Is This Beaten-Down Stock a Good Acquisition Target?

We’ve seen some significant acquisitions unfold in the biotech industry in the past five years, and there are good reasons to believe that trend will continue. Larger drugmakers can instantly expand their pipeline, potentially acquiring highly promising assets without going through the often troublesome discovery process.

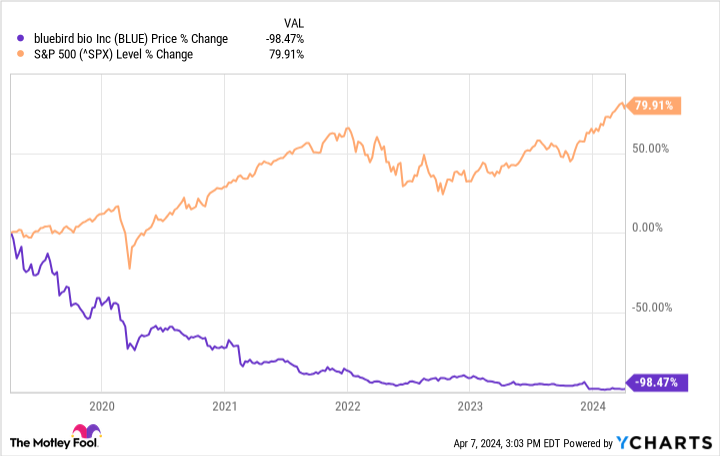

Of course, not every acquisition creates value. Corporations don’t make the decision to buy out a smaller company lightly. Let’s look at one potential acquisition target in the biotech sector: Bluebird Bio (NASDAQ: BLUE). Shares of this small-cap gene-editing specialist have slumped 60% in just the past 12 months — substantially lagging both the broad market and the biotech sector.

The stock is much cheaper than it was just a few years ago. But is that enough to attract a larger company looking for a good deal?

Why it makes sense for Bluebird

Bluebird Bio is an innovative company. The biotech currently has three products on the market. All three are gene-editing therapies for diseases that have been difficult to treat in the past. That’s a feat few gene-editing specialists have gotten even close to accomplishing.

The first of Bluebird’s marketed products is Zynteglo, which targets beta-thalassemia, a rare blood disorder. It earned the green light in 2022. Then there is Skysona, a therapy approved in late 2022 to treat a rare neurological condition called cerebral adrenoleukodystrophy. The last one is Lyfgenia, a treatment for sickle cell disease (SCD), also a rare blood disorder. It got the nod in December.

While these approvals were groundbreaking, developing gene-editing therapies is expensive. Administering them to patients is no walk in the park, either. The process for Zynteglo involves collecting the patient’s stem cells, sending them to a lab where the person-specific treatment is manufactured and then reinserted back into the patient via intravenous infusion. Bluebird Bio needs qualified treatment centers and specially trained staff to administer its therapies.

These factors make the company’s marketing expenses much higher than they would have been if it were selling simple oral pills. But the company isn’t particularly cash-rich. It ended 2023 with $275 million in cash and equivalents. Thanks to a recent round of debt financing in which it raised $175 million, management now believes it has enough money to last until the first quarter of 2026.

Bluebird’s long process of administering its treatments also means it will take some time to ramp up consistent revenue for these products. So it’s not clear that by 2026, it will generate enough money to be out of the woods. The biotech could benefit from the financial support of a larger drugmaker.

What Bluebird brings to the table

But why would another company want to acquire Bluebird Bio? Here’s one reason: The gene-editing field looks highly promising. It could help unlock more innovative therapies, and the acquirer would instantly have a team on its payroll that has proven it can develop groundbreaking gene-editing products.

The transaction would also help speed up the delivery of Bluebird’s therapies to patients, potentially contributing some meaningful revenue to whichever company might decide to buy Bluebird. That is especially true of Lygenia, the most promising of Bluebird’s approved products. The biotech estimates that about 20,000 patients in the U.S. could benefit from Lyfgenia, and the medicine costs $3.1 million per treatment course. Although there is competition from another recently approved gene-editing SCD treatment, Lyfgenia could become a blockbuster with the right strategy.

Furthermore, though Bluebird exited the European market in 2021 due to the difficulty of striking deals with insurers, a drugmaker with a significant footprint in Europe could help it launch its medicines in the region once again, thereby increasing its target market. Bluebird currently doesn’t have the funds to do that, but with some help, it might.

Don’t hold your breath

Bluebird Bio looks like a decent acquisition target, especially given its share price continues to fall. Whether the biotech gets acquired is anyone’s guess. But it’d be a mistake to invest in the stock today in hopes of an eventual buyout. In fact, Bluebird Bio looks too risky to invest in right now for most practical purposes. So it’s best to stay away — although if it does get acquired, it might be worth considering investing in the company that would be buying it.

Should you invest $1,000 in Bluebird Bio right now?

Before you buy stock in Bluebird Bio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bluebird Bio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $522,969!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 8, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool recommends Bluebird Bio. The Motley Fool has a disclosure policy.

Is This Beaten-Down Stock a Good Acquisition Target? was originally published by The Motley Fool