Is It Too Late to Buy Super Micro Computer Stock After It Soared 780%?

The “Magnificent Seven” stocks have captivated investors over the past year thanks to their collective contributions to the artificial intelligence (AI) revolution. Perhaps the most closely followed is Nvidia, which specializes in graphics processing units (GPU) and data center services. Both of these computer network applications are important pillars for generative AI.

One of Nvidia’s closest allies is IT infrastructure company Super Micro Computer (NASDAQ: SMCI) — often known as Supermicro. Its business is experiencing something of a renaissance at the moment, and that’s thanks to inbound business from Nvidia. With its shares having soared 780% over the last year, some investors may think the Supermicro train has left the station.

Let’s break down Supermicro’s entire business and assess if now is a good opportunity buy shares in this artificial intelligence (AI) innovator.

The next Nvidia?

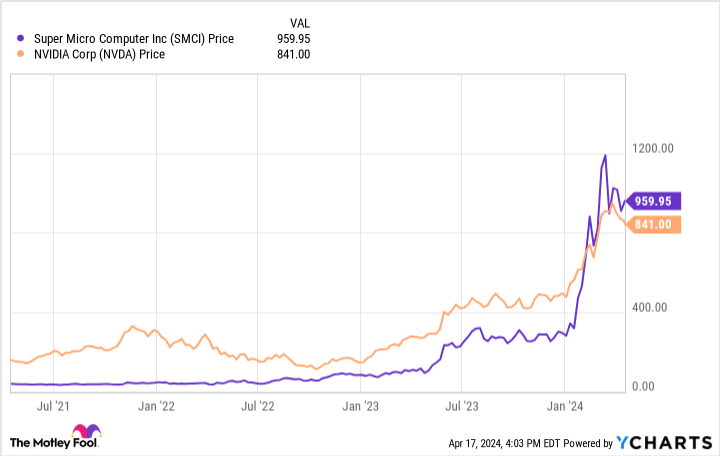

The chart below illustrates an interesting dynamic. Shares of Nvidia and Supermicro have generally traded in parallel over the past few years.

Supermicro’s business experienced quite a boom last year. During the company’s second fiscal quarter, which ended Dec. 31, revenue increased 103% year over year to $3.66 billion. Moreover, the company raised its full-year guidance from a midpoint of $10.5 billion in total revenue to $14.5 billion.

Much of this growth is attributable to Supermicro’s relationship with Nvidia. Considering that Nvidia is one of the core engines powering the overall AI picture right now and is also operating at record revenue and profit levels, it’s not all that surprising to see investors cheer both of these companies on.

However, despite the temptation to follow this momentum, smart investors should take a deeper look down the income statement.

There’s more to see than soaring revenue

One word of caution regarding Supermicro is that it is an extremely different business than Nvidia. Nvidia designs semiconductor chips that are used for supercomputing applications such as machine learning or helping train large language models (LLMs).

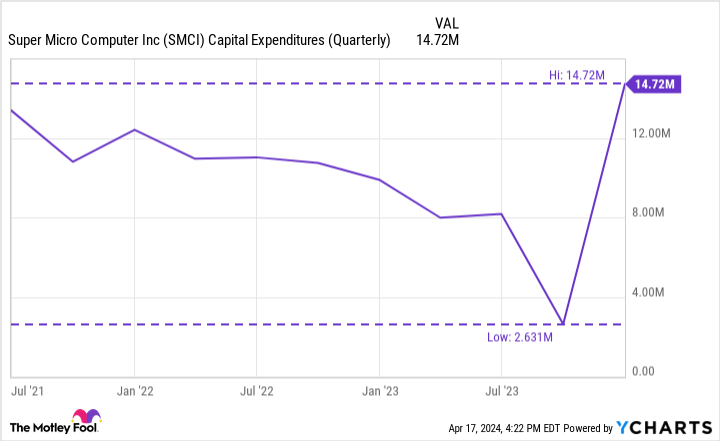

By contrast, Supermicro designs IT architecture systems, including storage clusters and server racks. This is a costly endeavor, which can be seen in the chart below illustrating Supermicro’s capital expenditure (capex) trends.

Investors can see that last quarter’s capex of $14.7 million was the highest for Supermicro in the last three years. Granted, demand for integrated IT solutions is going to vary from quarter to quarter, which will lead to some noticeable ebbs and flows.

However, as the AI narrative continues to play out, I am curious how capex levels will impact Supermicro in the long run. More specifically, rising spending on parts for server racks could materially change Supermicro’s margin profile over time. In fact, this is already happening to some degree.

For the period ended Dec. 31, Supermicro’s gross margin was 15.4% — down significantly from 18.7% one year prior.

Is it too late to buy Supermicro stock?

Supermicro’s deteriorating margins tell me two things.

First, unlike Nvidia, Supermicro does not have a high degree of pricing power. With loads of competitors, including Dell Technologies, International Business Machines, Hewlett Packard Enterprise, and Lenovo Group, Supermicro isn’t exactly in a position of leverage.

The second concern I have about the margin profile is what it could mean for cash flow and liquidity in the long run. When you layer on top the fact that traditionally non-chip businesses are beginning to explore developing their own solutions, Supermicro’s relationship with Nvidia appears far less lucrative. In turn, if demand for Nvidia’s chips begins to plateau, this will have a domino effect on Supermicro.

In addition, with a price-to-sales (P/S) ratio of 5.9, Supermicro stock trades at a significant premium compared to its peers.

Given the trepidations above, I would say that it is not too late to buy Supermicro stock. In fact, I think it might be too early. Sure, the company operates in an interesting area within the AI realm and could serve as a hedge to other opportunities in your portfolio. However, given some of the risks outlined above, I question how attractive Supermicro’s investment prospects are right now.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Super Micro Computer Stock After It Soared 780%? was originally published by The Motley Fool