Keurig Dr Pepper (NASDAQ:KDP) Reports Sales Below Analyst Estimates In Q4 Earnings

Beverage company Keurig Dr Pepper (NASDAQ:KDP) missed analysts’ expectations in Q4 FY2023, with revenue up 1.7% year on year to $3.87 billion. It made a non-GAAP profit of $0.55 per share, improving from its profit of $0.50 per share in the same quarter last year.

Is now the time to buy Keurig Dr Pepper? Find out by accessing our full research report, it’s free.

Keurig Dr Pepper (KDP) Q4 FY2023 Highlights:

-

Revenue: $3.87 billion vs analyst estimates of $3.91 billion (1% miss)

-

EPS (non-GAAP): $0.55 vs analyst estimates of $0.54 (1.5% beat)

-

Free Cash Flow of $152 million, down 66.8% from the previous quarter

-

Gross Margin (GAAP): 56.5%, up from 52.5% in the same quarter last year

-

Sales Volumes were down 3.7% year on year

-

Market Capitalization: $44.19 billion

Commenting on the results, Chairman and CEO Bob Gamgort stated, “2023 was a year of significant progress for KDP. Broad-based market share gains across our portfolio and entries into attractive white spaces supported our revenue momentum. Gross margin expansion resumed, as the relationship between inflation, pricing, and our redoubled productivity efforts improved throughout the year and helped fund investments in our brands and capabilities. We delivered on our financial commitments while simultaneously enhancing the composition of our earnings profile and strengthening our balance sheet.

Born out of a 2018 merger between coffee company Keurig Green Mountain and beverage company Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ:KDP) boasts a powerhouse portfolio of beverages.

Beverages and Alcohol

The beverages and alcohol category encompasses companies engaged in the production, distribution, and sale of refreshments like beer, wine, and spirits, along with soft drinks, juices, and bottled water. These companies’ performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. The industry is highly competitive, with a diverse range of products from large multinational corporations, niche brands, and startups vying for market share. It’s also subject to varying degrees of government regulation and taxation, especially for alcoholic beverages.

Sales Growth

Keurig Dr Pepper is one of the larger consumer staples companies and benefits from a well-known brand, giving it customer mindshare and influence over purchasing decisions.

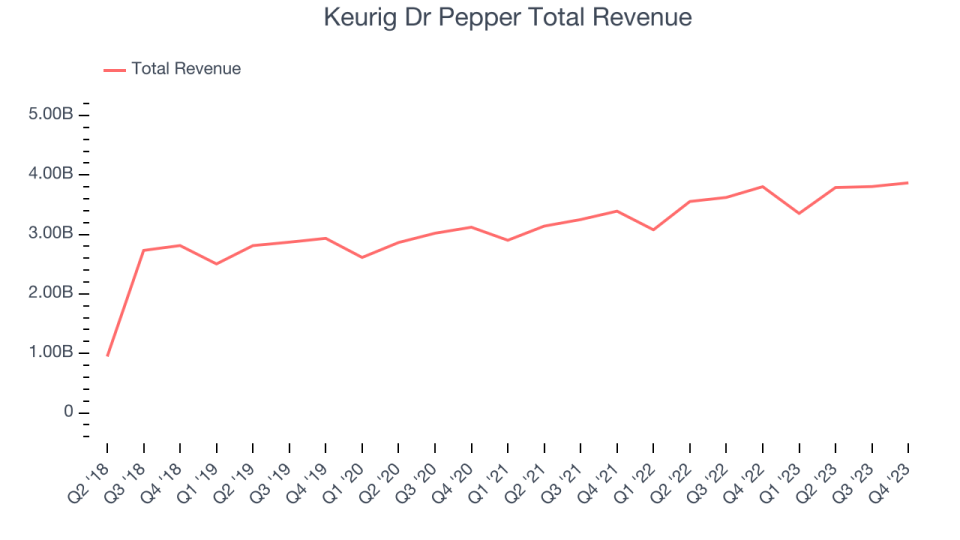

As you can see below, the company’s annualized revenue growth rate of 8.4% over the last three years was decent for a consumer staples business.

This quarter, Keurig Dr Pepper’s revenue grew 1.7% year on year to $3.87 billion, falling short of Wall Street’s estimates. Looking ahead, Wall Street expects sales to grow 4.4% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

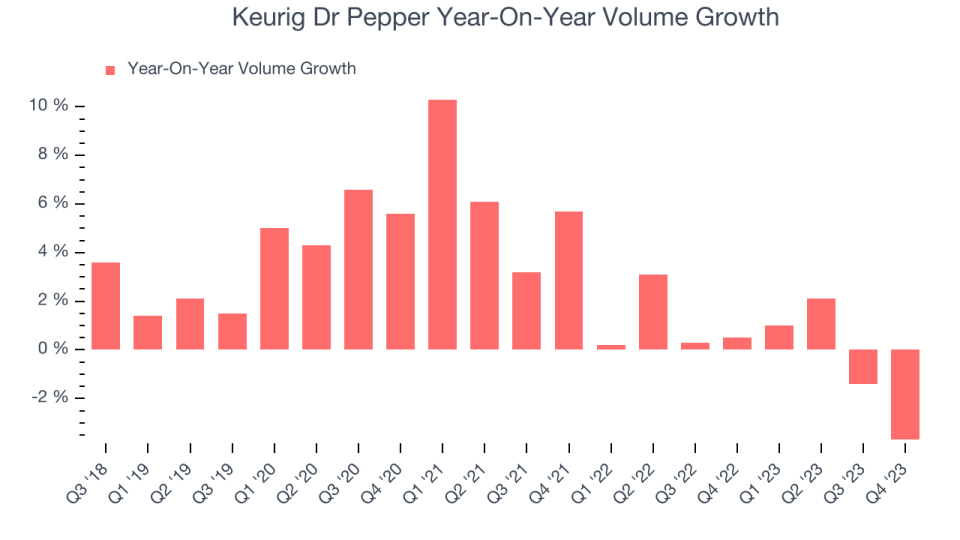

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Keurig Dr Pepper’s quarterly sales volumes have, on average, stayed about the same over the last two years. This stability is normal because the quantity demanded for consumer staples products typically doesn’t see much volatility.

In Keurig Dr Pepper’s Q4 2023, sales volumes dropped 3.7% year on year. This result was a reversal from the 0.5% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn’t deter you from investing in a business. We’ll be monitoring the company to see how things progress.

Key Takeaways from Keurig Dr Pepper’s Q4 Results

It was good to see Keurig Dr Pepper beat analysts’ gross margin and EPS expectations this quarter. That stood out as a positive in these results. On the other hand, its operating margin and its revenue missed Wall Street’s estimates as its sales volumes shrunk. A bright spot, however, was its U.S. refreshments division, where it won market share thanks to strong performance from Dr Pepper, Polar, Evian, Vita Coco, C4 Energy, and Hawaiian Punch. For 2024, the company expects to generate constant currency sales in the mid-single-digit range, which should translate into high single-digit EPS growth. Overall, this was a mixed quarter for Keurig Dr Pepper. The stock is flat after reporting and currently trades at $31.66 per share.

So should you invest in Keurig Dr Pepper right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.