How the impact of a post-Civil War bank failure lingers today

What does a bank failure in 1874 have to do with the racial wealth gap in America in 2024?

Turns out, a lot.

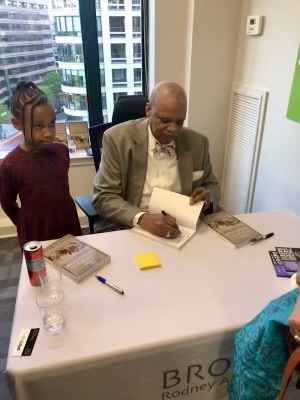

In his new book, “The Rise and Fall of The Freedman’s Savings Bank And its Lasting Socio-Economic Impact on Black America,” author Rodney Brooks, former deputy managing editor at USA Today, unpacks the story of the rapid rise and fall of the bank created in 1865 by Congress to provide former slaves a place to deposit their earnings from their service in the Union Army. It rapidly grew to millions in deposits, as Black Americans made small deposits of $5 to $50.

Through a combination of mismanagement and a financial panic that hit the country in 1873, the bank was forced to shut its doors with droves of depositors losing all of their life savings. And that is precisely where many Black Americans’ distrust of financial institutions, which has passed down for generations, began, Brooks writes.

“Many of the people who made deposits were led to believe — because all of the promotions featuring pictures of Union Generals and President Lincoln — that they were safe and protected by the US government,” Brooks said.

Not so.

“It was the first attempt of Black Americans trying to save and invest, and it was met with a disaster,” Brooks told Yahoo Finance.

Brooks traces that bank’s implosion to the racial wealth gap in the US today. There’s a seven-figure gap between the average wealth of white families compared to Black families, according to research by the Urban Institute, a nonpartisan think tank. The average wealth of white families in 2022 reached a record high of over $1.3 million, compared to about $211,000 for Black families.

Here’s what Brooks had to say about the bank’s failure, the financial issues facing Black Americans today, and the country’s persistent wealth gap, edited for length and clarity:

Kerry Hannon: Rodney, can you give us a snapshot of what the Freedman’s Bank was and why the demise?

The Freedman’s Bank was created and signed into law by President Lincoln after the Civil War. The basic thought behind it was that former slaves had no way to save their money because white banks did not accept them as customers. Some were earning wages for the first time, and there was nowhere to go. The major impetus behind it was that the black soldiers who fought in the Civil War, who received signing bonuses for joining the Army, and they were receiving wages. So it was created as a way for Black Civil War veterans and former slaves to save money, but also it was a way to provide a financial education. I mean, that’s one way you learn about money is to go to a bank, watch your money grow, and learn about interest.

Their deposits were not protected by the US government. What happened?

The bank was supposed to be overseen by Congress, which didn’t do so. Congress paid no attention to it, but it was governed by a board of 50 white businessmen.

In the beginning, the intention was to have one bank branch in Washington, D.C., not a branch system, which is very expensive. But the bank management decided to go where the Black soldiers were, so they could take advantage of those deposits. And before you knew it, the bank had 37 branches. There wasn’t even a nationwide system among white banks at that time.

You write that the failure of the bank was “a killer of Black dreams.” How so?

W.E.B. Du Bois said an additional 10 years of slavery would not have the same impact. These were people who were saving money, saving their pennies. Some of them had never earned money before. Farmers were putting in money to buy seeds, and people were saving money to buy homes. And when the bank failed, all of those dreams died because most of the depositors lost their money. The bank lost around $3 million in deposits which would have been about $80 million today.

Black Americans have a long history of distrust of American financial institutions — this is the legacy of the Freedman’s Bank and one of the root causes of the distrust of Blacks in the banking system.

How is Black America still feeling the effects of the bank failure right now?

There are still Black Americans who won’t put their money in banks. And Black people still have difficulty getting loans. Small Black businesses especially face this issue.

Let’s talk about the racial wealth gap, specifically the gap in retirement savings.

It’s really scary because Black Americans have little to nothing in terms of retirement savings, which makes a heavy dependence on Social Security. And because of that Black Americans, especially Black women, take Social Security early and that means you’re going to get a fraction of what you should if you wait until your full retirement age.

Let’s look at a few solutions. What are some things that could help change the course?

Most of them would involve some strong action by the federal government. The high support among white Americans for reparations has dissipated. Reparations were paid to the Japanese who were put illegally in concentration camps in America. Reparations are something that could narrow the wealth gap.

Baby bonds seem to be more viable politically. Basically the government puts aside money for children at birth to give them a jumpstart after they graduate from high school. The parents add money to it every year until the children reach college age. That’s one of the best solutions that would cut the racial wealth gap in half.

What’s your advice for Black Americans right now who are trying to save and take control of their financial futures?

The biggest thing I would say is that distrust with all financial institutions has to go. Black Americans, especially young Black Americans, have to be more comfortable with saving and investing. Financial education in itself is not going to solve the racial wealth gap. But it has to be a part of it.

One of my favorite stories is a Black business woman I talked to who said her mother made her write the checks for the bills when she was a teenager. And as a result, she knew that there was no money left after the bills were paid. It was a financial lesson she learned. When she was an adult, she hired a financial planner to help her. So I’m talking about parents teaching their kids, and in some cases, now kids teaching their parents.

Kerry Hannon is a Senior Columnist at Yahoo Finance. She is a career and retirement strategist, and the author of 14 books, including “In Control at 50+: How to Succeed in The New World of Work” and “Never Too Old To Get Rich.” Follow her on X @kerryhannon.

Read the latest financial and business news from Yahoo Finance