Got $5,000? 3 Tech Stocks to Buy and Hold for the Long Term

Technology stocks have been powering the market higher in recent years, led by powerful trends such as artificial intelligence (AI). Let’s look at three of these tech stocks and discuss the reasons why they might be good options to buy and hold for the long term.

1. Nvidia

No company has been a bigger winner from AI than chipmaker Nvidia (NASDAQ: NVDA), and there is good reason to believe that the company and its shareholders will continue to benefit from current AI trends well into the future.

Nvidia’s graphic processing units (GPUs) are the main force powering AI training and inference needed to power AI applications. While not the only GPU maker, the company’s chips have become the industry standard as programmers are generally trained using its CUDA software platform. This in turn has helped create a wide moat for the company, as it would be time-consuming and thus costly to have programmers learn other platforms.

With AI still in the early innings and demand for its chips booming, Nvidia is well-positioned to continue riding the AI wave well into the future. The company is seeing huge demand from data center customers, although the technology is likely to move to other areas as well, such as automotive. Tesla CEO Elon Musk proposed that his company’s vehicles could be used as a distributed computing network given how much computing power will go into them.

On top of that, the company is innovating quickly, pushing out new and improved GPU architecture designs such as its recently introduced Blackwell while already announcing its next-generation GPU architecture Rubin slated for next year.

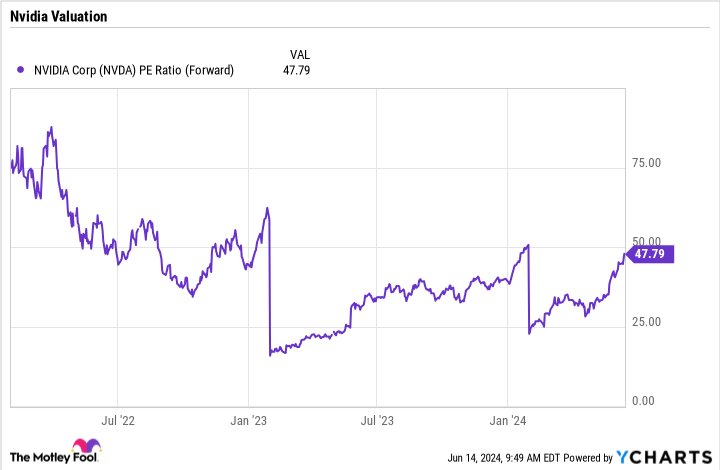

Trading at a forward price-to-earnings (P/E) ratio of around 48, the stock looks inexpensive given its current growth and future prospects, making it a great stock to buy and hold for the long term.

2. Taiwan Semiconductor Manufacturing

Another company set to ride the boom in AI chips is Taiwan Semiconductor Manufacturing (NYSE: TSM), or TSMC for short. The company is a leading semiconductor contract manufacturer and produces chips for Nvidia and other semiconductor companies in its foundries.

With demand for AI chips outpacing supply, TSMC is in the process of expanding capacity. The company is expanding and building out new fabrication facilities (fabs), while also pushing new technological innovations, such as moving to 2-nanometer production technology. As chip density is improved, more chips can fit on a wafer, increasing capacity while also improving the performance and power consumption of the chips as well.

Given Nvidia’s success, more and more companies have been developing their own AI chips to try to get a piece of this huge market, from traditional rivals such as Advanced Micro Devices to cloud computing companies such as Amazon and Alphabet. This puts TSMC in a strong spot as chipmakers try to secure limited capacity, giving the company nice pricing power. In fact, the company has indicated it will be raising prices soon.

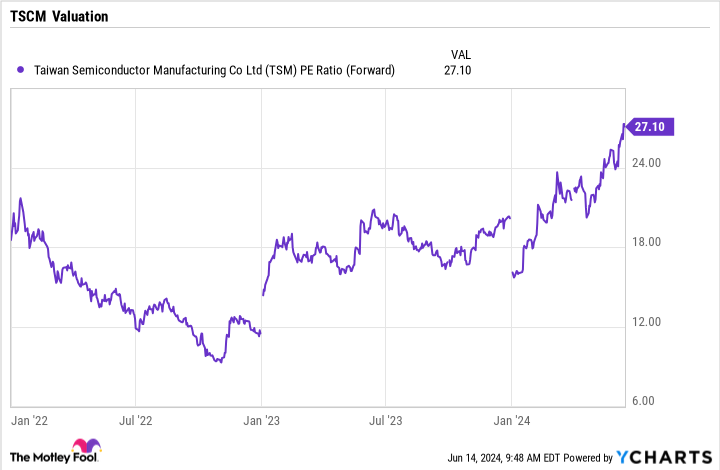

Trading at a forward price-to-earnings (P/E) ratio of 27, the stock is attractively valued given the long runway of growth in front of it, and a solid stock to buy and hold for the long term.

TSM PE Ratio (Forward) data by YCharts

3. ASML

Continuing the theme of tech stocks set to benefit from the AI chip boom leads to ASML (NASDAQ: ASML), which makes the equipment that companies like TSMC use to make semiconductors. With the need for more AI chips and fab expansion also comes the need for more equipment used to make those chips.

ASML is set to benefit from the increasing demand for its semiconductor equipment, as well as from the introduction of its latest technology, the high numerical aperture extreme ultraviolet lithography system, or high NA EUV. The new system will allow manufacturers to make transistors smaller and be able to put more of them onto silicon wafers. ASML says its new high NA EUV technology will improve manufacturing productivity as well as lower production costs while improving chip functionality.

The company is set to ship its latest systems to its three largest customers by year-end. At a price tag of $380 million, the systems are not cheap and will be a nice revenue driver for ASML as chip manufacturers look for the newest technology to produce the most chips to help meet the insatiable demand for AI chips.

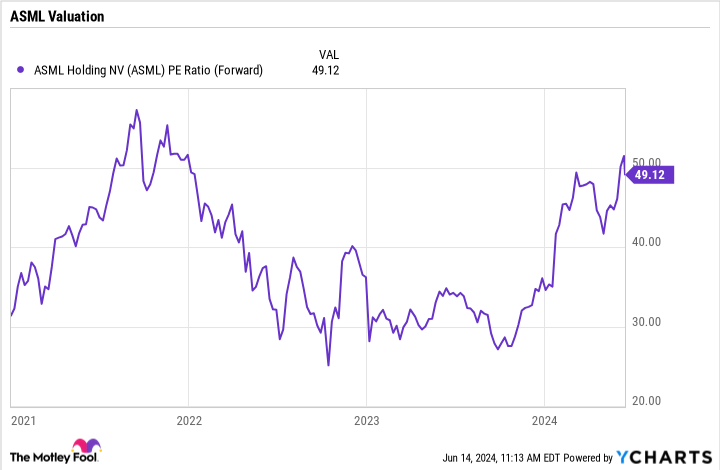

ASML trades at a forward price-to-earnings (P/E) multiple of about 49 times, but with the new system, revenue, and earnings growth is expected to surge next year, with adjusted earnings per share (EPS) expected to climb from an estimated $20.48 this year to $31.79 in 2025. That would lower its valuation to an attractive forward P/E of 32 times. Given…

Read More: Got $5,000? 3 Tech Stocks to Buy and Hold for the Long Term