Offerpad (NYSE:OPAD) Reports Sales Below Analyst Estimates In Q4 Earnings

Technology real estate company Offerpad (NYSE:OPAD) fell short of analysts’ expectations in Q4 FY2023, with revenue down 64.5% year on year to $240.5 million. Next quarter’s revenue guidance of $265 million also underwhelmed, coming in 24.3% below analysts’ estimates. It made a GAAP loss of $0.57 per share, improving from its loss of $7.35 per share in the same quarter last year.

Is now the time to buy Offerpad? Find out by accessing our full research report, it’s free.

Offerpad (OPAD) Q4 FY2023 Highlights:

-

Revenue: $240.5 million vs analyst estimates of $252.3 million (4.7% miss)

-

EPS: -$0.57 vs analyst expectations of -$0.47 (21.7% miss)

-

Revenue Guidance for Q1 2024 is $265 million at the midpoint, below analyst estimates of $350.1 million

-

Free Cash Flow was -$15.36 million compared to -$94.54 million in the previous quarter

-

Gross Margin (GAAP): 6.9%, up from -6.6% in the same quarter last year

-

Homes Sold: 712

-

Market Capitalization: $256 million

“We successfully navigated 2023 from a position of operational excellence,” said Brian Bair, chairman and CEO.

Known for giving homeowners cash offers within 24 hours, Offerpad (NYSE:OPAD) operates a tech-enabled platform specializing in direct home buying and selling solutions.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

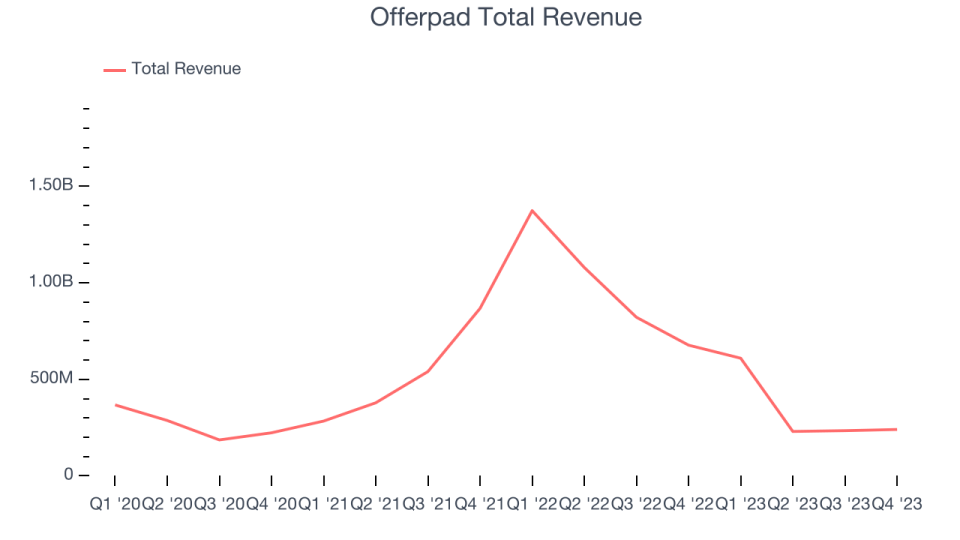

A company’s long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Offerpad’s annualized revenue growth rate of 7.3% over the last three years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That’s why we also follow short-term performance. Offerpad’s recent history shows a reversal from its already weak three-year trend as its revenue has shown annualized declines of 20.3% over the last two years.

We can dig even further into the company’s revenue dynamics by analyzing its number of homes sold, which reached 712 in the latest quarter. Over the last two years, Offerpad’s homes sold averaged 16.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Offerpad missed Wall Street’s estimates and reported a rather uninspiring 64.5% year-on-year revenue decline, generating $240.5 million of revenue. The company is guiding for a 56.5% year-on-year revenue decline next quarter to $265 million, a deceleration from the 55.6% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 30.3% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

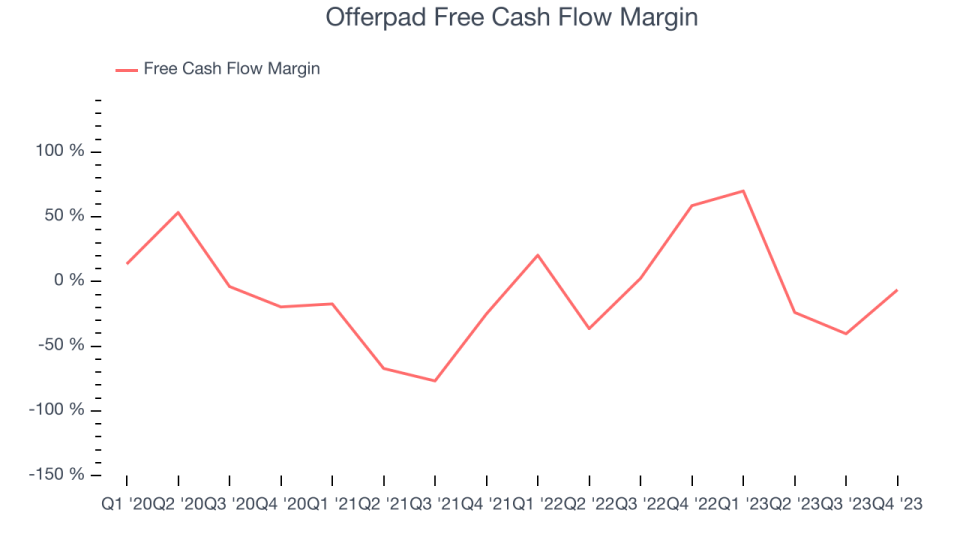

Over the last two years, Offerpad has shown decent cash profitability, giving it some reinvestment opportunities. The company’s free cash flow margin has averaged 10.7%, slightly better than the broader consumer discretionary sector.

Offerpad burned through $15.36 million of cash in Q4, equivalent to a negative 6.4% margin. This caught our eye as the company shifted from cash flow positive in the same quarter last year to cash flow negative this quarter. Over the next year, analysts predict Offerpad will flip from cash-producing to cash-burning. Their consensus estimates imply its LTM free cash flow margin of 19.9% will decrease to negative 1.3%.

Key Takeaways from Offerpad’s Q4 Results

We struggled to find many strong positives in these results. Its revenue, EBITDA, and EPS all missed analysts’ estimates as it sold fewer homes than expected (712 vs estimates of 749). Furthermore, its revenue and EPS guidance for next quarter fell short as it missed analysts’ homes sold estimates by an even wider margin (800 vs estimates of 1,086). On the bright side, its predicted EBITDA loss for next quarter came in lower than feared. Overall, this was a bad quarter for Offerpad. The company is down 1.1% on the results and currently trades at $9.1 per share.

Offerpad may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.