Nexstar Media (NASDAQ:NXST) Reports Sales Below Analyst Estimates In Q4 Earnings

Local broadcasting and digital media company Nexstar (NASDAQ:NXST) fell short of analysts’ expectations in Q4 FY2023, with revenue down 12.3% year on year to $1.30 billion. It made a GAAP profit of $3.32 per share, down from its profit of $5.31 per share in the same quarter last year.

Is now the time to buy Nexstar Media? Find out by accessing our full research report, it’s free.

Nexstar Media (NXST) Q4 FY2023 Highlights:

-

Revenue: $1.30 billion vs analyst estimates of $1.31 billion (0.7% miss)

-

EPS: $3.32 vs analyst expectations of $4.19 (20.8% miss)

-

Guidance for 2024 adjusted EBITDA of $2,140 million at the midpoint, below expectations of roughly $2,200 million

-

Free Cash Flow of $265 million, up from $85 million in the previous quarter

-

Gross Margin (GAAP): 58.6%, down from 66.7% in the same quarter last year

-

Market Capitalization: $5.51 billion

On September 30, 2022, Nexstar completed its acquisition of a 75% ownership interest in The CW Network, LLC (“The CW”).

Founded in 1996, Nexstar (NASDAQ:NXST) is an American media company operating numerous local television stations and digital media outlets across the country.

Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Sales Growth

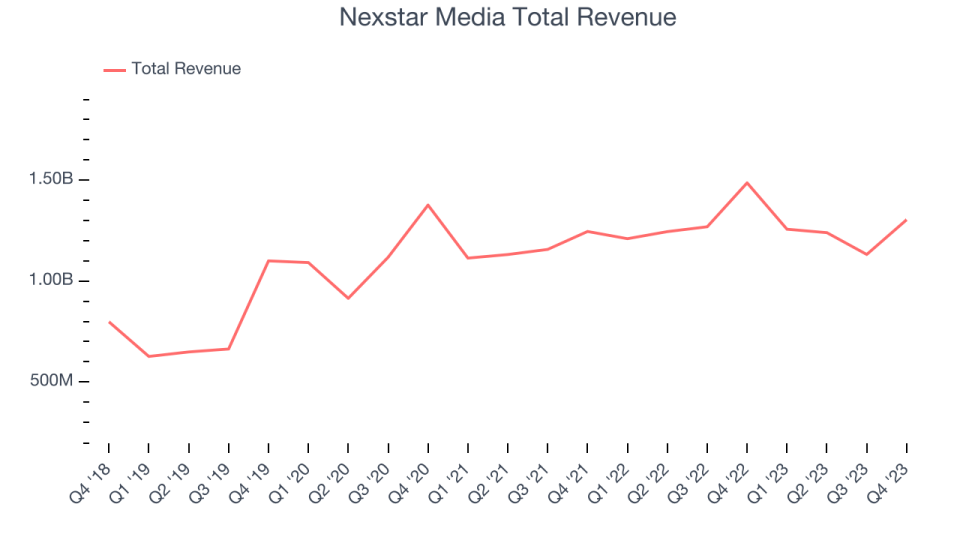

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Nexstar Media’s annualized revenue growth rate of 12.3% over the last five years was mediocre for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That’s why we also follow short-term performance. Nexstar Media’s recent history shows the business has slowed as its annualized revenue growth of 3% over the last two years is below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Distribution and Core Advertising, which are 54% and 34.4% of revenue. Over the last two years, Nexstar Media’s Distribution revenue (licensing and affiliate fees) averaged 5% year-on-year growth. On the other hand, its Core Advertising revenue (TV and radio ads) averaged 2.8% declines.

This quarter, Nexstar Media missed Wall Street’s estimates and reported a rather uninspiring 12.3% year-on-year revenue decline, generating $1.30 billion of revenue. Looking ahead, Wall Street expects sales to grow 14% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

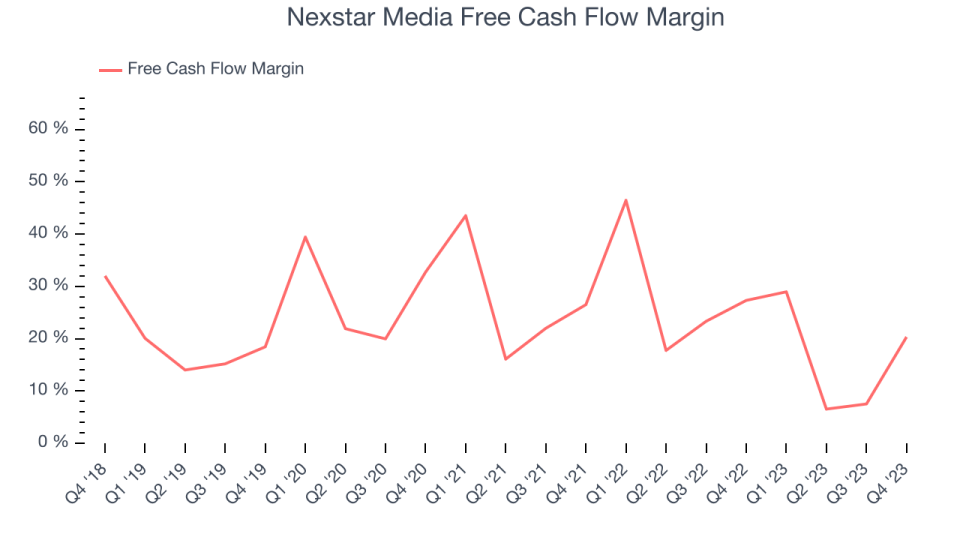

Over the last two years, Nexstar Media has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining a robust cash balance. The company’s free cash flow margin has been among the best in the consumer discretionary sector, averaging 22.5%.

Nexstar Media’s free cash flow came in at $265 million in Q4, equivalent to a 20.3% margin and down 34.7% year on year. Over the next year, analysts predict Nexstar Media’s cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 16.1% will increase to 25.4%.

Key Takeaways from Nexstar Media’s Q4 Results

We struggled to find many strong positives in these results. Its EPS missed and its operating margin fell short of Wall Street’s estimates. Adjusted EBITDA guidance for the full year was also below expectations., Overall, this was a mediocre quarter for Nexstar Media. The company is down 1.5% on the results and currently trades at $160.1 per share.

Nexstar Media may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.