How more old people owning equities could exacerbate a downturn

-

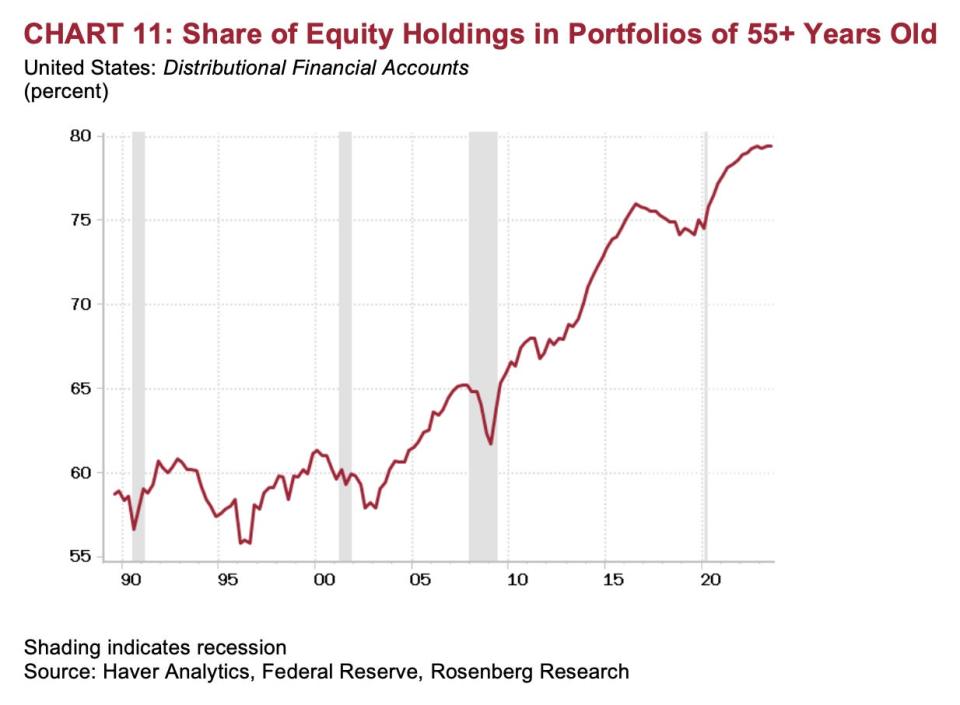

Americans over 55 own 80% of US stocks, creating a big “downside risk,” Rosenberg Research said.

-

Boomers have been buying up more and more stocks in their portfolios since the 1990s.

-

“If a downturn does materialize, demographically induced selling is a force that could exacerbate the spiral powerfully.”

Stock markets have a big downside risk: your grandma.

According to Rosenberg Research, 80% of US stocks are owned by Americans at or close to the age of retirement. And that’s a big problem if the economy tips into a recession.

Here’s why.

“Retirees don’t have the luxury to buy and hold through a market downturn,” economist David Rosenberg wrote in a note on Wednesday. “If a downturn does materialize, demographically induced selling is a force that could exacerbate the spiral powerfully, with the effects ricocheting into consumer spending.”

Rosenberg has been warning about a possible downturn in the market, saying the stock market set up this year is looking “eerily similar” to 2022.

Essentially, when you’re older, you don’t really have the luxury of time to keep holding stocks through a recession. So a downturn would spark a rapid sell-off as retirees readjust their portfolios, adding bearish momentum to the market in the event the economy slows.

A boomer-led sell-off would also trickle into industries like elective medical care, leisure, travel, and hospitality by hurting demand in those sectors.

The advice has often been to switch to safer investments as one gets older, like bonds. But as people live longer, they need higher returns for longer to finance their retirement years.

Ever since the 1990’s, through the Great Financial Crisis, boomers have been adding steadily to their equity holdings. Stock ownership among the age group went from below 60% in the 90s, to 65% before the ’08 crash, to 75% on the eve of the COVID-19 pandemic, to a full 80% today.

It’s not the same story with fixed income assets like bonds and CDs. The share of ownership of those assets among the older generations has remained stable, around 84%.

“It’s difficult to keep fundamental forces like demographics in mind in the hurly-burly of daily market moves, but they’re there, and shouldn’t be overlooked,” Rosenberg said.

Read the original article on Business Insider