDA and EPS this quarter. On the other hand, its revenue missed, with the company CEO citing “depressed market conditions” and “persistent consumer inflation.” Overall, investors were likely expecting more, and with this quarter’s results being mixed, the stock is down 4.2% after reporting, trading at $33.89 per share.

So should you invest in Pilgrim’s Pride right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.