Here’s A No-Brainer Artificial Intelligence (AI) Stock to Buy Hand Over Fist Before It Jumps 100%

The Nasdaq-100 Technology Sector index may not have gotten off to a great start in 2024 following last year’s impressive gains, slipping nearly 5% in the first week of the new year, but investors would do well to take a look at the bigger picture as there are indications that it could gain momentum as the year progresses.

A closer look at historical trends tells us that the Nasdaq-100 has endured only seven down years since it was introduced in 1985. What’s more, the index tends to bounce back strongly in the two years following a down year. Also, historically, the year in which the Nasdaq-100 has jumped more than 40% is followed by another year of strong growth that averages 24%.

That’s why investors shouldn’t get discouraged by the Nasdaq’s shaky start to the year, especially considering that the index could gain from additional tailwinds in 2024. From a recovery in the smartphone and personal computer (PC) markets to the hot market for artificial intelligence (AI) chips to a further cooldown in inflation to potential interest rate cuts by the Federal Reserve, there are several reasons to be bullish about the Nasdaq’s prospects in 2024.

As a result, now would be a good time to load up on shares of Applied Materials (NASDAQ: AMAT). The semiconductor equipment supplier has underperformed the Nasdaq over the past year with relatively lower gains of 43%, but a closer look at the market it serves suggests that it could step on the gas this year. Let’s see why that may be the case.

Applied Materials could surprise Wall Street by clocking faster growth

The demand for semiconductor manufacturing equipment is expected to recover strongly in 2024 following last year’s dip. According to the semiconductor industry association SEMI, spending on wafer fabrication equipment fell an estimated 15% in 2023 to $84 billion. That wasn’t surprising, as semiconductor sales were down an estimated 12% last year, according to market research firm IDC.

Weak semiconductor sales led foundries and chipmakers to pull back on equipment spending as they were left with excess capacity. With semiconductor sales expected to jump 20% in 2024, equipment spending is set to rise once again. SEMI is forecasting a 15% jump in global fab equipment spending this year, and this is good news for Applied Materials, as the demand for its semiconductor systems should increase.

Through its semiconductor systems business, the company sells equipment used for fabricating chips to semiconductor foundries and memory manufacturers. This segment produced $19.7 billion in revenue in fiscal 2023 (which ended on Oct. 29, 2023), accounting for 74% of the company’s top line of $26.5 billion. The segment’s revenue was up 5% year over year, which was commendable, given the bigger decline in semiconductor equipment sales last year.

However, the company struck a cautious tone when it issued its outlook for the first quarter of fiscal 2024, citing a “complex macroeconomic and geopolitical environment.” It expects revenue in the current quarter to land at $6.47 billion at the midpoint of its guidance range, which would be a 4% decline from the prior year. Earnings are expected to shrink to $1.90 per share at the midpoint from $2.03 per share in the year-ago period.

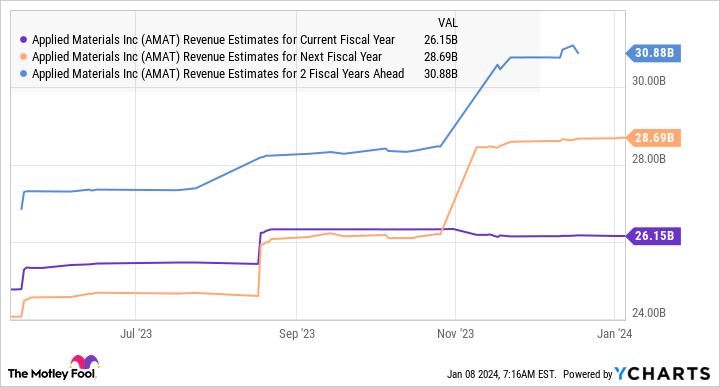

Additionally, analysts anticipate the company’s top line to remain flat in the current fiscal year at just over $26 billion.

However, as the chart above shows us, analysts have been raising their revenue estimates in recent months. It won’t be surprising to see this trend continuing as Applied Materials is anticipating “demand from our leading-edge foundry-logic customers to be stronger year on year, underpinned by higher PC, cloud, and AI data center spending.”

It is worth noting that Applied Materials’ semiconductor systems business clocked impressive growth of more than 15% in fiscal 2022, outpacing the 9% growth in semiconductor equipment spending that year. So, there is a good chance that Applied Materials may have lowballed its guidance, especially considering that its top two customers are looking to boost their AI chip production capacities and will probably need to order more equipment.

Samsung and Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC, are Applied Materials’ top two customers, together accounting for 34% of its total revenue. Both these foundries are aggressively working to increase the capacity of AI chips.

TSMC, for instance, has reportedly increased its advanced chip packaging capacity to 15,000 wafers a month from the earlier run rate of 12,000 wafers a month to meet the robust demand for AI chips from Nvidia. Meanwhile, the number of customers for TSMC’s advanced 3-nanometer (nm) chips is expected to increase this year. TSMC’s 3nm process was only used by Apple last year, but the likes of Nvidia, Qualcomm, AMD, and MediaTek are expected to use these chips in 2024.

As a result, TSMC will have to raise the production of its 3nm chips, and this could rub off positively on Applied Materials’ top line. Samsung, on the other hand, is aiming to increase its production capacity of high-bandwidth memory (HBM) chips by 2.5x in 2024. These memory chips are deployed in AI servers to tackle large workloads, and they are witnessing a sharp increase in demand owing to the proliferation of AI.

All this explains why Applied Materials management is forecasting sales of AI-related semiconductor equipment to increase at a compound annual growth rate of 30% in the future. As such, there is a good chance that Applied Materials could indeed outpace consensus estimates thanks to the tailwinds the semiconductor market is set to enjoy this year.

The valuation is too attractive to ignore

Applied Materials stock is trading at 18 times trailing earnings, which is in line with the company’s five-year average earnings multiple and cheaper than Nasdaq-100’s average earnings multiple of 29. Investors, therefore, are getting a good deal on Applied Materials stock right now, and they should consider grabbing this opportunity considering the potential upside it could deliver.

Consensus estimates forecast annual growth of 15% in Applied Materials’ earnings for the next five years. Based on the company’s fiscal 2023 earnings of $8.05 per share, its bottom line could jump to $16.20 per share after five years. Multiplying the projected earnings with the company’s five-year average earnings multiple of 18.5 points toward a stock price of $300. That would be a 100% jump from current levels.

But if Applied Materials manages to achieve faster growth thanks to AI and the market decides to reward it with a higher multiple as a result, it could deliver even bigger gains. That’s why investors looking to buy a top semiconductor stock right now should consider going long Applied Materials before it steps on the gas.

Should you invest $1,000 in Applied Materials right now?

Before you buy stock in Applied Materials, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Materials wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Applied Materials, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

History Says the Nasdaq Could Soar in 2024: Here’s A No-Brainer Artificial Intelligence (AI) Stock to Buy Hand Over Fist Before It Jumps 100% was originally published by The Motley Fool