Matterport (NASDAQ:MTTR) Reports Sales Below Analyst Estimates In Q4 Earnings

Real estate focused virtual reality platform Matterport (NASDAQ:MTTR) missed analysts’ expectations in Q4 FY2023, with revenue down 3.9% year on year to $39.55 million. Next quarter’s revenue guidance of $40 million also underwhelmed, coming in 2.9% below analysts’ estimates. It made a non-GAAP loss of $0.04 per share, improving from its loss of $0.09 per share in the same quarter last year.

Is now the time to buy Matterport? Find out by accessing our full research report, it’s free.

Matterport (MTTR) Q4 FY2023 Highlights:

-

Revenue: $39.55 million vs analyst estimates of $39.98 million (1.1% miss)

-

EPS (non-GAAP): -$0.04 vs analyst estimates of -$0.04 (in line)

-

Revenue Guidance for Q1 2024 is $40 million at the midpoint, below analyst estimates of $41.21 million

-

Management’s revenue guidance for the upcoming financial year 2024 is $178 million at the midpoint, in line with analyst expectations and implying 12.8% growth (vs 18.8% in FY2023)

-

Free Cash Flow was -$12.66 million compared to -$15.49 million in the previous quarter

-

Customers: 938,000, up from 887,000 in the previous quarter

-

Gross Margin (GAAP): 46.1%, up from 28.8% in the same quarter last year

-

Market Capitalization: $755 million

“We closed 2023 on a high note with fourth quarter total revenue of $39.5 million, in line with our guidance range. Subscription revenue growth accelerated to 23% year-over-year, ahead of our expectations, driven by broad based strength across our global customer base. Our net dollar expansion rate expanded to 109%, the highest level in two years, as we helped customers work faster and more efficiently to improve business productivity and reduce operational costs,” said RJ Pittman, Chairman and Chief Executive Officer of Matterport.

Founded in 2011 before any mass-market VR headset was released, Matterport (NASDAQ:MTTR) provides the hardware and software necessary to turn real-world spaces into 3D visualization.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

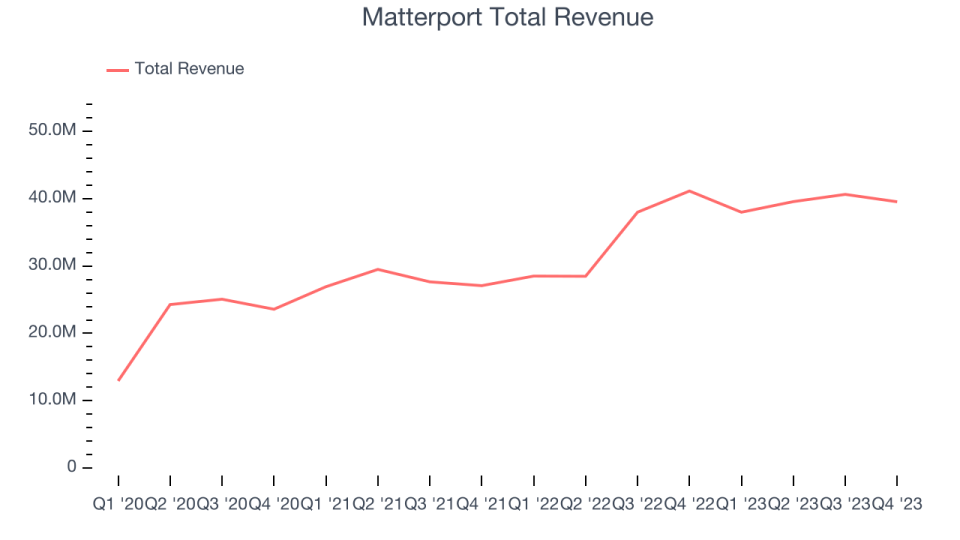

Sales Growth

As you can see below, Matterport’s revenue growth has been solid over the last two years, growing from $27.09 million in Q4 FY2021 to $39.55 million this quarter.

This quarter, Matterport’s revenue was down 3.9% year on year, which might disappointment some shareholders.

Next quarter’s guidance suggests that Matterport is expecting revenue to grow 5.3% year on year to $40 million, slowing down from the 33.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $178 million at the midpoint, growing 12.8% year on year compared to the 15.9% increase in FY2023.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

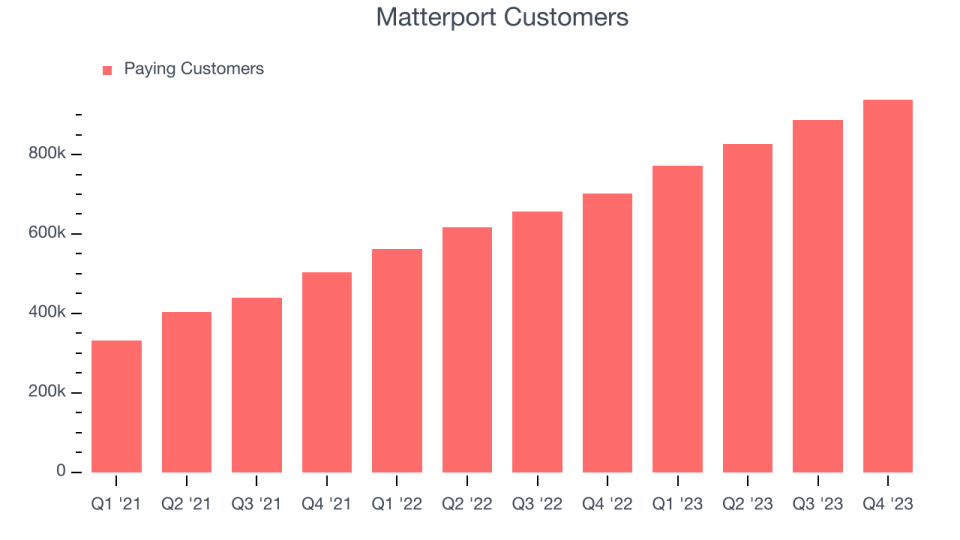

Customer Growth

Matterport reported 938,000 customers at the end of the quarter, an increase of 51,000 from the previous quarter. That’s a fair bit slower customer growth than last quarter but in line with what we’ve observed in past quarters, suggesting that the company still has decent sales momentum.

Key Takeaways from Matterport’s Q4 Results

Revenue missed and EPS was in line, so this wasn’t an exciting quarter but also not disastrous. Its revenue guidance for next quarter missed analysts’ expectations and its revenue missed Wall Street’s estimates. Overall, this was a mixed quarter for Matterport. The stock is flat after reporting and currently trades at $2.53 per share.

Matterport may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.