Is Kinder Morgan the Best Dividend Stock for You?

Energy stock Kinder Morgan (NYSE: KMI) has a 6.5% dividend yield, which is well above the 1.4% you’d collect from an S&P 500 index fund. The investment-grade midstream giant has increased its dividend annually since 2018. There are clear reasons to like the stock, but that doesn’t mean investors should buy it over other options.

Here’s why Kinder Morgan may not be the best dividend stock for you.

Kinder Morgan should be a boring business

Kinder Morgan is a midstream company, which means it owns pipelines, storage, and transportation assets in the energy sector. This is a fairly boring segment of the industry, known for consistency even through oil’s inevitable downturns. The key is that midstream companies generally charge fees for the use of their assets, with the actual price of the commodities flowing through the system being less important than demand for the system.

If you are a conservative dividend-focused investor looking at the energy sector, a company like Kinder Morgan would be a good starting point. The hefty 6.5% dividend yield and regular dividend increases in recent years help to support a bullish stance. In addition to these facts, with a market cap of roughly $38 billion, Kinder Morgan is also one of the largest midstream players in North America. It would be difficult, if not impossible, to replicate or replace the asset portfolio Kinder Morgan has created.

And yet, if you are considering Kinder Morgan today, you should step back and hit the pause button. When you look at the history here, there are other choices in the midstream sector that may be better options, including Enterprise Products Partners (NYSE: EPD). And there’s more behind that statement than just Enterprise’s larger 7.4% yield.

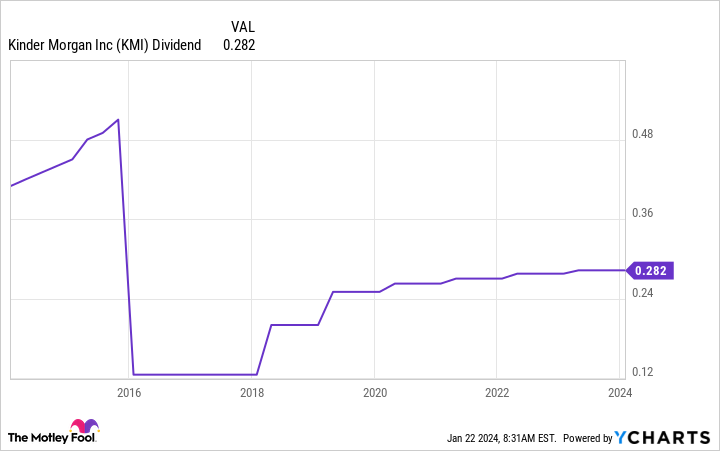

A bit of dividend history at Kinder Morgan

The really important year for Kinder Morgan is 2016. That was when the company cut its dividend by about 75%. Only in late 2015 management had told investors to expect a dividend increase of as much as 10% in 2016! In short, the company went back on a promise in a very big way.

Now fast-forward to 2020, when the dividend was back in growth mode. Trying to win back investor trust, Kinder Morgan had laid out an aggressive dividend growth plan that included a 25% dividend boost in 2020. But, instead, investors ended up with an increase of roughly 5%. That’s the second dividend promise that got broken in what is a rather short period of time.

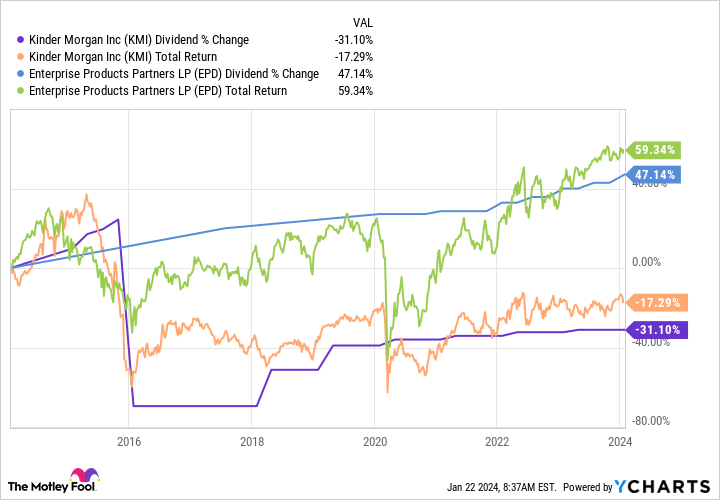

To be fair to Kinder Morgan, it made the right call for the company in both instances. But dividend investors would still be justified if they had questions around trust here. By contrast, Enterprise Products Partners has a higher yield and has increased its distribution annually for 25 consecutive years. It hasn’t made any major distribution promises only to end up reneging on its word.

As the chart above shows, providing a more consistent income stream has left investors much better off when looking at total return, which assumes dividend reinvestment. That’s not to suggest that Enterprise is the investment you should choose over Kinder Morgan. But it does highlight the fact that, perhaps, Kinder Morgan isn’t the only midstream stock you should be considering if you are trying to find a reliable income stock.

Add a few names to the list

Kinder Morgan is in a much better position today than it was in 2016 to deal with industry adversity, but that doesn’t mean it is the best midstream stock you can buy. There are plenty of other high-yield choices with much better records of rewarding investors via consistent dividend growth. Enterprise is just one example of why Kinder Morgan may not be the best dividend stock for your portfolio.

Should you invest $1,000 in Kinder Morgan right now?

Before you buy stock in Kinder Morgan, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kinder Morgan wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Is Kinder Morgan the Best Dividend Stock for You? was originally published by The Motley Fool