Is The Trade Desk Stock a Buy Now?

The digital advertising downturn that started with the inflation panic of 2021 has been tough for The Trade Desk (NASDAQ: TTD) investors. The stock price has more than doubled from the multiyear lows that followed, but it’s far from a complete recovery. Even now, as the advertising market is getting back on its feet again, The Trade Desk’s stock sits nearly 22% below the pre-crisis pinnacle.

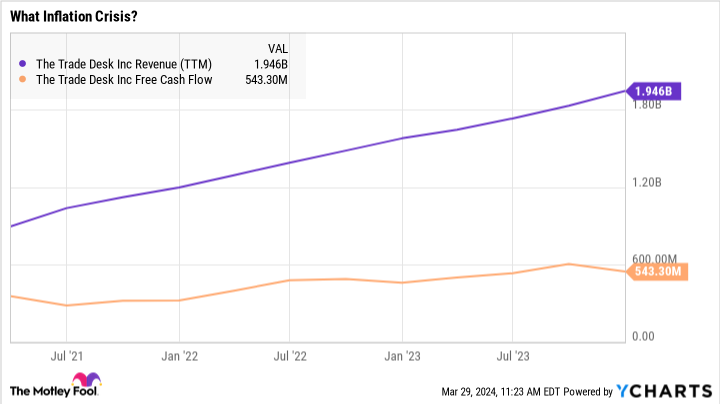

But here’s where it gets interesting: The company’s business really didn’t suffer from the inflation crisis. In fact, the added economic pressure on advertising budgets was arguably a selling point for The Trade Desk’s services.

As a result, this stock stands out as a particularly promising growth story right now — but is it a good buy? Let take a closer look at The Trade Desk’s current situation.

The Trade Desk’s playbook for thriving in tough times

The Trade Desk didn’t just stay afloat in the economic downturn, but also delivered robust revenue growth with strong cash-based profit margins. That’s quite an achievement in the middle of industrywide headwinds.

In a recent video chat with yours truly, Laura Schenkein, The Trade Desk CFO, provided a striking insight into how the company turned economic challenges into a competitive edge.

“Over the last two years, every quarter we’ve grown north of 20% even when our peers or peer set were flat or even in some quarters growing negatively,” she said. “So from my perspective, what I look for is consistent execution. I expect that trend to continue. I feel confident that we’re going to continue to outpace the growth of the advertising industry.”

Next, Schenkein provided a long list of tailwinds driving the company forward despite a challenging market. From connected TV (CTV) media to the Kokai ad-buying platform with built-in artificial intelligence (AI) assistance, no to mention the lucrative election cycle and fast-growing international ad spending, The Trade Desk has plenty of fuel for its sales-growth fires.

The engines behind The Trade Desk’s growth

Schenkein’s statement isn’t merely a reflection of past performance, either. It shows how The Trade Desk provides more value for each advertising dollar spent through its platform. In an era where every penny counts more than ever, The Trade Desk has promised and delivered efficiency and effectiveness, enabling advertisers to optimize their spending amid tightened budgets. When this company does a good job, its clients save money on more efficient advertising campaigns.

What does this mean for potential investors pondering whether The Trade Desk stock is a buy now?

The company’s proven capability to outperform the market, even in adverse conditions, highlights its adaptability and innovation. The Trade Desk hasn’t merely endured the downturn; it has harnessed the forces of the crisis to deliver positive results, like a judo master turning an attacker’s momentum into an unstoppable throw.

Is it time to take action on this thrilling growth story?

In light of this powerful ability to roll with the shifting market’s punches, The Trade Desk stands out as a beacon of strategic innovation in the digital advertising space. The economic downturn, while challenging to everyone involved, also presented a unique opportunity for The Trade Desk to take advantage of the inherent penny-pinching value of a more efficient ad-buying system. This ability to turn potential obstacles into avenues for growth and value creation for advertisers suggests a robust foundation for future performance.

As the digital advertising market evolves, The Trade Desk’s proven track record of growth and resilience in challenging times offers a compelling narrative for investors. The stock isn’t cheap, even though the price chart stalled for years amid rising financial results, but I think the company’s top-notch execution is well worth a premium price.

Don’t forget that The Trade Desk has exceeded Wall Street’s average sales targets in every quarter since going public in 2016, often by a wide margin. In other words, people tend to underestimate this high-octane growth story.

So The Trade Desk’s stock isn’t every investor’s cup of tea today, but I highly recommend picking up a few shares if you don’t mind some volatility on the road ahead.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and The Trade Desk made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of March 25, 2024

Anders Bylund has positions in The Trade Desk. The Motley Fool has positions in and recommends The Trade Desk. The Motley Fool has a disclosure policy.

Is The Trade Desk Stock a Buy Now? was originally published by The Motley Fool