If You Invested $1,000 in Bitcoin 5 Years Ago, This Is How Much You’d Have Now

Index investing is a great approach, but you can do even better with specific stocks or cryptocurrencies from time to time.

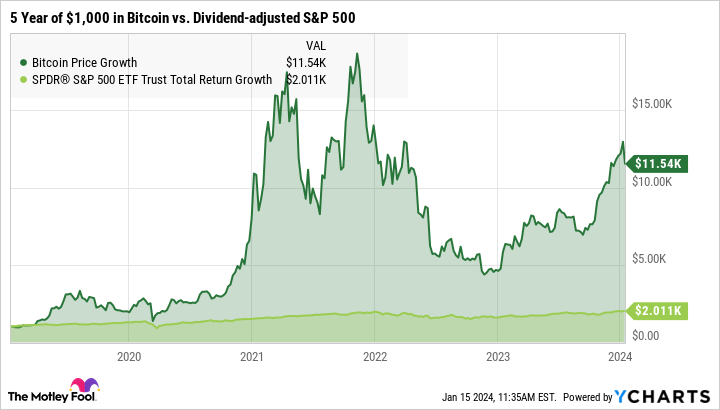

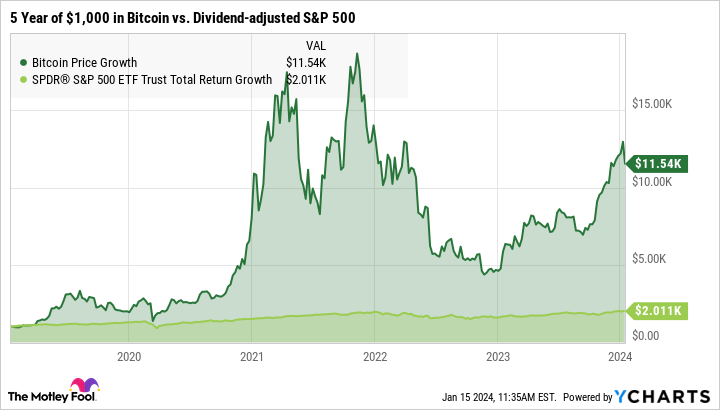

Let’s say you invested $1,000 in an index fund tracking the S&P 500 (SNPINDEX: ^GSPC) index 5 years ago. The SPDR S&P 500 ETF (NYSEMKT: SPY) is one popular option with minimal management fees and a stellar history of reflecting its chosen index.

If you reinvested dividends into more shares of the exchange-traded fund (ETF) over time, you would have doubled your money by now. That’s an average annual return of 15% — well above the 10-year average at 12% or the 10% annual returns since the ETF was introduced 41 years ago.

It’s easy to see why The Motley Fool recommends holding a diversified stock portfolio for a long time, in the spirit of index-fund pioneer John Bogle and master investor Warren Buffett. I mean, good luck finding a savings account with a stable 10% interest rate, not to mention the higher gains in recent years. Diversified investing is a proven strategy for building and protecting your wealth in the long run.

But what if you picked up $1,000 of Bitcoin (CRYPTO: BTC) tokens five years ago? The largest cryptocurrency was in the middle of another crypto winter back then, hampered by hacking scandals and regulatory crackdowns with no support to speak of from large banks and other financial institutions. The $19,345 record price of the Bitcoin boom in 2017 felt like a distant memory, melted down to $3,644 per token.

Bitcoin’s rocky five-year gains

As it turns out, that was a solid buying window for investors looking to commit their funds over a five-year span. A $1,000 Bitcoin investment on Jan. 15, 2019, was worth $11,540 at the time of writing exactly five years later:

It hasn’t been a smooth ride, but there’s no denying the general upswing over five years. In this period, Bitcoin investors faced more crypto-exchange hacks, the coronavirus health crisis, a global inflation surge, and other challenges. Bitcoin prices fell more than 10% in August 2023, not to mention six single-month drops of that magnitude in 2022. The preceding chart includes all of these headwinds and crashes.

The road ahead: Bumpy but hopeful

Still, Bitcoin is back on its digital feet with more gains than losses in recent months and a robust slate of upcoming catalysts for further gains.

-

The next Bitcoin halving — a regularly scheduled increase of the computing power required to mine new Bitcoins — is scheduled in April 2024. These events are typically followed by a strong bull run in Bitcoin prices over the next couple of years.

-

American regulators recently approved 11 applications for ETFs based on spot-market Bitcoin prices. The approval did not result in a sharp price boost, but having easy access to Bitcoin-based investment vehicles such as the ARK 21Shares Bitcoin ETF (NYSEMKT: ARKB) and iShares Bitcoin Trust (NASDAQ: IBIT) should ultimately increase trading volume and support higher Bitcoin prices.

-

The regulatory picture is starting to clear up, driven by renewed public interest in the crypto space and progress in important legal cases such as the U. S. Securities and Exchange Commission vs. Ripple (CRYPTO: XRP). The wheels of justice and regulatory rulemaking grind slowly, and I don’t expect a complete rulebook in 2024 or 2025. Still, every step in the direction of clarity is good news, even if they’re not always taken in the direction of lower taxes and greater investor access to cryptocurrency assets.

The general long-term trend tends to leave traditional stock market indices like the S&P 500 far behind. Furthermore, that bullish market tenor should continue over the next couple of years due to the technology, market, and regulation events listed above — with the caveat that there may be dramatic price drops along the way for a myriad unforeseen reasons.

So Bitcoin isn’t a magic ticket to automatic investment gains, with a significant risk of sudden downswings and long periods of stalled or negative returns. Sticking with a market tracker like the SPDR S&P 500 ETF may be a better choice if you’re not ready for the volatility and technical quirks of Bitcoin investing.

Still, it’s a robust digital currency with an unpredictable yet promising future, and I think a modest position in Bitcoin (or one of the Bitcoin-based ETFs) would be a healthy addition to a diversified portfolio.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Anders Bylund has positions in Bitcoin and XRP. The Motley Fool has positions in and recommends Bitcoin and XRP. The Motley Fool has a disclosure policy.

If You Invested $1,000 in Bitcoin 5 Years Ago, This Is How Much You’d Have Now was originally published by The Motley Fool