Is It Time to Buy the Dip On Netflix Stock?

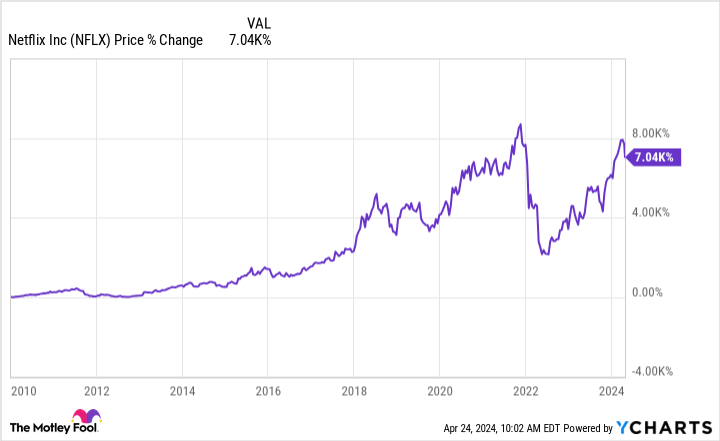

After getting clobbered by the bear market, shares of leading TV streamer Netflix (NASDAQ: NFLX) have rallied nearly 200% in the last two-year stretch. That epic performance includes a sell-off following the first-quarter 2024 earnings update as investors took a breather.

The reason for the recent dip in the stock could be the upcoming changes to how Netflix will report on its business metrics starting in 2025. Whenever a company pivots, there’s reason for shareholders to reassess their ownership thesis. If that investment thesis still holds, is Netflix a buy-the-dip candidate?

Bye-bye, quarterly membership numbers

Stealing the headlines during Netflix’s Q1 2024 earnings update was the tidbit about the company stopping its quarterly report on paid membership numbers and average revenue per member (ARM) starting with its Q1 2025 report next April. Instead, management will provide more commentary about member engagement, such as its new bi-annual report on hours watched of individual shows and movies available on the streaming service.

Quarterly membership (which, for the record, was 269.6 million worldwide at the end of March 2024, up from 232.5 million at the same time in 2023) has been a hallmark of Netflix’s shareholder letters for years. As the company acknowledges, paid member numbers were a fantastic metric for the internet company, especially in the early days when there was little in the way to report from the financial department. Management assures us that it will continue to report these figures, perhaps on an annual basis or when major milestones are reached.

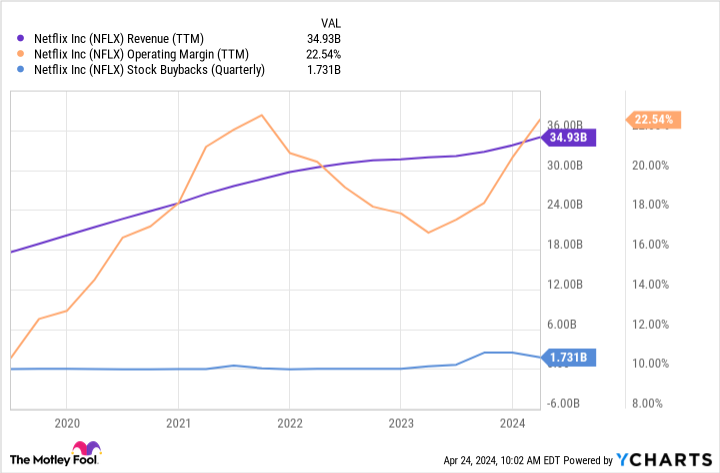

However, going more opaque with growth metrics might sound like a red flag. I don’t think so, though. Instead, it’s a sign that Netflix is growing up as a business. Netflix itself acknowledges this, stating that rather than paid membership numbers, simply following revenue and free cash flow growth is far more meaningful now. I, for one, cheer on this change, as I (finally) decided to buy Netflix for this very reason: The business is now profitable by all counts. As a result, quarterly member counts could just be a distraction from here on out.

Additionally, Netflix is now growing other types of revenue streams, such as its advertising business and “extra member” tier (aka the “password sharing crackdown,” which allows multiuser login on a membership plan). These new revenues also make membership numbers less meaningful and strengthen the case for using good-old-fashioned financial growth metrics for Netflix.

The new Netflix — better than ever

I’ll admit that my past discomfort with Netflix’s expansion strategy (negative free cash flow, and using debt to produce original content) meant I missed out on what were surely the best years of the company’s growth.

I’m fine with that, though, as I believe Netflix will still be a very solid investment going forward. Revenue is still growing (up 15% year over year in Q1 2024), profit margins are still rising (operating margin outlook for 2024 increased from 24% to 25%), and big share repurchases just began in earnest in recent quarters (which boosts earnings-per-share growth over time).

Global entertainment is still a broad and diverse market, and Netflix might still be early on in tapping its full potential using the internet. After the dip, shares trade for just under 40 times trailing-12-month earnings, and about 37 times free cash flow. Sure, it’s not cheap. But if Netflix can keep growing and steadily increase profit margins over time, it’s a worthy premium in this new era for the streaming business. This stock price dip looks like a good time to nibble some more.

Should you invest $1,000 in Netflix right now?

Before you buy stock in Netflix, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Netflix wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Nicholas Rossolillo has positions in Netflix. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

Is It Time to Buy the Dip On Netflix Stock? was originally published by The Motley Fool