Is It Too Late to Buy American Express Stock?

Credit card company American Express (NYSE: AXP) has been on a roll since the calendar turned over. Shares are up 21% since January. Now at 52-week highs, the question is whether this run can keep going or if investors on the sidelines have missed the boat.

Fear not; there is still an opportunity to be had.

Long-term investors are looking at potential consumer tailwinds over the coming years, and growth could remain resilient despite household credit card debt sitting at record highs today.

A preferred financial instrument for young consumers

As a credit card company, American Express makes more money when cardholders spend more. The good news for shareholders is that tailwinds are swirling for increased spending over the long term. The power dynamic in the economy is shifting from older generations to millennial and Gen Z consumers. American Express reported that over 60% of new card and 75% of gold and platinum card signups came from these demographics in 2023.

Understand these young consumers to gain insight into their spending habits. Housing is costly, and fewer young consumers are buying homes. The average homebuyer’s age has increased to 35 for first-time buyers from roughly 30 a decade ago. Some young people are opting to rent. Additionally, living costs have inflated in recent years.

According to a consumer survey by PYMNTS and Elan Financial Services, 43% of millennials and Gen Z reported increasing credit card usage. The survey concluded that these young consumers use credit 30% more than the average cardholder.

Watch for cardholder health

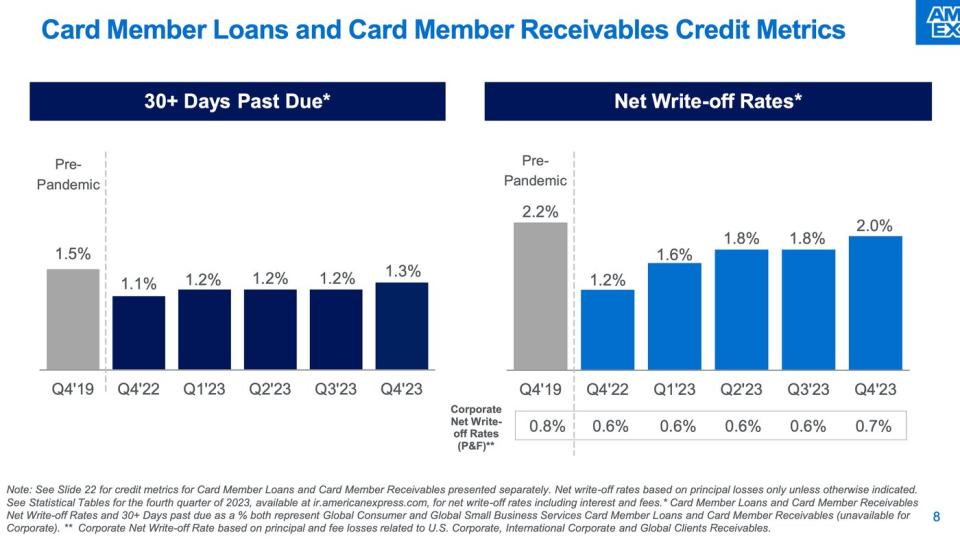

American Express holds its loans, which makes default the greatest threat to the business. Despite household credit card debt at record levels, American Express is experiencing no problems here. Late-paying customers and write-offs are below pre-pandemic levels, a healthy sign that customers are paying their bills.

Problems arise if these numbers rise too much, but they reflect a high-quality user base. American Express is a premium card company that caters to many business accounts and prime borrowers. This potentially insulates American Express from defaults more than companies serving subprime borrowers.

Growth at a value

Analysts have been encouraged by American Express’ performance, gradually raising long-term earnings growth estimates since January to over 13.5% today. The stock’s valuation has also climbed with the share price, which has risen to nearly 18 times earnings from a price-to-earnings ratio of 14 just a few months ago.

The stock looks attractively valued in two different ways. First, American Express is expected to grow faster than the broader market’s historical average, around 10% annually. Yet, the stock’s valuation trails the S&P 500‘s, currently at a P/E of 21. In other words, American Express is growing faster, but the stock is less expensive. That could be due to the business model’s default risk, but remember, default metrics are healthy.

Secondly, I use the PEG ratio to gauge what I pay for a company’s earnings growth. I like to buy long-term stocks with PEG ratios of 1.5 or less (lower is better), and American Express’ PEG ratio of 1.3 fits that criterion.

Ultimately, American Express seems poised to benefit from increased spending by young consumers. The stock’s valuation leaves enough room for future growth to trickle to shareholders as investment returns, meaning it’s not too late to buy the stock today.

Should you invest $1,000 in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Is It Too Late to Buy American Express Stock? was originally published by The Motley Fool