If You Invested $1,000 in Bitcoin 5 Years Ago, This Is How Much You’d Have Now

If there is anyone familiar with volatility, it’s those who hold cryptocurrencies. Specifically, Bitcoin (CRYPTO: BTC) has been an absolute rollercoaster ride over the years. Bitcoin prices have fallen over 30% from their high twice, and over 60% once, over the past five years alone!

But you’d be pretty happy if you’d bought five years ago and held on for dear life. A $1,000 investment in Bitcoin five years ago will have grown to over $13,000 today.

So, what’s the lesson here, and how can investors apply it to Bitcoin moving forward?

Here is what you need to know.

Why is Bitcoin so volatile?

Bitcoin and other cryptocurrencies have some similarities with stocks. For starters, their short-term prices result from supply and demand. Prices go up when more people want to buy than sell, and vice versa. But stocks represent underlying companies — tangible businesses. They generate profits, and stocks represent ownership of a piece of that.

Cryptocurrency is a bit more complex because there is technically no tangible value to cryptocurrency. That doesn’t mean it’s worthless. After all, the same could be said about fiat currency. Its value comes from what it represents. In the case of the U.S. dollar, the currency represents a legal tender backed by the government. The dollar’s value might fluctuate against other currencies, but the U.S. dollar is generally stable because of that backing. It’s the world’s reserve currency for that reason.

Bitcoin is decentralized — no bank or government backs it. Some may argue that this makes Bitcoin and other cryptocurrencies some pyramid scheme, but that’s not necessarily true. Decentralization is both a bug and a feature. Bitcoin’s still a young asset. It’s volatile because it doesn’t yet have the widespread adoption fiat money has. But as more people own and transact with it, the more stable the price will likely be.

What drives Bitcoin’s long-term value?

Over time, Bitcoin’s value goes back to supply and demand, but on a much larger scale. Theoretically, demand for Bitcoin will increase as adoption grows. The more people own and use it, the more people will want it.

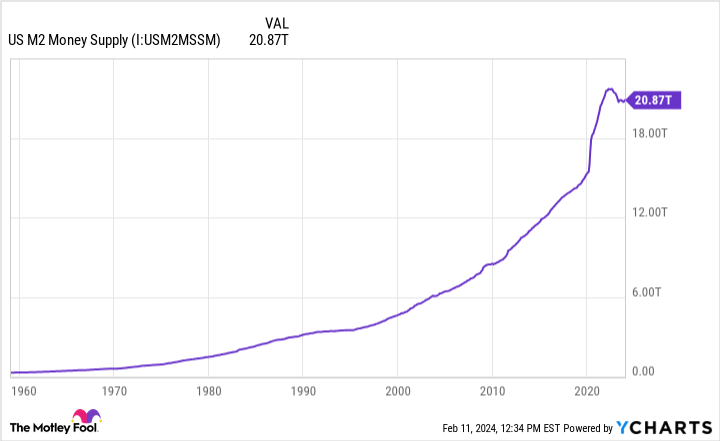

It’s the supply side of the equation that’s interesting. With fiat money like the U.S. dollar, the Federal Reserve controls the money supply. It can increase or decrease, but as you see below, the supply almost always grows. This is measured as the M2 Money Supply, essentially the total number of dollars circulating in the economy.

The more dollars in the economy, the higher the demand for goods and services, causing prices to rise. Notably, inflation means the buying power of the dollar decreases. In other words, a dollar doesn’t buy nearly as much today as it did 50 years ago. Just compare the cost of a house in 1960 to the cost today.

Bitcoin was created with a hard supply cap of 21 million bitcoin. There can never be more than that. Today, there are approximately 19.6 million bitcoins in existence. The last bitcoin will be mined in the year 2140. The idea is that Bitcoin’s buying power will increase over time instead of decreasing. Why? Because there will only be so many bitcoins to accommodate ever-increasing demand. That buying power should ultimately drive its value higher.

How should investors buy Bitcoin today?

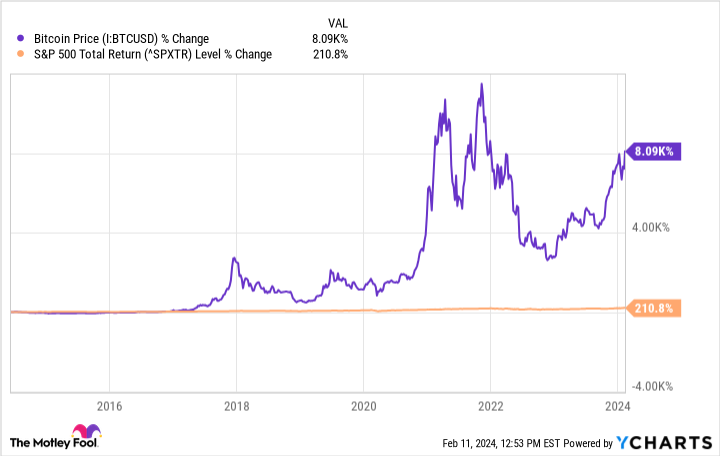

Volatility makes trying to time Bitcoin and other cryptocurrencies a nearly impossible task. But Bitcoin has continually increased in value over time, just as its creator intended. Despite Bitcoin prices being nearly 30% off their high today and the S&P 500 at an all-time high, Bitcoin has appreciated far more than the broader stock market over the past 10 years.

Investors shouldn’t own Bitcoin to speculate, but because they believe in the purpose of Bitcoin and its long-term potential as an alternative to fiat currency.

Consider buying Bitcoin with a dollar-cost averaging strategy. Buy a little at a time, often on a schedule, regardless of the price. Over time, you’ll buy some at high and low prices, but it will average out. That way, you don’t put all your money in at the wrong time.

Steady purchases and a long time horizon should enable investors to enjoy Bitcoin’s success, despite its occasionally violent price swings.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Justin Pope has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

If You Invested $1,000 in Bitcoin 5 Years Ago, This Is How Much You’d Have Now was originally published by The Motley Fool