Meta Platforms Stock Rallied Nearly 200% Last Year — Is It Too Late to Buy for 2024?

After an epic rally and nearly 200% gains in 2023, it may seem hard to believe that Meta Platforms (NASDAQ: META) had been all but left for dead by Wall Street in 2022. As 2024 gets underway, share prices of the parent company of Facebook, Instagram, WhatsApp, and the Quest virtual reality (VR) headsets are nearly back to all-time highs set during the pandemic.

Contrary to popular belief, Meta is far more than a social media business, nor is this company solely betting on the metaverse as its future (despite what the corporate name change a couple of years ago might have implied). Meta has a massive global data center network at its core, enabling millions of businesses — especially small businesses — to reach audiences. Don’t write off the possibility Meta could have yet another great run in 2024.

2024 could kick off another boost in digital ad activity

Meta is coming off of CEO Mark Zuckerberg’s “year of efficiency” in which the company vowed to keep expenses in check after a pandemic-era spending spree. More on that in a moment, because one key to Meta stock’s continued success in 2024 will be a resurgence in digital ad spending.

When the company reports fourth-quarter 2023 earnings on Feb. 1, expect strong revenue growth to capture the spotlight. Management did forecast revenue to be $36.5 billion to $40 billion, implying as much as a 24% increase over Q4 2022. Meta is still lapping depressed results in 2022 from a falloff in peak-pandemic user activity and resulting digital spending on its apps, as well as the effects of Apple‘s privacy changes reducing Meta’s ability to monetize ads on its fellow tech giant’s devices.

Additionally, other companies involved in the digital advertising ecosystem — like Adobe and Salesforce, both of which help with marketing analytics and ad distribution — said that Black Friday, Cyber Monday, and holiday shopping in general hit fresh records in the final weeks of 2023. The two software giants reported mid- to high-single-digit percentage increases in online shopper spending versus 2022.

Meta powers brand marketing for businesses all over the world — owing to the incredible reach it offers with over 3.1 billion daily active users (as of the third quarter of 2023). Early indicators of strong consumer spending could mean great things for the social media company, which uses its data centers and new artificial intelligence (AI) algorithms to help marketers find an audience and realize sales.

Part two of the “year of efficiency”?

Zuckerberg and company have indicated they have been pleased with renewed success in 2023, and that new modes of operating will continue into 2024 and beyond. That means not just revenue growth, but more profitable revenue growth.

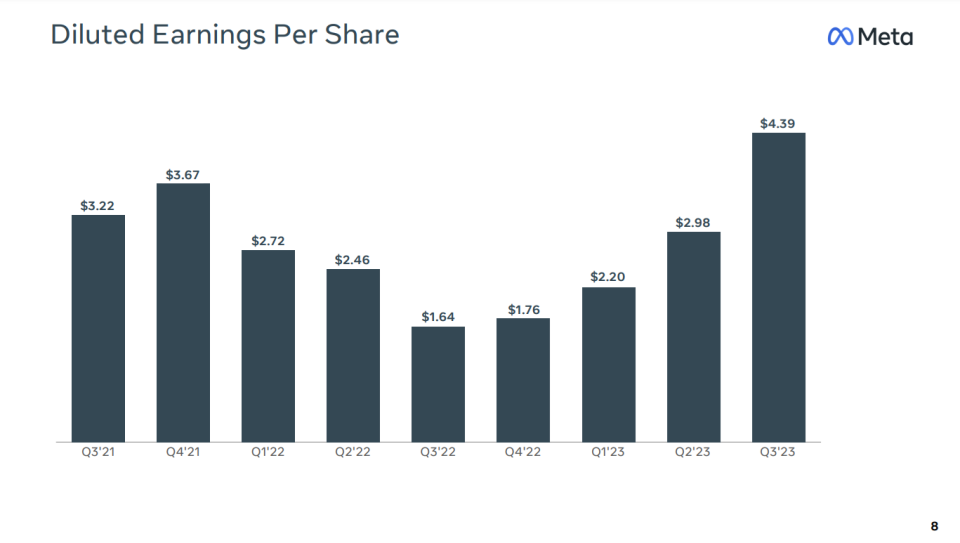

Cutting back on expenses, paired with Meta’s share repurchase program, have already done wonders. Earnings per share (EPS) in Q3 2023 were $4.39 — a massive 168% increase from the same quarter in 2022, and a 36% increase over Q3 2021 (the pandemic EPS peak).

A similar cadence of EPS increases is expected in Q4, and could perhaps continue into the new year. Thus, though Meta has an expensive-looking stock on a backward-looking basis (31 times trailing-12-month EPS, and 25 times trailing-12-month free cash flow), shares could actually be a value on a forward-looking basis (20 times Wall Street analysts’ early estimate for 2024 EPS, and 21 times the estimate for 2024 free cash flow).

It doesn’t look like it’s too late to invest in Meta stock for the long term. The business is back on track with a focus on profitable growth, and its data centers and AI are unlocking healthy returns for marketing customers. Meta could be another standout winner in 2024.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Nicholas Rossolillo and his clients have positions in Apple, Meta Platforms, and Salesforce. The Motley Fool has positions in and recommends Adobe, Apple, Meta Platforms, and Salesforce. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

Meta Platforms Stock Rallied Nearly 200% Last Year — Is It Too Late to Buy for 2024? was originally published by The Motley Fool