High Insider Ownership Growth Stocks On Chinese Exchanges In June 2024

As of June 2024, the Chinese market has shown signs of deflationary pressures and a cautious consumer sentiment, with key indices like the Shanghai Composite and CSI 300 experiencing declines. Amidst these challenging economic conditions, high insider ownership in growth companies could signal strong confidence from those most familiar with the company’s prospects, potentially making these stocks an interesting focus for investors navigating the current landscape.

Top 10 Growth Companies With High Insider Ownership In China

|

Name |

Insider Ownership |

Earnings Growth |

|

KEBODA TECHNOLOGY (SHSE:603786) |

12.8% |

25.1% |

|

Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) |

22% |

54.9% |

|

Arctech Solar Holding (SHSE:688408) |

38.6% |

24.8% |

|

Sineng ElectricLtd (SZSE:300827) |

36.5% |

39.8% |

|

Ningbo Deye Technology Group (SHSE:605117) |

24.8% |

28.4% |

|

Anhui Huaheng Biotechnology (SHSE:688639) |

31.5% |

28.4% |

|

Fujian Wanchen Biotechnology Group (SZSE:300972) |

14.9% |

75.9% |

|

UTour Group (SZSE:002707) |

24% |

33.1% |

|

Xi’an Sinofuse Electric (SZSE:301031) |

36.8% |

43.1% |

|

Offcn Education Technology (SZSE:002607) |

26.1% |

65.3% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★★

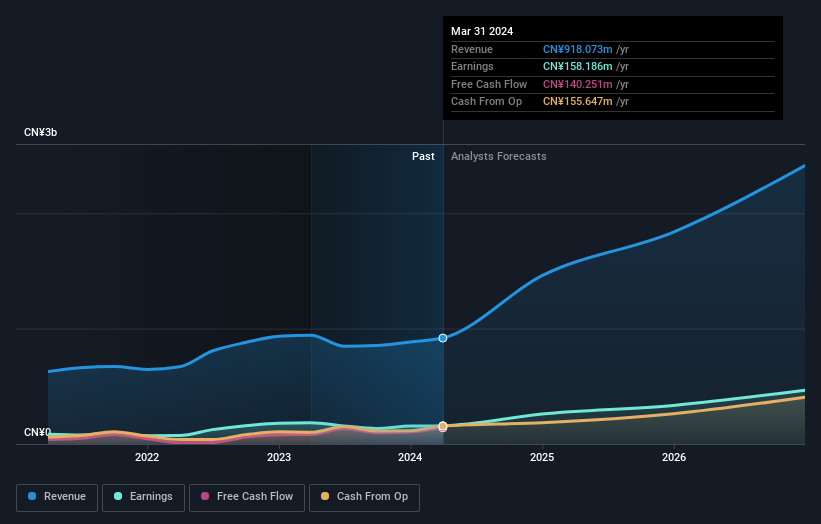

Overview: T&S Communications Co., Ltd. is a company based in the People’s Republic of China that specializes in developing, manufacturing, and selling fiber optics communication products, with a market capitalization of approximately CN¥7.87 billion.

Operations: The company’s revenue from optical communication components amounts to approximately CN¥912.85 million.

Insider Ownership: 27.8%

T&S Communications Ltd., a company with high insider ownership, shows promising growth prospects in China. Recent financials reveal a steady increase in quarterly and annual revenues and profits, with significant year-over-year improvements. The firm’s earnings are expected to grow by 35.3% annually, outpacing the broader Chinese market forecast of 22.7%. Despite its highly volatile share price and an unstable dividend track record, T&S stands out for its above-market revenue growth projections and robust forecasted return on equity.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Advanced Fiber Resources (Zhuhai) Ltd. specializes in designing and manufacturing passive optical components, serving both the Chinese and international markets, with a market capitalization of approximately CN¥10.09 billion.

Operations: The company generates its revenue from the design and production of passive optical components, serving markets in China and globally.

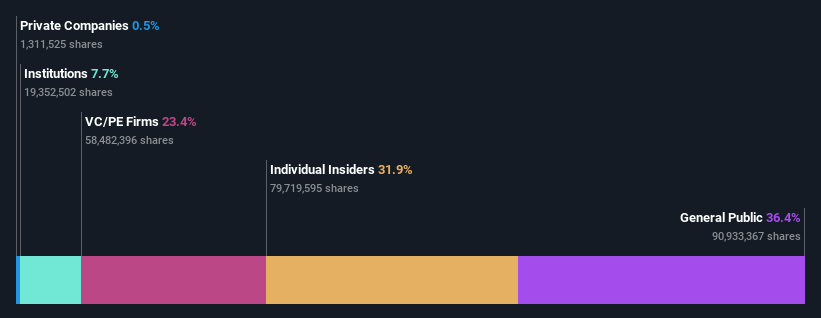

Insider Ownership: 31.9%

Advanced Fiber Resources (Zhuhai) exhibits robust growth with forecasted annual revenue increases of 24.2% and earnings growth of 40.2%. However, profit margins have declined from last year, with a significant drop from 16.8% to 7.1%. Recent corporate actions include dividend reductions and shareholder meetings focused on amending company articles, indicating active management engagement but also potential financial recalibrations which could concern investors looking for stable returns.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wondershare Technology Group Co., Ltd. specializes in developing application software products for both domestic and international markets, with a market capitalization of approximately CN¥10.90 billion.

Operations: The company generates revenue primarily from developing application software products across global markets.

Insider Ownership: 15.3%

Wondershare Technology Group, a Chinese software company, has demonstrated strong growth with earnings up by 40.3% last year and forecasted annual earnings growth of 30.1%. Insider ownership remains substantial, aligning management’s interests with shareholders. Recent product upgrades in its Filmora video editing software highlight technological advancement and market responsiveness. However, its return on equity is expected to remain low at 11.5%, which could be a concern for potential investors seeking high returns on equity.

Turning Ideas Into Actions

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest…

Read More: High Insider Ownership Growth Stocks On Chinese Exchanges In June 2024